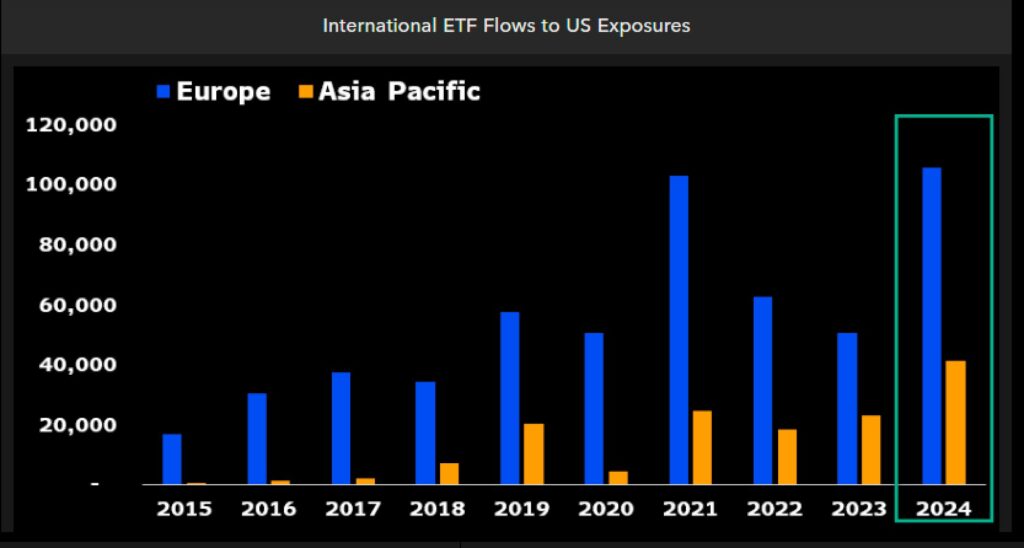

European investors have ramped up their investments in U.S. based spot Bitcoin ETFs to nearly $105 billion year-to-date.

European investors have invested an unprecedented amount of capital in exchange-traded funds (ETFs) based in the United States that involve spot Bitcoin. Year-to-date (YTD) investments in spot Bitcoin ETFs by European investors have reached an all-time high of almost $105 billion.

Eric Balchunas, a senior ETF analyst at Bloomberg, was the one who shared the record European ETF flows. He said the following in a piece that was published on October 21st. Increasing inflows into exchange-traded funds (ETFs) have the potential to propel Bitcoin to an all-time high from its current state of a crabwalk.

“Flows into US-focused ETFs by locals in Europe is now at a record $105b YTD. And why not? $SPY is up 24% vs 10% for Europe. Asia also funneling record flows.”

About 75 percent of the additional money that helped Bitcoin cross $50,000 in February of 2024 came from inflows into Bitcoin ETFs in the United States. Bitstamp’s data indicates that Bitcoin has failed to break through the psychological barrier of $70,000, last observed on July 29.

This is the case even though European inflows have reached record levels. European inflows were not the only major milestone for Bitcoin and Bitcoin-based exchange-traded funds (ETFs) that occurred this past week. Bitcoin’s hashrate, which is the total computer power that is used to secure the network, reached an all-time high earlier today, on October 21.

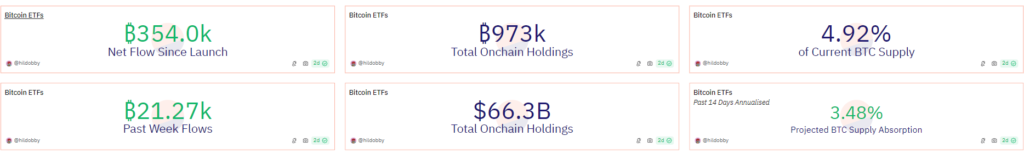

This achievement demonstrates the improving security of the network as well as the rising costs associated with mining Bitcoin. According to Balchunas, on October 17, the total net flows of US Bitcoin ETFs) surpassed $20 billion, which is considered the “most difficult metric to grow” for ETFs.

