Coinbase’s entry signals the latest major institutional entrant into the field of BTCFi.

Coinbase, the world’s second-largest cryptocurrency exchange, is poised to significantly advance the adoption of Bitcoin-native decentralized finance (DeFi).

The exchange recently hinted at developing a new Wrapped Bitcoin (BTC) token, Coinbase BTC (cbBTC), sparking considerable excitement among crypto investors.

According to Rena Shah, Chief Operating Officer of Trust Machines, a company focused on Bitcoin solutions, the new token could greatly enhance Bitcoin-native DeFi. Shah told Cointelegraph:

“The opportunity for cbBTC, based solely on current Coinbase users, is a massive onboarding opportunity for Bitcoin DeFi…”

This move by Coinbase represents a significant step for Bitcoin DeFi, or BTCFi, a broader initiative aimed at increasing the utility of the Bitcoin network.

Interest in BTCFi surged with the launch of Runes, a new protocol for creating fungible tokens on the Bitcoin network, which debuted on April 20, coinciding with the halving event.

The announcement comes three months after the introduction of USDh, the first Bitcoin-backed synthetic dollar, which launched with a 25% yield for investors.

Coinbase cbBTC Adoption Relies on DApp Usage

Coinbase’s new wrapped token stands to benefit from the mainstream trust associated with the exchange.

However, its adoption will primarily hinge on the demand generated by decentralized applications (DApps) and the use cases offered by the token, according to Shah:

“The value proposition made by these EVM wrappers isn’t compelling enough for Bitcoin native audiences, and I predict those who enter through them will soon see the benefit in more decentralized approaches that keep the secure and immutable nature of Bitcoin intact.”

Shah also noted that the success of cbBTC will depend on the number of developers attracted to the token, with builders seeking more decentralized and non-custodial solutions.

Bitcoin Liquidity Could Drive DeFi Growth

The DeFi sector could experience significant growth from the liquidity provided by the Bitcoin ecosystem.

This insight was a key factor in developing Wrapped Bitcoin (wBTC), as Loi Luu, a core contributor to wBTC, explained in an Aug. 13 X post:

“DeFi’s total value locked (TVL) was only in the tens of millions. We realized that to really help DeFi grow, we needed to bring Bitcoin liquidity into the ecosystem.”

While wBTC is an ERC-20 token on the Ethereum network, it is considered one of the first major BTCFi innovations, enhancing utility and capital efficiency for Bitcoin.

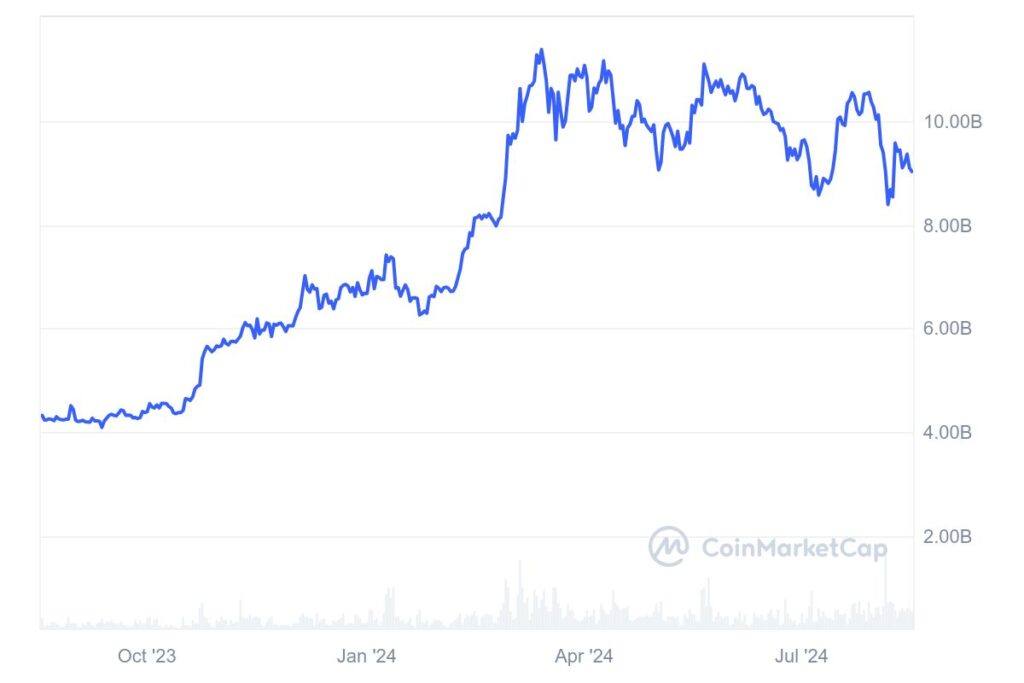

According to CoinMarketCap, Wrapped Bitcoin has a market capitalization exceeding $9 billion, marking a more than 100% increase over the past year.