Standard Chartered predicts Ethereum could hit $10,000 by 2025 and Bitcoin $200,000 soon, following Trump’s win and a Fed rate cut.

Standard Chartered has made a bold prediction that the price of Ethereum is likely to reach $10,000 in the near future. This statement has sparked excitement in the midst of the continuing climb.

In addition to Ethereum, the report suggests that Bitcoin is preparing for a significant upward push, potentially surpassing the short-term milestone of $200,000. This estimate comes at a time when the broader digital assets space is experiencing favorable momentum as a result of Donald Trump’s election victory and the 25 basis point decline in the Federal Reserve’s interest rate this week.

Standard Chartered Predicts Ethereum Price To Hit $10,000

Standard Chartered predicts a four-fold increase in the total market capitalization of cryptocurrencies by the time of the United States midterm elections in late 2026. Considering that the present market capitalization is hovering around the $2.5 trillion mark, the projection, if it comes true, means that it has the ability to reach $10 trillion by the time that the future arrives.

Furthermore, the renowned financial firm reaffirmed its original target for Ethereum, which remains unchanged at $10,000. The company stated that the cryptocurrency with the second-largest market cap might surpass the figure as soon as the year 2025 comes to a close, which bolstered market optimism in the midst of an already robust surge.

While this was going on, Geoffrey Kendrick, Head of Research at Standard Chartered, listed a number of factors for his bullish prognosis. These variables included the recent victory of the Republican Party, the anticipated clarity of regulations, among others.

He stated that the Donald Trump administration is likely to implement laws favorable to cryptocurrencies, potentially leading to an increase in the adoption of digital assets in the near future.

In addition, the company believes that the United States Securities and Exchange Commission (SEC) would modify its approach to the cryptocurrency sector while the Republican administration is in power. This has also sparked discussions, as recent reports suggest that Gary Gensler, the chair of the Securities and Exchange Commission, may leave his position as soon as this year.

Specifically, notable cryptocurrency market specialist Ali Martinez expressed a sentiment similar to this one, stating that Ethereum’s recent rise to $3,000 represents “just the beginning” of its bull run. In a previous statement, he stated that Ethereum might follow a pattern that is comparable to that of the S&P 500 and would reach $10,000 in the days ahead.

Additionally, the bank reaffirmed its forecast that the price of Bitcoin would reach $200,000 at the same time that the price of Ethereum would reach $10,000. According to the analysis, Bitcoin and other prominent alternative cryptocurrencies, such as Solana and Ethereum, among others, are likely to reap the most benefits from the new administration.

Aside from that, Standard Chartered is also considering the prospect that the United States of America may use Bitcoin as a strategic reserve for the country, which could potentially sustain the strong run for the cryptocurrency. However, there is a low likelihood of such a development occurring.

In contrast, Donald Trump and Senator Cynthia Lummis have pledged to make Bitcoin the US’s strategic reserve.In the meantime, the price of bitcoin today reached a 24-hour high of $77,252.75, a 0.3% increase from its previous level of $76,532. Also, the significant amount of money that has been flowing into the US Spot Bitcoin ETF is a reflection of the growing institutional backing for the cryptocurrency.

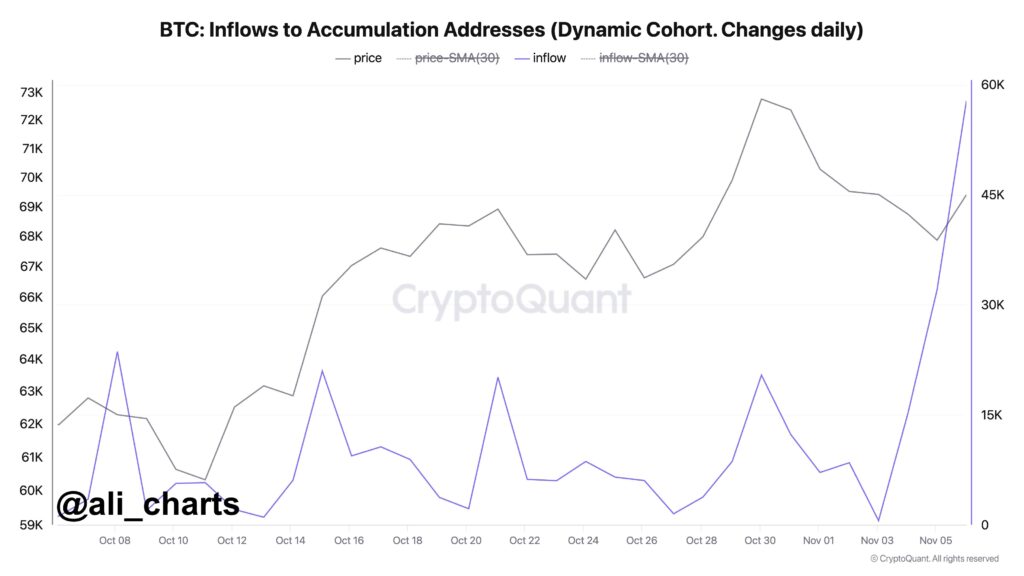

A recent research study, which is particularly noteworthy, reveals that a large number of new wallets have begun to accumulate Bitcoin as the cryptocurrency’s popularity among traders continues to rise. Ali Martinez highlighted the accumulation of over 57,800 Bitcoins over the past several days, valued at approximately $4.16 billion.

The price of Ethereum, on the other hand, increased by 4% and surpassed the $3,000 threshold today, while its trading volume reached $32.76 billion worldwide. In addition, the open interest in Ether Futures increased by 4%, which indicates that the market has a favorable attitude toward the most prominent alternative cryptocurrency.

In the midst of this, the US-listed Ethereum ETF has begun to experience significant demand once more, which indicates that there is more rising. In addition, a new analysis of the price of Ethereum suggests that the cryptocurrency is aiming for the $4,000 mark next, which provides more support for its potential climb to $10,000 by the end of the year.