Zodia, backed by several financial firms, plans to raise $50 million to reach out to more diverse investors.

Zodia Custody, the institutional crypto custody platform partly owned by Standard Chartered, is set to scale its global operations through new funding.

CEO Julian Sawyer revealed plans to raise $50 million to expand services and launch new products, as reported by Bloomberg on Nov. 4.

According to Sawyer, supported by various financial institutions, Zodia is now looking to attract a broader range of investors, including firms specializing in payments and tokenization.

The company began its fundraising efforts in October in partnership with crypto advisory firm Architect Partners.

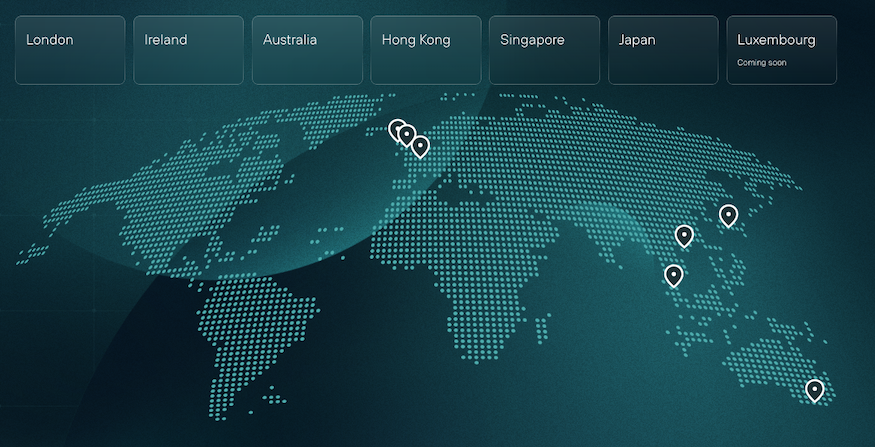

Zodia’s Reach in Major Financial Hubs

Founded in 2021, Zodia Custody has grown into a prominent international crypto custody provider, establishing a presence in key financial markets like London, Dublin, Luxembourg, Sydney, Hong Kong, Singapore, and Tokyo.

Based in London, Zodia holds several regulatory registrations worldwide, including with the Hong Kong Companies Registry.

In a 2023 Series A funding round led by Japan’s SBI Holdings, Zodia secured $36 million, leaving Standard Chartered with a 90% ownership stake.

Other investors include National Australia Bank and Northern Trust. As of October 2023, Zodia supports 38 cryptocurrencies, including Bitcoin, Ether, and stablecoins like Tether’s USDt and USD Coin.

Institutional Interest in Crypto Custody Grows

The demand for crypto custody services among financial institutions has risen in recent years. In 2022, Bank of New York Mellon introduced digital custody services.

In October, Nomura’s digital asset custody subsidiary, Komainu, announced plans to acquire Singapore-based Propine Technologies, expanding its reach in Asia.

Meanwhile, Taiwan’s Financial Supervisory Commission prepared a trial for institutional crypto custody services in early October, and State Street partnered with Taurus in August to develop institutional custody and tokenization offerings.