This decision has outraged FTX creditors, many of whom feel cheated and frustrated by the handling of the situation.

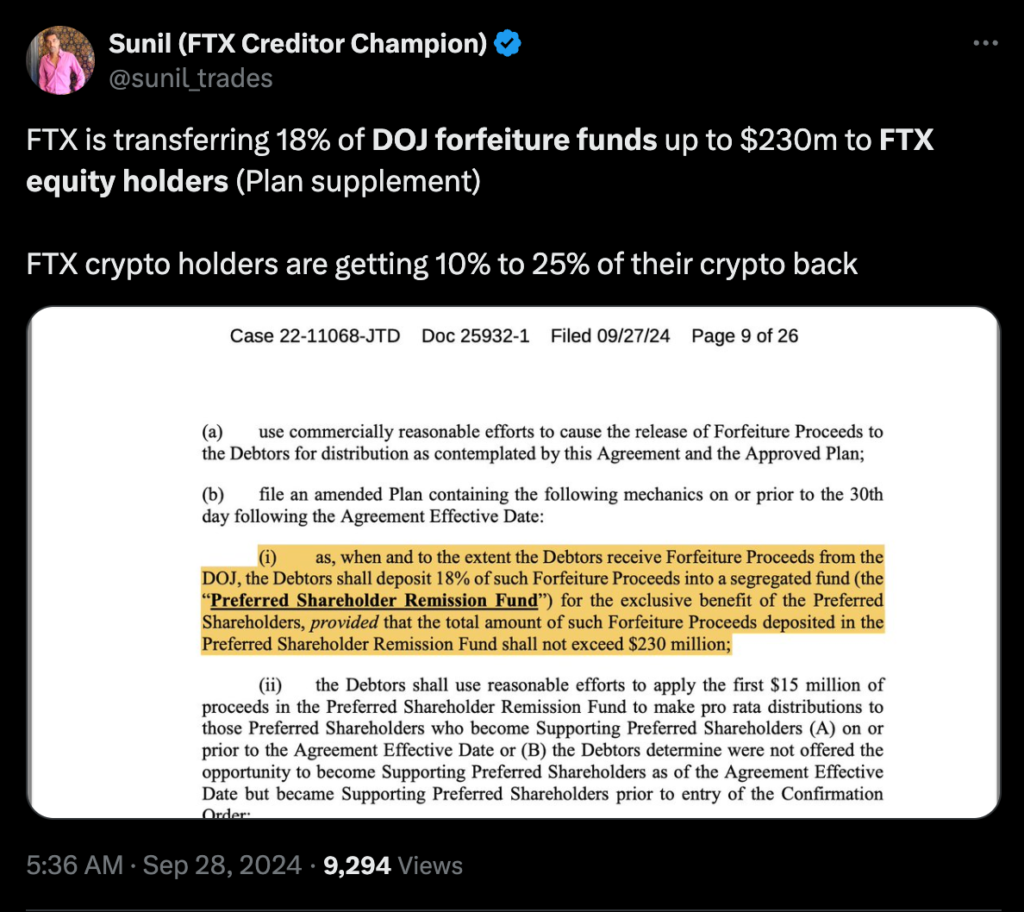

According to FTX creditor Sunil Kavuri’s newly revised bankruptcy paperwork, the FTX Creditors will only receive 10–25% of their cryptocurrency back. The FTX creditor activist explained that the creditors would receive reimbursement based on the date of the petition, when cryptocurrency prices were significantly lower than they are today.

The price of bitcoin was approximately sixteen thousand dollars at the time of the legal petition submission. This serves to contextualize the situation. When it was decided to reimburse consumers and creditors based on the prices that were in effect on the petition date, fights broke out among FTX creditors.

“Crypto holders are not whole at petition date prices as confirmed by the debtors, DOJ, and Judge Kaplan. Many FTX customers continue to suffer from mental distress, panic attacks, divorces, and suicidal thoughts as their life savings have been stolen and property still has not been returned.”

Other creditors and individuals associated with FTX were unanimous in their agreement with Kavuri’s viewpoint. “It’s disgusting they sneak this into the plan so late, after the vote,” a particular person commented. Another FTX creditor asked, “I don’t understand why the law can’t protect us investors,” and referred to FTX’s collapse as a fraudulent scheme.

One of the other FTX Creditors made the following remark: “Disgraceful, we have been scammed twice!”In addition, Kavuri contended that Sam Bankman-Fried had breached FTX’s terms of service as well as the larger meaning of property rights by using customer cash to pay off existing debts.

On September 6, 2024, the FTX estate and Emergent Technologies, a company Bankman-Fried founded, negotiated a contract to purchase the $600 million worth of Robinhood shares in order to pay off creditors.

Many people, including Kavuri and his followers, oppose the reorganization proposal of the FTX estate. In August of 2024, an administrator based in the United States, responsible for overseeing the bankruptcy process, filed a challenge against the FTX reorganization plan.

The trustee argued that the plan provides an excessive amount of legal protections for administrators and representatives of the FTX bankruptcy estate. Trustees Andrew Vara pointed out in the legal filing that these kinds of protections were not typical in situations that were comparable to the one at hand, and that they represented an alarming anomaly.

“Such immunity would far exceed the protections that estate professionals, whose employment and compensation are subject to Court approval and oversight receive during the case.”

The United States Securities and Exchange Commission (SEC) also indicated that they may object to the reorganization plan of FTX if the former cryptocurrency exchange decides to reimburse customers with stablecoin payments.