After Sam Bankman-FTX Fried’s exchange failed, more and more crypto traders are turning to decentralized finance (DeFi) protocols. This is because Ethereum tokens are leaving big centralized crypto exchanges like Binance and OKX.

Decentralized finance (DeFi) protocols are becoming more and more popular at the same time that there are more and more signs that big centralized crypto exchanges are going backward.

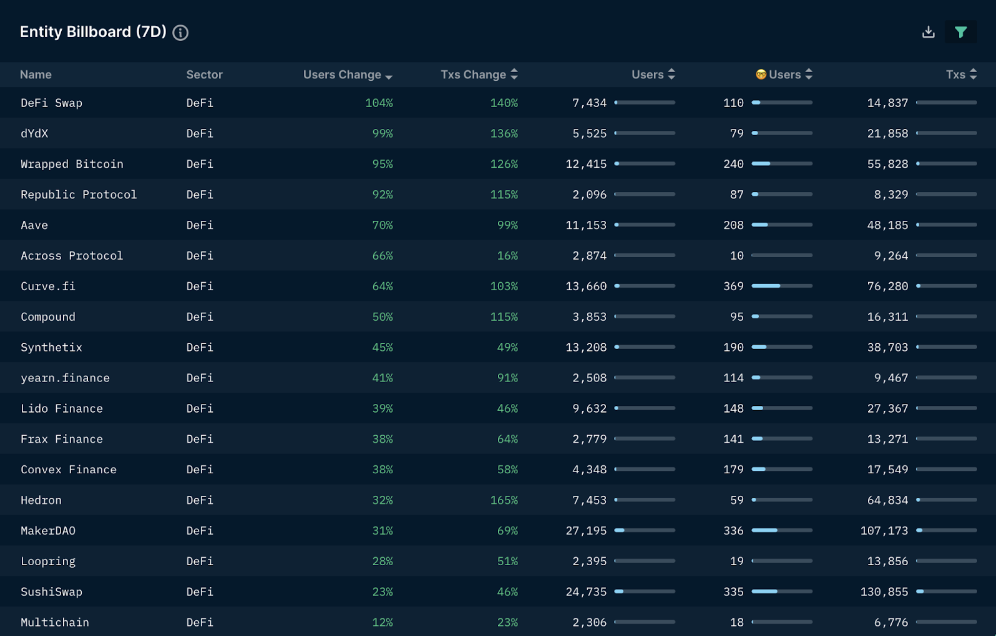

According to the data analytics platform Nansen, the number of users and transactions on most DeFi protocols has grown by more than 10% in the past week. This is a sign of health after the collapse of FTX.

For example, the number of users on dYdX, a decentralized cryptocurrency exchange on the Cosmos blockchain ecosystem, has gone up by 99% and the number of transactions has gone up by 136%.

The growth is reflected in the markets for digital assets. For example, the price of the dYdX token (DYDX) is up 77%, even though 88% of digital assets in the DeFi sector fell in the week ending on Tuesday as a result of FTX’s collapse.

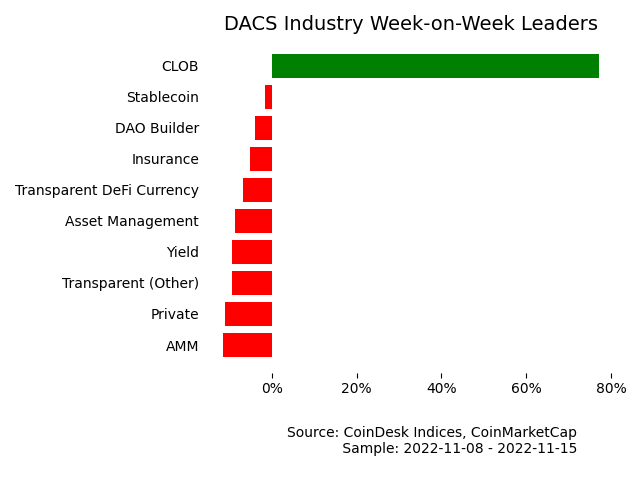

In the CoinDesk Digital Asset Classification Standard (DACS), the DYDX token is part of the CLOB (central order limit book) industry. According to CoinDesk Indices, this is the only industry out of 36 that has a positive week-over-week return.

