For the first time since 2019, the fifth-largest Bitcoin holding address, also known as “37X,” has transferred more than $6 billion worth of BTC to three new addresses, according to a report.

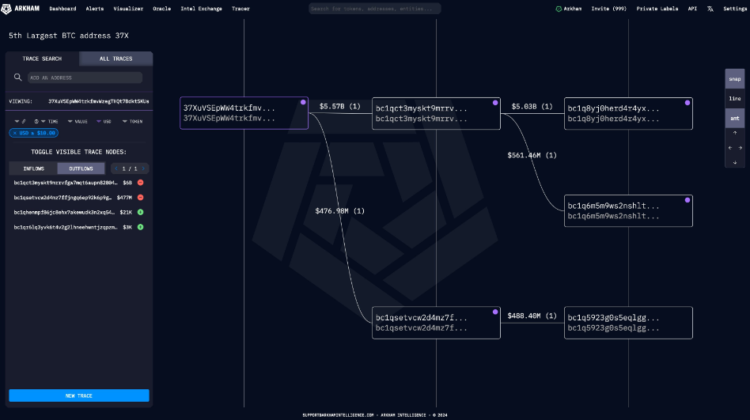

According to a March 25 X post by Arkham Intelligence, the Bitcoin whale transferred nearly its entire balance of 94,500 Bitcoin, worth $6.05 billion, on March 23, leaving only 1.4 BTC in the initial address. They penned:

“$5.03B BTC was sent to bc1q8yj, with addresses bc1q6m5 and bc1q592 receiving $561.46M and $488.40M in BTC respectively. bc1q592 has since sent those funds onwards.”

Ahead of the forthcoming Bitcoin halving, which will reduce block issuance rewards by half in twenty-five days, increased institutional interest in Bitcoin, facilitating the transfer.

For the first time in history, the incoming supply issuance reduction is not fully factored in, despite the Bitcoin price reaching an all-time high before the halving, according to a co-founder of the D8X decentralized exchange and former executive director at UBS, who spoke to Cointelegraph.

The transfer of more than $6 billion BTC occurred two days before Bitcoin reclaimed the psychological price threshold of $70,000 for the first time in ten days on March 25. As investors resumed accumulating BTC off exchanges, the supply of BTC on Coinbase decreased to 344,856 BTC on March 18, the lowest level in nine years.

According to CoinMarketCap, Bitcoin increased 6.4% in the twenty-four hours before 9:53 a.m. UTC to $71,222.

The expanded institutional inflows from the ten-spot Bitcoin exchange-traded funds (ETFs) in the United States and the anticipation of the halving are the primary drivers of Bitcoin’s current rally. Christopher Cheung, partner at Ten Squared, a provider of digital asset funds, stated in a research note:

“The involvement of traditional financial institutions like BlackRock and Fidelity in launching BTC products is further legitimizing cryptocurrency as an alternative asset class. This reduces the ‘career risk’ for investors who were previously hesitant to enter the crypto market.”

Dune reports that the combined on-chain holdings of Bitcoin ETFs have reached $58.3 billion, or 4.17% of the current BTC supply.