Crypto.com exchange is filing a lawsuit with the US Securities and Exchange Commission to safeguard the future of the crypto industry in the United States.

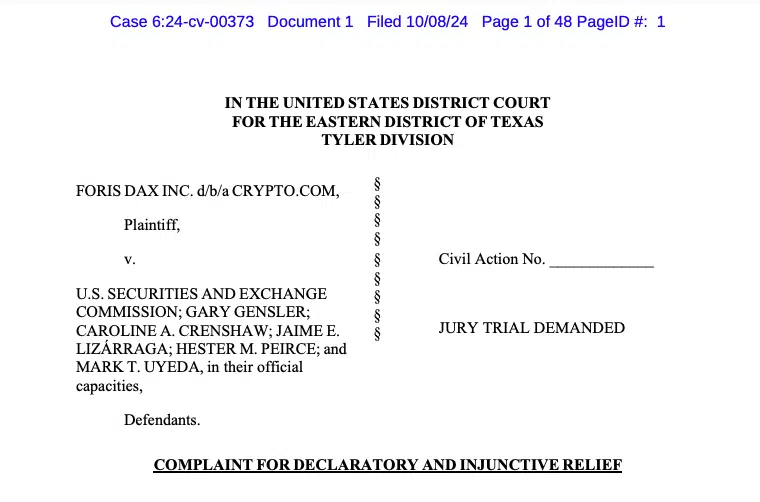

On Oct. 8, Kris Marszalek, the co-founder and CEO of Crypto.com, announced on X that the company had filed a lawsuit against the US Securities and Exchange Commission(SEC).

“This unprecedented action by our company against a federal agency is a warranted response to the SEC’s regulation by enforcement regime, which has harmed over 50 million American crypto holders,” he wrote.

Crypto.com’s official announcement states, “We are taking this action to safeguard the future of the crypto industry in the United States, joining a group of our peers who are actively defending themselves and taking action against a misguided federal agency acting beyond its authorization under the law.”

Marszalek also pledged to implement “all available regulatory tools” to ensure the industry is secure through appropriate rulemaking.

Also, Crypto.com has submitted a petition to the US Commodity Futures Trading Commission and the SEC to verify the classification of crypto derivative products.

The action is in response to the SEC’s Wells notice that Crypto.com received.

Upon receiving a Wells notice from the SEC, Crypto.com announced that it would file a lawsuit against the agency.

The exchange posits that the SEC’s action “demonstrates that the SEC’s unauthorized and unjust regulation by enforcement campaign persists despite bipartisan indications that the upcoming Administration will adopt a more constructive and effective approach.”

According to Crypto.com,

“For now, improper SEC enforcement actions are part of the process of operating a legitimate and licensed crypto business in the US. While this is an unprecedented move for our company to file suit against a federal agency, actions by that agency towards our industry have left us no other choice.”

Crypto.com’s lawsuit alleges that the SEC has “unilaterally expanded its jurisdiction beyond statutory limits.”

In addition, the exchange contended that the SEC has “implemented an unlawful regulation that classifies trades in nearly all crypto assets as securities transactions, regardless of the method of sale.”

Despite receiving a Wells notice from the SEC, Crypto.com maintained that it conducts business as usual as it pursues the “integration of cryptocurrency into every wallet.”

Crypto.com seeks confirmation for crypto products “exclusively regulated by the CFTC”

In addition, Crypto.com submitted a petition to the CFTC and SEC to verify that specific cryptocurrency derivative products are “exclusively regulated by the CFTC” through a joint interpretation.

Crypto.com emphasized that any market participant is entitled to inquire with the CFTC and SEC as to whether a product is a “swap,” a “security-based swap,” or a “mixed swap” by referencing joint rulemaking under the Dodd-Frank Act.

Crypto.com stated that the agencies have 120 days to issue a jointly approved interpretation or deny an interpretation under these joint rules.

Denial of the requested interpretation by authorities necessitates the provision of justifications for the denial.

Crypto.com further stated that the agencies must consult with the Federal Reserve Board of Governors and may participate in joint rulemaking in collaboration with the Fed.