El Salvador currently holds more than $31 million in Bitcoin profit, despite the widespread initial criticism.

El Salvador is celebrating its third anniversary of adopting Bitcoin as legal tender, a move the country implemented on September 7, 2021, to enhance financial inclusion, improve remittance efficiency, and attract financial innovation.

President Nayib Bukele’s decision positioned El Salvador as a groundbreaking country in the digital asset space, according to Alex Momot, founder and CEO of Peanut Trade, a crypto trading platform.

“El Salvador’s experiment with Bitcoin can be seen as a success. The country acted as a pioneer, taking risks and trying something radically new. While it’s too early to declare whether all aspects of the reform were successful, it’s clear that El Salvador has reaped some benefits.”

El Salvador’s Bitcoin Gains

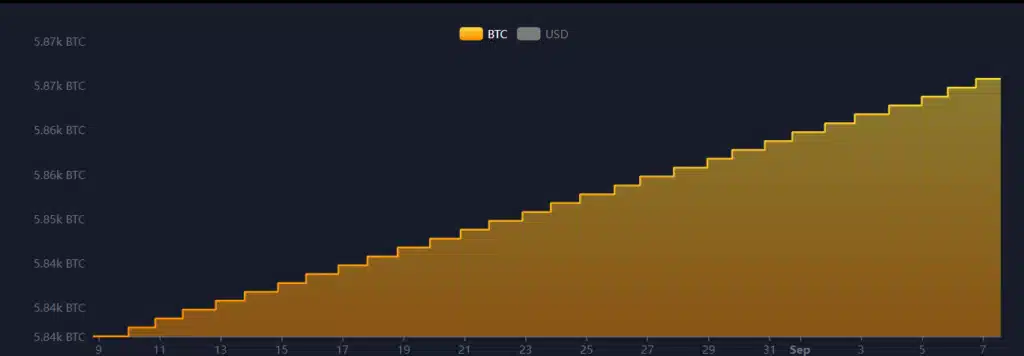

Since 2021, El Salvador has been dollar-cost averaging its Bitcoin purchases, acquiring one Bitcoin daily as part of its adoption strategy.

Currently, the nation’s Bitcoin holdings show over $31 million in profit, according to the Nayib Bukele Portfolio Tracker website.

El Salvador bought its Bitcoin at an average price of $43,877 per BTC. As of September 7, 10:55 am UTC, Bitcoin was trading at $54,300.

Momot noted that the country’s $31 million profit underscores the economic viability of the decision despite initial skepticism:

“This financial gain further strengthens Bukele’s position, as the initiative now appears to be yielding tangible benefits, adding another layer of validation to his bold cryptocurrency experiment.”

According to its treasury, El Salvador holds 5,865 Bitcoins, now valued at over $318 million.

Although President Bukele’s decision initially drew criticism, especially after Bitcoin dropped from its all-time high of $69,000 in November 2021, following the collapse of the FTX exchange, the country’s Bitcoin reserves took a hit during the bear market when the cryptocurrency fell as low as $16,000.

Why Haven’t Major Economies Adopted Bitcoin?

Bitcoin’s economic model rewards early adopters, leading some crypto investors to expect more countries to follow El Salvador’s example.

However, only one other nation, the Central African Republic, has adopted Bitcoin as legal tender, while larger economies remain reluctant.

In April 2022, the Central African Republic became the second country to legalize Bitcoin, aiming to boost its economy and improve financial inclusion.

Momot explained that larger countries are less likely to adopt Bitcoin due to their reliance on international creditors, who generally oppose such moves:

“The bigger the country, the less likely it is to take such risks. This is because larger economies often depend on relationships with international creditors, who are strongly opposed to such moves.”

El Salvador faced pressure from the International Monetary Fund (IMF) to reverse its decision, according to Harshit Gangwar, head of marketing and investor relations at Transak.

“In hindsight, El Salvador was a trailblazer for normalizing Bitcoin as both an everyday currency and as a national investment, and the subsequent institutional adoption in other global regions has vindicated that decision. If El Salvador had left it until today to make Bitcoin legal tender, it’s fair to say there would be much less pushback.”

Although Brazilian lawmakers have expressed interest in creating a legal framework for Bitcoin, concrete regulations have yet to materialize.