Aave, which is a decentralized lender, got 70% more users and 98% more transactions.

Walter Teng, vice president of digital asset strategy at Fundstrat Global Advisors, told CoinDesk via Twitter, “As we see the spread of FTX, users realize the importance of self-custody and transparency that DeFi protocols offer. Because of this, the number of people using DeFi protocols has gone up.”

Decentralized exchange Uniswap

Even though trust in centralized exchanges has dropped a lot since FTX went down, Nansen data shows that Uniswap, the largest decentralized cryptocurrency exchange, has seen a 19% increase in users and a 21% increase in transactions in the last 30 days.

At press time, Uniswap’s 24-hour ether trading volume was $900 billion, which CoinGecko says is more than Coinbase, OKX, and Gate.io put together.

Also, 55,550 new wallets are added to Uniswap’s Web App every day, which is 2022 high.

“Self-custody and transparency are in demand, and users are flocking to what they know and trust,” Uniswap Labs said in a tweet.

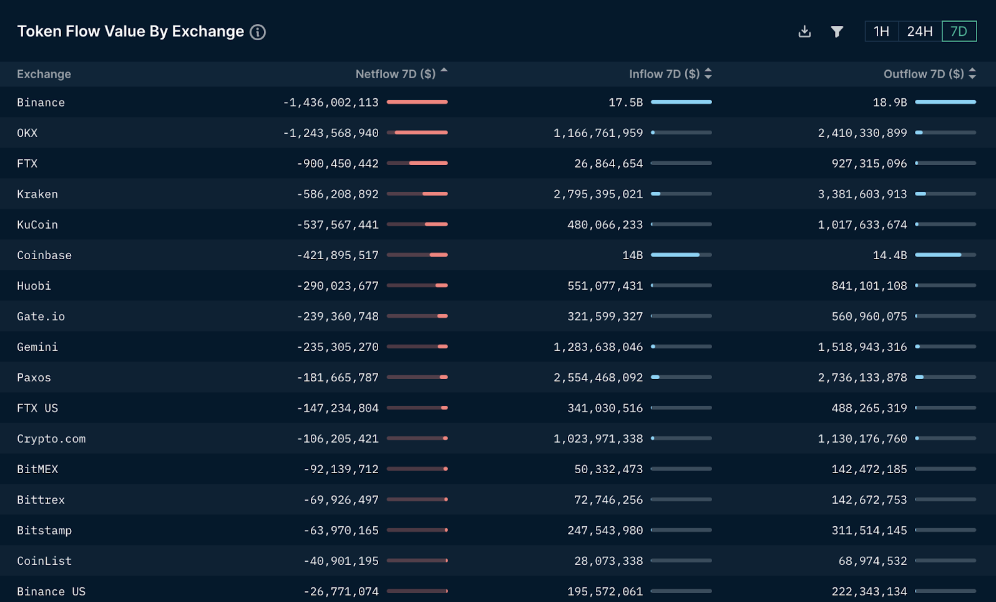

Token flow value of centralized exchanges

People are moving a lot of money out of centralized exchanges because they want to store their cryptocurrencies somewhere else.

In the past 7 days, Binance had the largest net outflow, which is the difference between outflows and inflows. This was about $1.44 billion. This means that users have taken out $1.44 billion more from Binance than they have put in. (Nansen’s token flow value by exchange only takes into account ETH and ERC-20 tokens based on Ethereum.)

OKX came in second with a $1.24 billion loss in net cash flow. With a net outflow of $900 million, FTX is in third place. Kraken, on the other hand, had a net outflow of $586 million.

Nansen says that in the past week, users have taken $48.35 billion out of Binance, OKX, FTX, Kraken, KuCoin, Coinbase, Huobi, Gate.io, Gemini, Paxos, FTX US, and Crypto.com. This is because users put $42.03 billion into these exchanges but took $48.35 billion out.

The large outflows probably show that users don’t trust centralized exchanges enough to keep their money there.