Ethena Labs has received $14 million in financing from various crypto industry venture capitals for an Ethereum-based synthetic dollar.

Among other investors, venture capital firm Dragonfly provided the financing that Ethena’s team disclosed on February 16. The startup secured $6 million in an earlier round of funding in 2023 from Binance Labs, Gemini, Bybit, Mirana Ventures, OKX Ventures, and Deribit to bootstrap decentralized finance solutions on the Ethereum network.

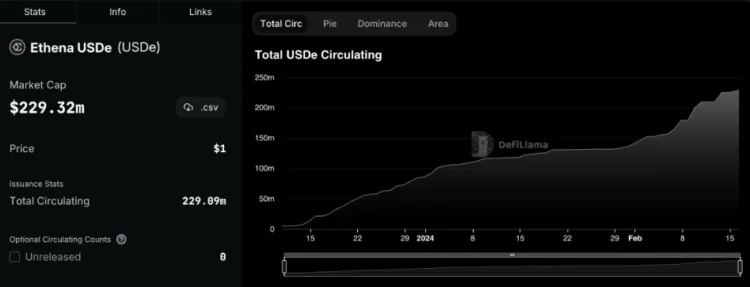

Using staked Ether as collateral and delta-hedging strategies, the funds will bolster the USDe, a synthetic currency. Since its introduction in December, the product has accumulated a total locked value of $200 million, according to data from DefiLlama.

The company explained in a statement that, “USDe maintains its approximate target to the U.S. dollar by delta-hedging assets provided by users minting USDe to short-staked Ethereum collateral using perpetual swaps to achieve “delta-neutral” stability.”

Alternatively stated, USDe sustains its linkage to the U.S. dollar by employing various hedging tactics. It uses financial derivatives, including perpetual swaps contracts and arbitrage, to guarantee the digital currency’s value remains unchanged from the dollar. This deviates from the conventional stablecoins, which rely on algorithmic preservation or direct collateral.

Guy Young, CEO of Ethena Labs, remarked, “We consider stablecoins to be the most significant instrument in cryptocurrencies and the only concept that has achieved true product-market fit, with over $130 billion in global demand despite issuers fully internalizing the yield.”

As an illustration, in the fourth quarter of 2023, Tether Holdings Limited, the foremost issuer of stablecoins, reported a “record-breaking net profit” of $2.85 billion. This resulted from yields on its Tether reserves, which comprised approximately $1 billion in interest from United States Treasury securities—the primary asset backing for the stablecoin.

“The space is predicated on centralized stablecoins backed by collateral stored in the banking system; therefore, the greatest opportunity, in our opinion, is to provide a synthetic crypto-native dollar.”

Despite delta hedging, the synthetic dollar remains susceptible to certain risks. Liquidity and counterparty risks are ever-present during periods of market duress and unforeseen circumstances. The startup asserts that institutional-grade firms, including Fireblocks, Copper, and Bitgo, have insured and settled collateral to mitigate these risks.

“Despite their significant surge in popularity in recent years, stablecoins continue to face obstacles in one of three areas: capital efficiency, censorship, or access to USD-denominated savings and remittances for global users,” said Tom Schmidt, general partner at Dragonfly. Schmidt referred to the synthetic product as the “holy grail of crypto dollars.”