Today will be the first monthly Bitcoin options expiry after the approval of the spot Bitcoin ETF earlier this month.

The price of Bitcoin has mainly remained volatile since the approval, succumbing to substantial selling pressure and falling below $40,000. Bitcoin is valued at $39,925 with a market capitalization of $782 billion as of press time.

Greeks Attend Bitcoin Options Expiration in Significant Volumes. Live, an options data specialized platform has furnished an analysis of the options data for January 26th, uncovering significant figures about Bitcoin (BTC).

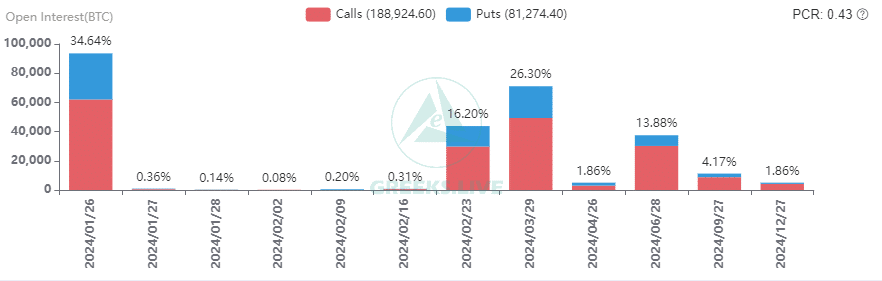

There will be an expiration of around 94,000 Bitcoin options, each with a Put Call Ratio of 0.51, a Maxpain point of $41,000, and a fictitious value of $3.75 billion.

Regarding ETH, an estimated 932,000 options are near expiration dates, representing a put call ratio of 0.31, a maximum price at risk of $2,300, and a theoretical value of $2.07 billion.

This week has been a period of weakness for the cryptocurrency market, with the recent grayscale sell-off directly ascribed to the introduction of the Bitcoin Spot ETF.

A persistent decrease in volatility is apparent, as indicated by the decline in major-term implied volatilities (IVs) and the descent of certain short-term IVs below the 40% threshold.

A significant decrease in the Put Call Ratio (PCR) signifies a reduction in adverse activity, with excess traders selling calls and a dearth of those engaging in active calls.

With the expiration of over 30% of options approaching today, there is an expectation that the margin released during this period may once more influence IV, thereby contributing to the re-establishment of Bitcoin’s option term structure.

The Price Movements of Bitcoin in 2024

Since the approval of the spot ETF, the price of Bitcoin has been declining, and analysts anticipate a further decline to $35,000 or less before the cryptocurrency resumes its next bull run.

All sentiments are optimistic regarding the forthcoming Bitcoin halving, which is anticipated to occur around 2024. Analysts even forecast the onset of a subsequent bull run.

Still, confident market analysts recommend exercising prudence! Bloomberg senior commodity strategist Mike McGlone predicts that Bitcoin will likely underperform the stock market in 2024 when risk is accounted for, whereas gold may outperform.

Although there is considerable optimism regarding the forthcoming Bitcoin halving and the approval of spot Bitcoin exchange-traded funds (ETFs), macroeconomic factors may hinder the cryptocurrency’s capacity to surpass previous all-time highs in 2024.

McGlone stresses that market anticipations regarding a possible reduction in interest rates by the Federal Reserve of the United States, an institution that generally favors high-risk assets such as Bitcoin, might be misguided.