To get the best prices for token swaps, more traders are turning to DEX aggregators.

Over the last few weeks, trading volumes on prominent decentralized exchange (DEX) aggregators have reached new highs. Token traders and swappers can use decentralized exchange aggregators to search many DEX platforms for the best swap prices at any given moment.

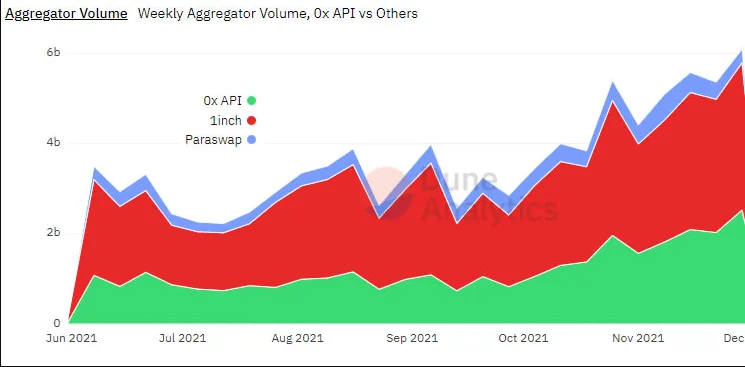

Popular DEX aggregators like 1inch, 0x, and Paraswap have witnessed increased volumes over the last month, according to Dune data. Last week, the aggregate volume for those three reached an all-time weekly high of $6 billion, up about 50% from the beginning of November.

1inch has a slight lead in terms of current market share, with 53%, but 0x is quickly coming up, with 42% in December so far. 1inch reported last week that it had secured $175 million in a Series B investment headed by Amber Group.

According to Dune, on December 5, 0x actually outperformed 1inch in terms of daily volume share, with 49 percent vs 43.7 percent. The DEX aggregator processed $3 billion in volume in the last seven days, according to 0xTracker.

DeFi developers may leverage 0x’s application programming interface (API) to implement token swaps directly into smart contracts from popular DEXes.

The 0x protocol also contains a native DEX called Matcha, which, according to its dashboard, has handled $4.7 billion in transaction activity in the last 30 days.

According to Dune’s DEX data, trade activity on decentralized exchanges reached $4 billion in the last 24 hours, and $33 billion in the previous week. At the moment, the aggregator has a 20% share of that volume.

According to Dune reports, Uniswap has a 79 percent market share in the present DEX market. Over the last week, it has handled $26.2 billion in trade activity. SushiSwap, which was cloned from Uniswap, is second in the DEX market with a 9.8% share.