Gold-based exchange-traded funds (ETFs) took more than five years to reach this same milestone. Despite the achievement of significant ETF milestones, the price of Bitcoin has stayed below $69,500 since July 29

.Analysts at Bitfinex identified the delayed effects of ETF inflows, which might take several days to impact spot Bitcoin prices, as the cause of this phenomenon. As a result of the ask-heavy order book, it appears that cryptocurrency traders are utilizing ETF flows as exit liquidity for their business transactions.

“Usually, this means that large ETF inflows have a muted impact for a few days and then the market reverses lower once the aggression from spot market buyers fades.

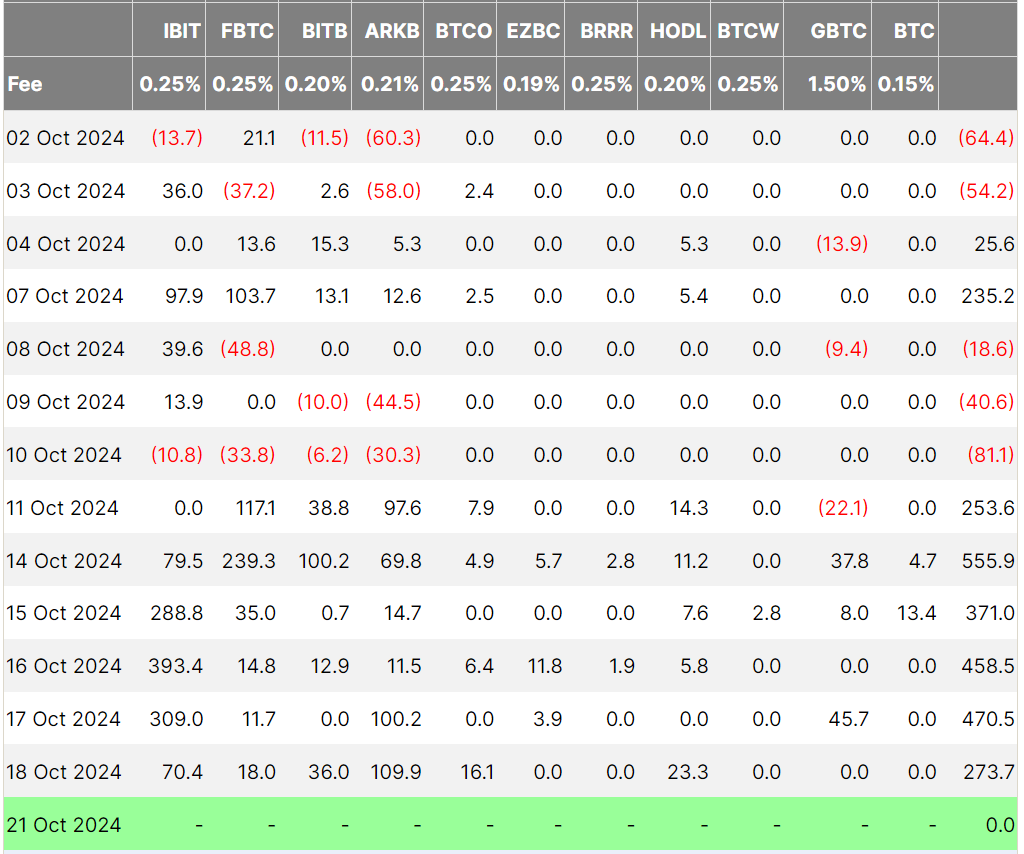

According to the data provided by Farside Investors, the Bitcoin exchange-traded funds have experienced net positive inflows for six straight days.

Bitcoin ETFs in the United States purchased a total of $555 million worth of Bitcoin on October 14.

This resulted in a daily gain of 5% in the price of Bitcoin, which rose from $62,450 to a daily high of $66,479. According to data provided by Dune, Bitcoin exchange-traded funds (ETFs) have topped $66.3 billion in cumulative onchain Bitcoin holdings. This amount represents 4.9% of the current supply of Bitcoin that is circulating.