An Ethereum address that participated in the blockchain’s ICO in 2014 has just made its first transaction after 7.5 years of dormancy. The address bought 2,365 ether in the ICO and has increased its value by over 600,000% since then.

A test transaction or a sign of selling?

The address was sent one ether to a new address on April 23, 2023, possibly as a test transaction before moving more funds. The remaining balance of the address is 2,364 ether, worth about $4.4 million at the current price of $1,860 per token.

The transaction was spotted by Twitter user @eth_classic, who tracks old Ethereum addresses and their activities. He speculated that the address might be preparing to sell some or all of its ether holdings.

“This is a very rare event and it could indicate that the owner is getting ready to sell some or all of their ETH,” he tweeted. “It could also be just a test transaction to check if the address is still accessible.”

The address is one of the earliest participants in Ethereum’s ICO, which took place between July and August 2014. The ICO raised $18 million in Bitcoin from 60 million ether sold at $0.31 each

Understanding Ethereum’s Functionality

Ethereum is a blockchain-based platform that allows anyone to create and run dApps using smart contracts. A smart contract is a self-executing agreement that can encode logic and rules. For example, a smart contract can enable value transfer, conditional execution, or workflow automation.

Ethereum uses its native cryptocurrency, ether (ETH), as the fuel for running dApps and smart contracts. People can use ether as a store of value or a medium of exchange within or outside the Ethereum ecosystem.

Ethereum uses PoW, where miners solve puzzles to validate and secure transactions. It plans to switch to PoS, where validators stake ether to govern and reward the network.

Ethereum is constantly evolving and improving its features and performance. Some of the significant upgrades that Ethereum has undergone or is undergoing include the following:

- Homestead: The first stable release of Ethereum in 2016, which introduced several enhancements and bug fixes.

- Metropolis: A two-part upgrade with Byzantium (2017) and Constantinople (2019), adding features like zk-SNARKs, account abstraction, and lower block rewards.

- Serenity: The final upgrade will switch Ethereum to PoS, add sharding and eWASM (a new virtual machine). Serenity is expected to be completed by 2022.

The ICO Boom and Bust

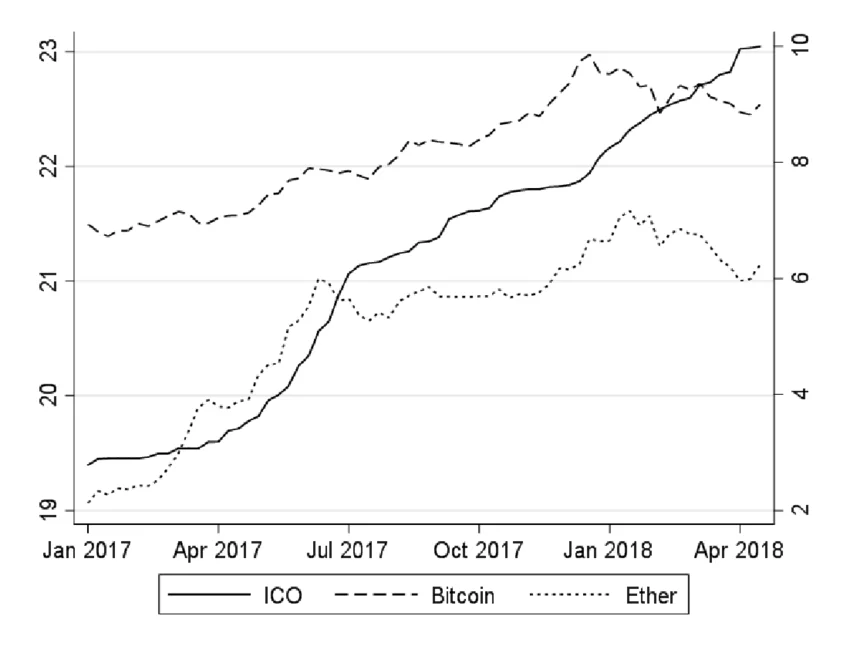

Ethereum’s ICO in 2014 was a precursor to the boom from 2016 to 2018. During this period, hundreds of projects launched their tokens on Ethereum’s platform, raising billions of dollars from investors who hoped to get in on the next big thing in crypto.

Some of the most notable ICOs that took place on Ethereum include:

- DAO: A decentralized autonomous organization that aimed to create a new form of governance and funding for crypto projects. A $50 million hack in 2016 split Ethereum into two chains after it raised $150 million.

- BAT: A token that powers the Brave browser and rewards users and publishers for viewing and creating online content. It raised $35 million in 2017 in less than 30 seconds, setting a record for the fastest ICO ever.

- EOS: A platform that claims to offer faster and more scalable dApps than Ethereum. It raised over $4 billion in 2018 in a year-long ICO, making it the largest Initial Coin Offering ever.

Regulators and authorities cracked down on the ICO market. Some of their actions include:

- SEC: Some ICOs, such as Telegram, Kik, and Paragon, faced lawsuits or charges from the SEC, which said most ICO tokens must follow federal securities laws and gave warnings and guidance.

- China: The People’s Bank of China (PBoC) banned all ICOs and crypto exchanges in 2017, citing risks of financial fraud and instability. It also launched a campaign to block access to ICO websites and platforms.

- India: The Reserve Bank of India (RBI) prohibited banks and financial institutions from dealing with or providing services to entities dealing with cryptocurrencies in 2018. It also warned investors of the legal and financial risks of participating in ICOs.

The Future of Ethereum and ICOs

Despite the challenges and setbacks faced by Ethereum and ICOs, both still have a lot of potential and innovation to offer. Ethereum is working on several upgrades and solutions to improve its scalability, security, and usability. Some of the upcoming developments include:

- EIP-1559: A proposal that aims to change the fee market of Ethereum by introducing a base fee that is burned and a tip that is paid to miners. This is expected to reduce congestion, volatility, and gas fees on the network, as well as make ether more scarce and valuable.

- Eth2: A long-term vision that will transition Ethereum from PoW to PoS, introduce sharding, and implement eWASM. This is expected to increase the throughput, efficiency, and sustainability of the network, as well as enable new features and possibilities for dApps.

- Layer 2: A set of solutions that aim to increase the scalability of Ethereum by moving some transactions or computations off-chain while maintaining security and interoperability with the main chain. Some examples of layer 2 solutions include rollups, state channels, plasma, and sidechains.

ICOs are also evolving and adapting to the changing market and regulatory environment. Some of the new trends and models for token sales include:

- IEO: An initial exchange offering (IEO) is a token sale conducted on a crypto exchange platform instead of directly by the project. This is supposed to provide more credibility, security, and convenience for both investors and projects.

- STO: A security token offering (STO) is a token sale that complies with securities laws and regulations. This is supposed to provide more transparency, accountability, and protection.