Cuban’s criticism of the SEC’s crypto laws reflects concerns about the regulatory landscape and the cryptocurrency industry’s future.

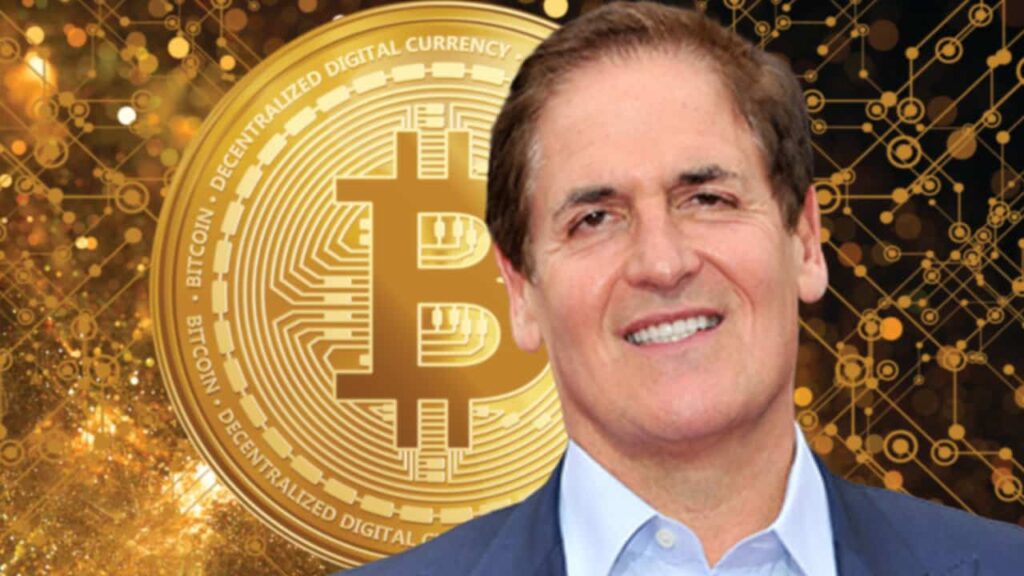

Recently, billionaire Mark Cuban has expressed his support for digital assets while criticizing the U.S. Securities and Exchange Commission’s (SEC) approach to crypto regulations.

According to him, the current Biden administration and the SEC must draw lessons from Japan regarding the management of cryptocurrency regulations.

SEC Should Imitate Japan’s Crypto Regulations

Entrepreneur and investor Mark Cuban has implored U.S. legislators to emulate Japan’s regulatory framework concerning cryptocurrencies in a letter of appeal.

Cuban questioned, in a series of tweets directed at Senate and House Democrats, why Japan fully supports cryptocurrencies while the Securities and Exchange Commission (SEC) of the United States implements stringent regulations that make it difficult for crypto businesses to flourish domestically.

Cuban underscored the worldwide importance of cryptocurrencies, articulating apprehension regarding the United States’ potential lag behind in this domain by impeding innovation.

He emphasized Japan’s proactive efforts in mitigating fraudulent activities and proposed that the U.S. market could gain advantages by adopting comparable regulatory principles.

Moreover, Cuban levied disapproval towards the SEC, attributing its deficiencies to institutional flaws and contending that the regulatory organization’s shortcomings transcend the domain of cryptocurrencies.

In highlighting inconsistencies in the SEC’s management of conventional stock markets, he referenced institutional lapses and instances of fraud.

Cuban’s statement emphasizes the significance of regulatory transparency and backing for technological progress in cultivating a flourishing environment for investment and innovation.

Japan to Gain From Crypto Innovations

At this time, 65 tokens are eligible for transactions in cryptocurrencies in Japan.

A Mark Cuban follower inquired which of these tokens resulted in an innovative application.

Additionally, he stated that one of the largest cryptocurrency bankruptcies, the Mt. Gox collapse, occurred in Japan.

In light of the Mt. Gox incident, Cuban underscored Japan’s proactive stance by revising regulations to protect stakeholders against substantial losses in the case of cryptocurrency failures.

On the other hand, Cuban criticized the SEC for allegedly failing to draw lessons from previous occurrences, such as the Mount Gox incident.

He levied allegations against the SEC, contending that it inadequately adjusted its regulations and instead utilized registration procedures to create the illusion of safeguarding investors.

He referenced instances like the FTX incident and the Madoff scandal to illustrate how the SEC adopted a reactive stance rather than a proactive one.

Cuban expressed his admiration for the regulatory framework in Japan, stating that it promotes innovation by enabling entrepreneurs to exploit ground-breaking technologies.

He criticized the SEC’s inability to foster an environment conducive to innovation, drawing a parallel between this and the historical trajectory of technological progress in the United States.