Bitcoin discussions exploded in the hours following the Fed’s interest rate increase, and BTC prices approached $30,000 in minutes.

The US Federal Reserve announced a 25 basis point increase in interest rates on Wednesday, July 26. Almost immediately after that, Bitcoin and the broader crypto market turned green, with the BTC price approaching $30,000.

BTC is trading 0.7% higher at $29,464 with a market valuation of $572 billion as of press time. Conversely, all of the leading altcoins have been in the green.

The value of Ether (ETH), XRP, and Binance Coin (BNB) has increased by 1.5%. Solana (SOL) continues to lead the top ten cryptocurrency list with over 7% advances. Cardano (ADA) and Polygon (MATIC) are each up greater than 3 percent.

With the recent rate increase, US interest rates have reached their highest level in 22 years. Santiment, an on-chain data provider, explains that the Federal Open Market Committee (FOMC) recently increased US interest rates by 25 basis points to their most incredible level since 2001.

The response of the cryptocurrency markets may hinge on social reactions. Early indications suggest a “sell the rumor, buy the news” strategy, with anticipated price increases.

Amid Fed Rate Hike Bitcoin Gains Popularity

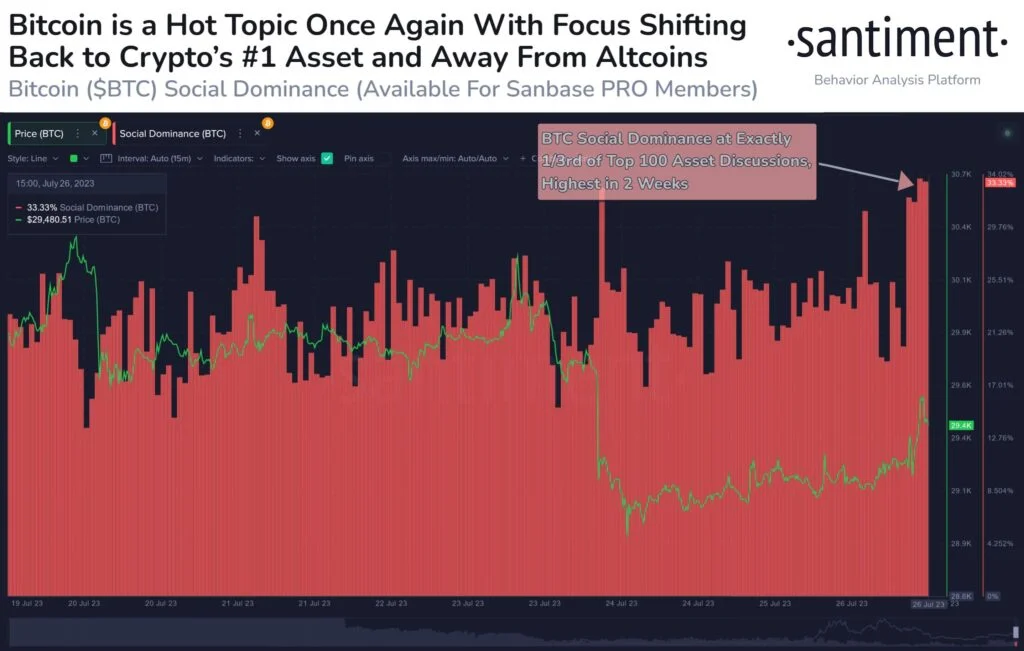

As the Fed proclaims a rate hike, Bitcoin once again eclipses alternative cryptocurrencies. After the Federal Open Market Committee (FOMC) raised interest rates and Bitcoin approached $30,000, there has been a substantial increase in BTC-related conversations relative to the other top 100 assets. According to Santiment, this elevated social dominance typically signifies fear, which could increase the likelihood of a price increase.

The Bitcoin supply at exchanges has fallen to a five-year low, a significant bullish indicator. Despite the current selling pressure, many Bitcoin holders have been self-custodying their coins.

In addition, Fed Chairman Jerome Powell indicated the possibility of another rate increase in September 2023. Over the next two months, investors may prefer Bitcoin to alternative cryptocurrencies.