The investor held the Ethereum for two years despite market challenges, demonstrating the “diamond hands” strategy.

During the bear market of 2022, an investor in cryptocurrencies made a profit of $131.72 million by purchasing Ether, holding onto it for a period of two years and successfully navigating through challenging market conditions.

The blockchain analytics company Lookonchain discovered an Ether wallet address belonging to a wealthy investor. This illustrates the long-term losses associated with panic selling.

We refer to an investor as having diamond hands if they persist in holding onto their investments, even in the face of market volatility and price fluctuations.

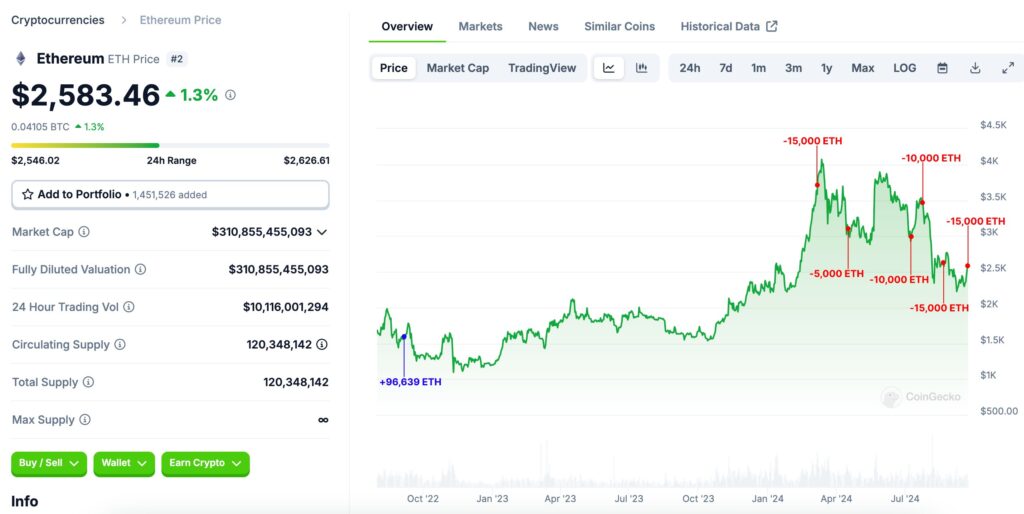

The investor reportedly made a purchase of 96,639 ETH from the Coinbase cryptocurrency exchange between September 3 and September 4, 2022, according to Lookonchain.

Reaping profits through hodl strategy

During that time period, Ether was priced at approximately $1,567. As a result of the operation, the whale investor was able to obtain ETH tokens worth $151.42 million.

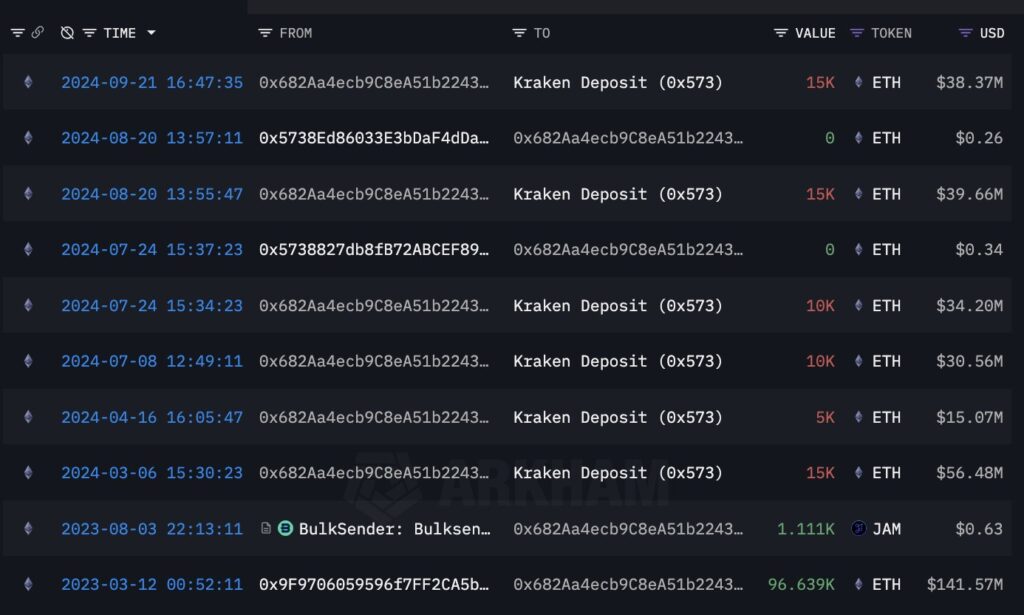

The investor carried out multiple transactions in March 2024, resulting in the transfer of more than 72 percent of the initial investment, which was 70,000 ETH, to the cryptocurrency exchange Kraken.

The current market price of Ether was $3,062, which corresponds to a transfer value of $214.34 million at the time the transfer took place. The investor has 26,639 ETH in their wallet from the initial purchase, which is currently valued at $68.81 million.

Diamond hand investors eye memecoins

They have also made recent transfers through Kraken. Investors in cryptocurrencies have been able to achieve excellent long-term returns by adopting the buy-the-dip mentality throughout the years.

A Shiba Inu investor with diamond hands just made a $1.1 million profit on an investment of $2,625 after waiting for three years.

According to Lookonchain, the transaction took place two weeks after another astute cryptocurrency trader turned $3,000 worth of Pepe into $46 million by trading the Pepe memecoin during the reemergence of the GameStop saga, which caused the price of some memecoins to increase.