Coin Center is appealing a previous ruling by the United States district court for Northern Florida, which determined that Tornado Cash generates indirect advantages for foreign entities and individuals that qualify as a financial interest subject to sanctions from the Office of Foreign Assets Control (OFAC).

Jeffrey S. Hetzel, the legal counsel for Coin Center, stated to the 11th Circuit Court of Appeals, “The most straightforward approach to resolving this case is to assert that there is no foreign property involved in the transactions of our plaintiffs.”

The district court was required to eliminate the term “property” from the statute. Hetzel then proceeded with his argument:

“The government, on appeal, says that the software published at the banned addresses is property, but the software is non-proprietary lines of code that no one on the planet can own, control, or alter in any way.”

The United States government’s attorneys responded to Hetzel by arguing that the price appreciation of the Tornado Cash token, TORN, directly benefited TORN holders and that withdrawal fees were a form of accrued benefits for the protocol’s founders.

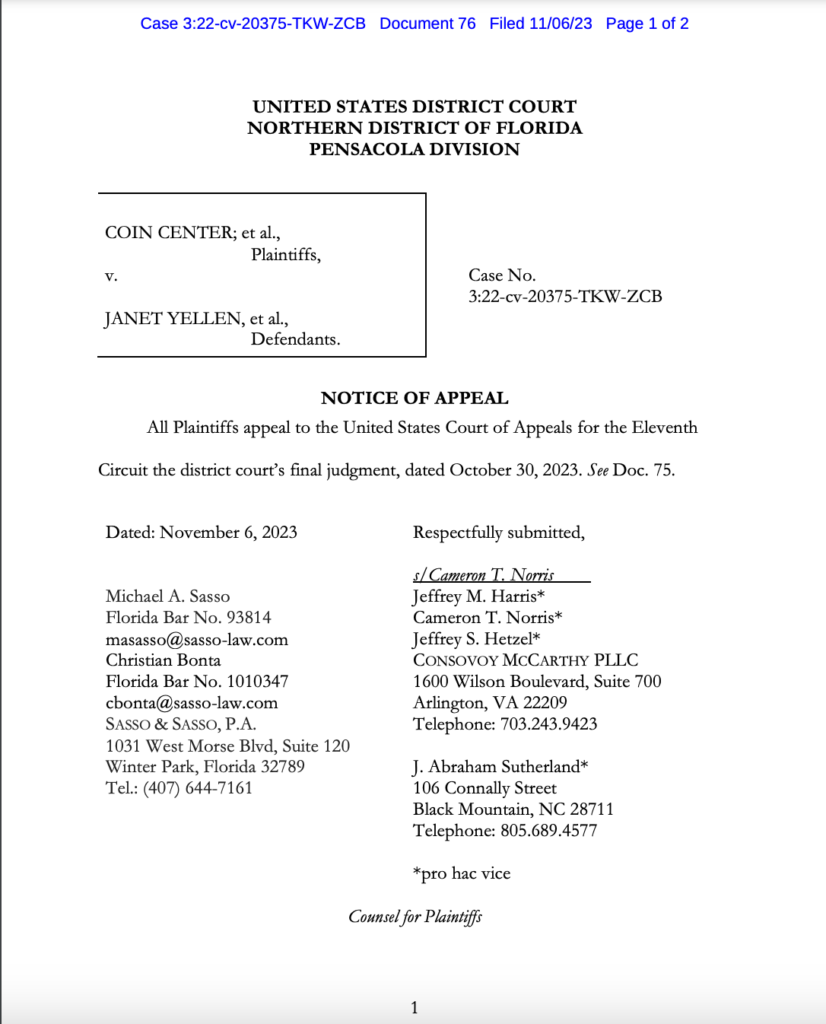

US Tornado Cash consumers are subject of 2022 Coin Center lawsuit

The United States Treasury Department sanctioned over 40 wallet addresses purportedly associated with the Tornado Cash mixture service in August 2022.

The Treasury Department asserted that these individuals and entities were responsible for approximately $7 billion in money laundering schemes and other illicit transactions at the time.

In 2022, Coin Center filed a lawsuit on behalf of US residents who were using the service to safeguard their privacy in response to the actions of the US Treasury.

According to Coin Center’s attorneys, OFAC and the US Treasury “exceeded their statutory authority” by sanctioning the blending service. The attorneys emphasized that their clients were using the service for lawful purposes.

The US Treasury clarified shortly after Tornado Cash was sanctioned that the Tornado Cash code cannot be published or replicated online in violation of sanctions.

The Treasury also urged individuals who utilized the service before its sanctioning to apply for an OFAC license and acknowledged that it would approve non-illicit transactions.