DraftKings shuts down its NFT business following legal issues and a court ruling on an unregistered securities lawsuit.

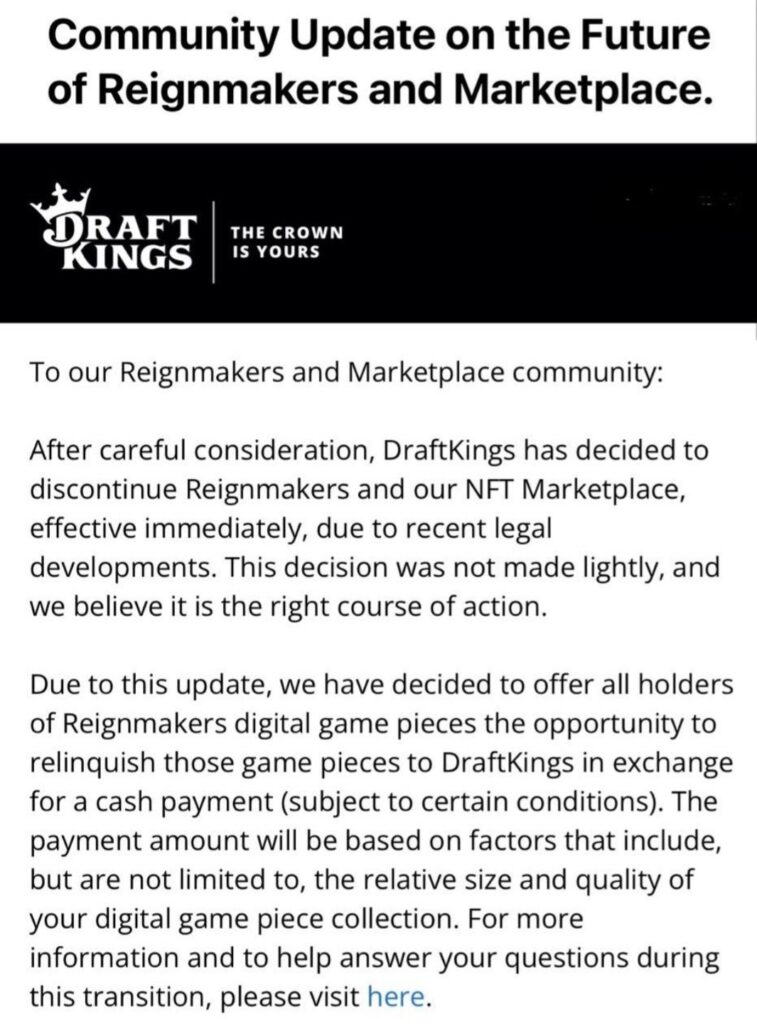

DraftKings, a sports betting platform, has promptly discontinued its nonfungible token business as a result of recent “legal developments.”

DraftKings’ motion to dismiss a class action lawsuit in which it was alleged that the NFTs it issued were unregistered securities was denied by a federal court judge four weeks ago.

Due to recent legal developments, DraftKings has reportedly informed users in an email that Reignmakers and our NFT Marketplace will be discontinued immediately. This decision was made after careful consideration.

“This decision was not made lightly, and we believe it is the right course of action.”

Access and transfer of assets will be permitted to NFT collectors of the fantasy sports game Reignmakers.

DraftKings initiated its NFT marketplace on the Ethereum layer 2 Polygon network during the NFT summer of 2021.

In February 2023, Matt Kalish, one of the firm’s founders, stated that a portion of the motivation stemmed from the enthusiastic reception of NBA Top Shot NFTs.

One of the company’s initial Tom Brady-themed NFT collectibles was in high demand and was sold out immediately.

However, in March 2023, Justin Dufoe, a consumer of DraftKings, initiated a class action lawsuit against the company, asserting that its NFT satisfied the Howey test.

The court determined on July 2 that Dufoe “plausibly pled” that DraftKings NFTs were investment contracts and, as a result, securities “within the meaning” of the Securities Act and Exchange Act.

In June, Dapper Labs, the company responsible for the NBA Top Shot NFTs, encountered a comparable legal proceeding. Ultimately, the company resolved the dispute by agreeing to pay $4 million.

A day after two artists filed a lawsuit against the US securities regulator in an effort to ascertain whether NFTs are within the commission’s jurisdiction, this development has transpired.

The court was asked by the attorneys representing the artists whether they must “register” their NFT art before selling it to the public and whether they must make public disclosures about the “risks” of purchasing their art.

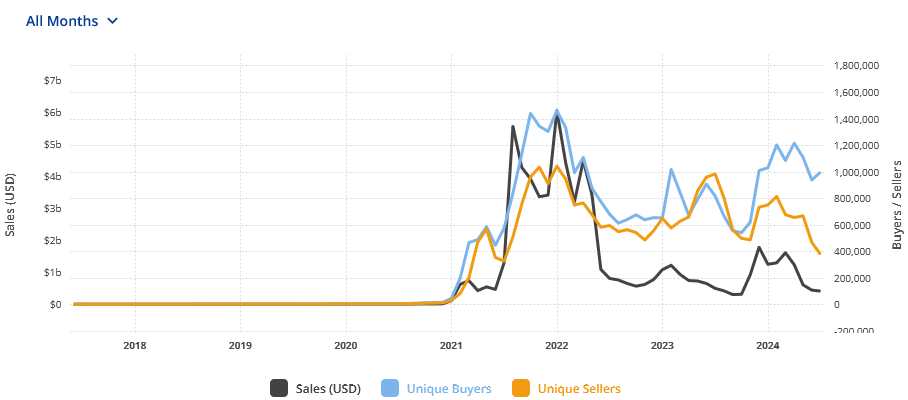

According to CryptoSlam’s NFT data tracker, NFTs are expected to generate a combined $407.8 million in sales this month, the lowest monthly volume since November 2023.

March, which achieved a 2024-record of $1.6 billion in sales, experienced a 74.6% decline.