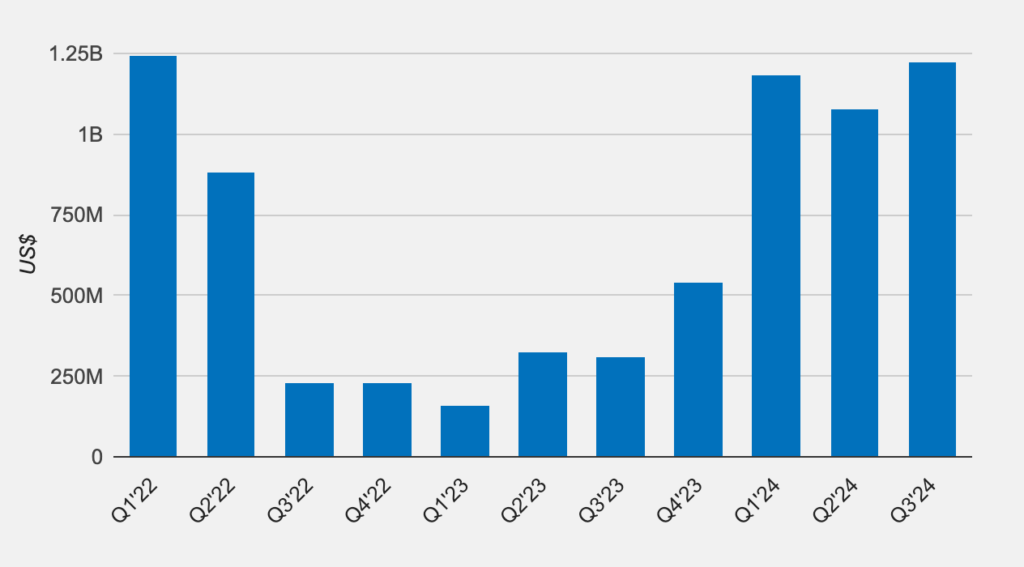

On a year-to-date basis, publically traded mining companies invested $3.6 billion in plant, property, and equipment (PP&E) enhancements, including acquiring new mining hardware.

TheMinerMag reports that 16 mining companies have collectively raised over $5 billion in 2024, with Q3 exhibiting the highest level of PP&E expenditure since Q1 2022.

Mining infrastructure expenditures comprised the majority of PP&E expenditures. Combined hardware enhancements have cost public mining companies $2 billion since 2023.

TheMinerMag also observed the transition of mining companies from equity financing to debt financing. MARA, previously known as Marathon Digital, was the most recent mining company to adopt this approach. The company utilized its 0% convertible note offering to acquire 6,474 Bitcoin for its corporate treasury.

PP&E expenditures by mining corporations in November 2024

On November 1, Bitfarms executed a miner hosting agreement with Stronghold that stipulated hosting an additional 10,000 Bitcoin mining devices at its Pennsylvania facility.

CleanSpark, a company specializing in renewable Bitcoin mining, announced its intention to construct 400 megawatts of mining infrastructure in October 2024, shortly after acquiring mining company GRIID.

Hive Digital acquired 6,500 application-specific integrated circuits (ASICs) on November 11 for its forthcoming Paraguay facility, which is presently under construction.

Bitmain faces criticism

United States authorities recently investigated Xiamen Sophgo, a China-based chip designer with connections to Bitmain, for allegedly employing the same computer chips as Huawei’s Ascend 910B AI processor.

In 2020, the United States imposed sanctions on Huawei, a Chinese technology company and mobile device manufacturer. The company was accused of endangering US national security by utilizing backdoors in its technology that the Chinese government could exploit to access sensitive data and eavesdrop on US citizens.

Xiamen Sophgo and Bitmain issued statements in response to the controversy, denying allegations of violating US sanctions and having a business relationship with Huawei.

Despite the statements, the Customs and Border Protection Agency has suspended a shipment of Bitmain Antminers, which are ASIC devices used to mine crypto, at US ports.

The customs agency requests a $200,000 charge to clear the shipment, which has sparked fear, uncertainty, and doubt that sanctions and geopolitical tensions could result in a supply shortage of the back-ordered and badly needed mining hardware