The US Federal Reserve claimed it discovered “significant deficiencies” in the bank’s dealings with crypto clients and risk management systems.

The United States Federal Reserve has issued a cease and desist order to United Texas Bank, known for its crypto-friendly approach, due to “significant deficiencies” in its risk management and dealings with cryptocurrency clients.

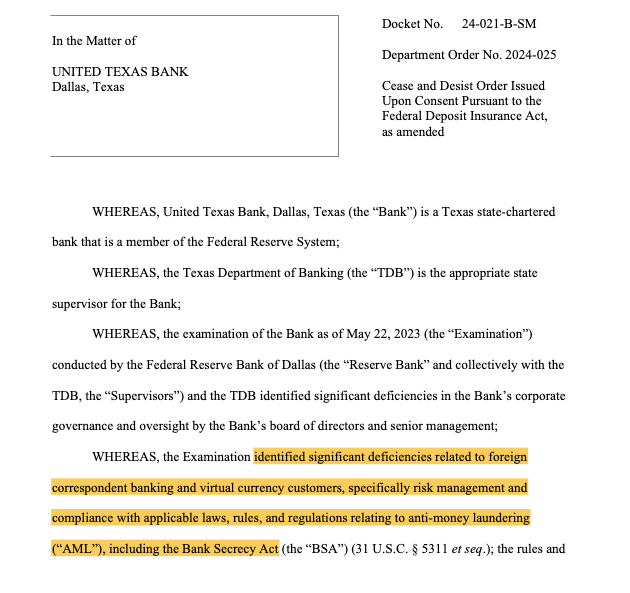

In a cease and desist order dated Sept. 4, the Fed stated that its May examination of United Texas Bank uncovered issues with the bank’s corporate governance and oversight by its board of directors and senior management.

“The Examination identified significant deficiencies related to foreign correspondent banking and virtual currency customers, specifically risk management and compliance with applicable laws, rules, and regulations relating to anti-money laundering including the Bank Secrecy Act,” the Fed explained in the order.

However, the order did not specify how the bank had failed to comply with regulations concerning its crypto clients.

The Fed noted that United Texas Bank has since taken steps to improve its compliance with the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) program.

The bank’s board also agreed to submit a formal plan to enhance its BSA/AML compliance oversight.

According to its latest quarterly report, United Texas Bank, with 75 employees and managing about $1 billion in assets, is not alone in facing regulatory scrutiny.

In August, the Fed took similar action against another crypto-friendly institution, Pennsylvania-based Customers Bancorp, and its subsidiary Customers Bank.

The Fed cited “significant deficiencies” in their risk management following recent examinations by the Philadelphia Federal Reserve Bank.

Customers Bank has begun addressing these issues, focusing on improving its management and AML practices.

These enforcement actions have sparked renewed allegations of a coordinated effort by the government to prevent banks from engaging with the cryptocurrency sector, a campaign referred to by some as “Operation Chokepoint 2.0.”

Dan Spuller, head of affairs at the crypto advocacy group Blockchain Association, described the Fed’s action against United Texas Bank as a continuation of “Operation Chokepoint.”