A number of law firms have offered to represent Hut 8 investors who recently incurred losses on the Nasdaq amid short-selling accusations.

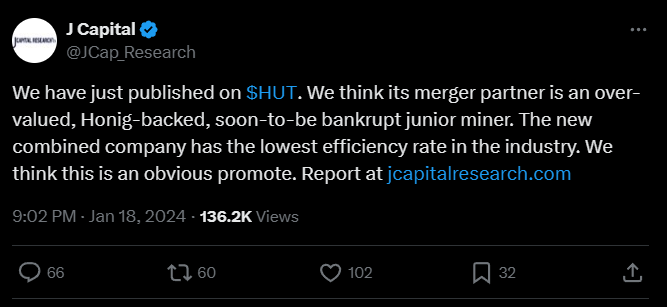

The share prices of Hut 8, a Bitcoin mining company, dropped 23% on January 19, from $7.12 to $2.16, following the publication of an unverified allegation by J Capital that claimed insiders were preparing to sell Hut 8 stock. On January 24, after reviewing the report, Hut 8 refuted all accusations of short-selling. The firm declared:

“The report appears to represent a deliberate attempt to spread misinformation about Hut 8, its operations, finances, management practices, and key executives. The statements made by the short seller expose an inadequate, distorted understanding of the Company, its operations, and its key executives.”

According to the J Capital report, USBTC, a partner of Hut 8, has a documented record of legal complications involving a merger transaction valued at $725 million.

Following the resignation of Jaime Leverton as CEO of Hut 8, the position was subsequently filled by Asher Genoot, who now serves as the organization’s president and a council member.

All supporting law firms urge investors who acquired Hut 8 shares between November 9, 2023, and January 18, 2024, to join their efforts in pursuing a settlement for the losses sustained during that period.

By April 8, 2024, shareholders of Hut 8 who suffered losses during the specified period and are interested in filing as the main plaintiff are requested to contact the law firm of their preference.

Kuznicki Law, one of the law firms, asserts that Hut 8 and its executives contravened federal securities laws by fabricating specific financial information, which ultimately hurt the share price.

While certain legal actions target specific individuals who have incurred losses, others assert that compensation is owed to all shareholders who acquired securities during the specified period. Additionally, implementing a contingency fee arrangement will shield shareholders from potential court fee liability.