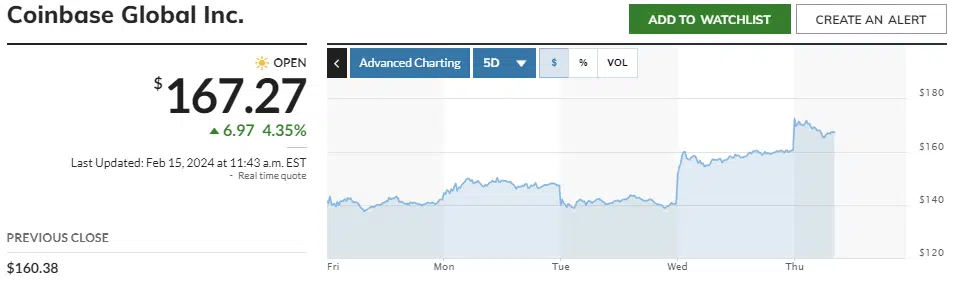

This week, Coinbase Global Inc. saw a 17% boost as a result of multiple analysts’ positive reevaluations of the company’s financial stability.

According to Bloomberg, analyst Kenneth Worthington of JPMorgan changed his opinion on the company’s shares from negative to positive, following Bitcoin’s surge in value to over $50,000 earlier this week—its highest level since 2021.

Worthington reevaluated his downgrade from January and changed his suggestion from underweight to neutral. His first downgrade was predicated on the notion that the enthusiasm surrounding Bitcoin ETFs may fade, a forecast that did not come to pass because these funds have done well in important trading areas.

Another well-known analyst, John Todaro of Needham & Co. predicted that Coinbase would record a net income of $103 million for the fourth quarter.

This prediction, which is based on a Bloomberg survey, deviates from the predictions of numerous other analysts who projected a loss for the firm of about $16 million, or 5 cents per share.

Bull markets tend to see more profitability for Coinbase because of increased trading activity from institutional and retail investors, which increases fee income.

The quarter saw an almost 60% gain in the price of Bitcoin, bringing the cryptocurrency’s worth to a 157% increase at year’s end. The increase occurred prior to the launch of spot Bitcoin ETFs.

How these ETFs will affect Coinbase’s business model in the long run still needs to be determined. The company has encountered difficulties in the past as industry trading volumes declined.

Since the beginning of the 2022 crypto winter, coinciding with Terra Luna’s demise and Sam Bankman-Fried’s FTX, Coinbase has not turned a profit. As a result, hundreds of workers were let go by the biggest exchange in the United States.