During the crypto chaos at the beginning of this month, they saw a rise in MEV or profits from optimizing the order of transactions.

The collapse of FTX this month made running the Ethereum network much more profitable. The crypto industry ran into the almost unbreakable rule that when markets are chaotic, the best place to be is in the middle of the action.

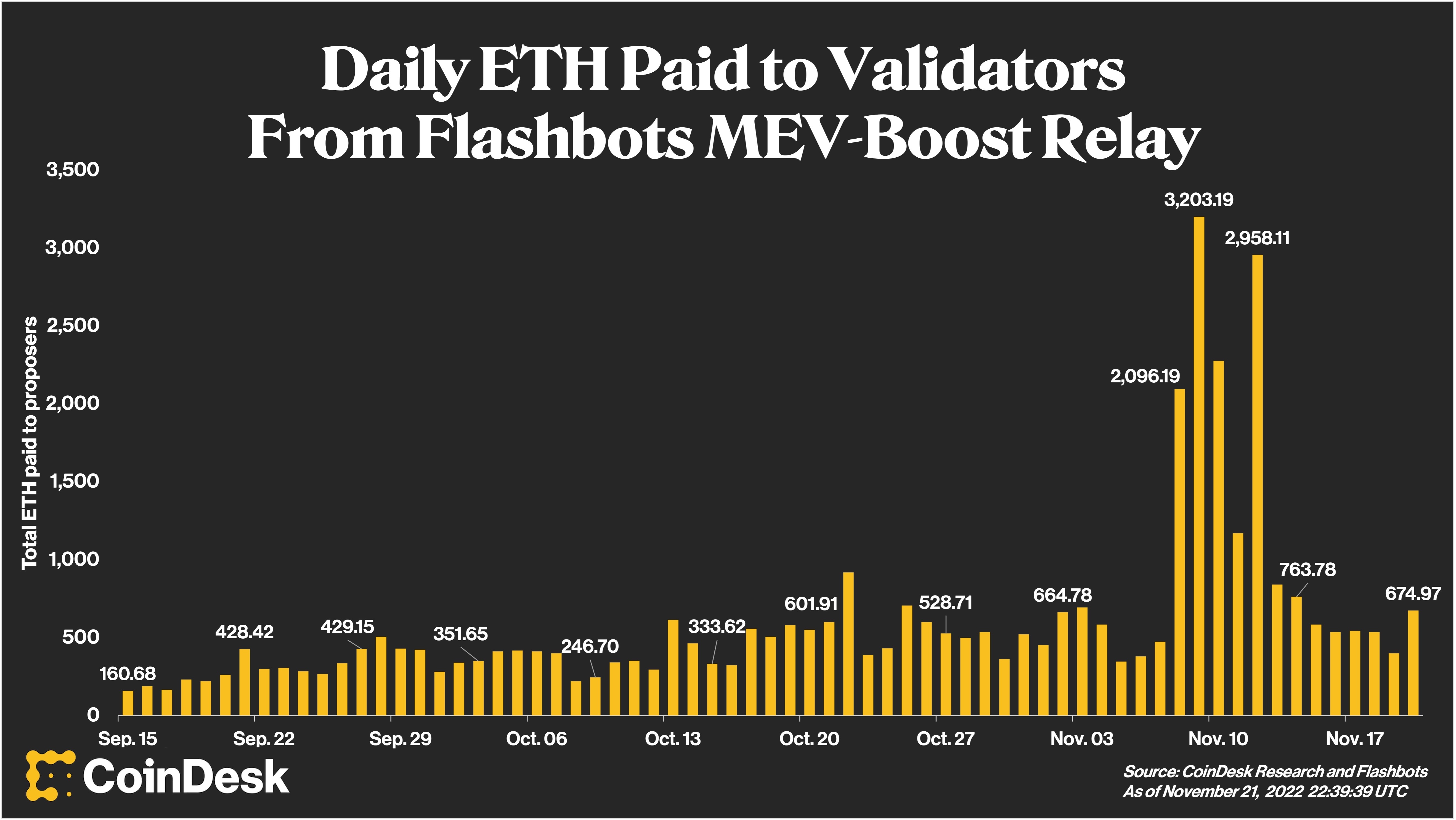

Flashbots data shows that Ethereum validators, who are in charge of running the blockchain after the Merge in September, made more money from MEV (maximum extractable value) as FTX lost value.

MEV is a key part of how crypto is traded. It has some similarities to arbitrage in traditional markets, but there are also big differences. It measures how much extra money validators can make by changing and optimizing the order in which transactions are recorded on the blockchain. Some people say it’s an unfair tax on the environment.

MEV-Boost is a middleware component made by Flashbots that lets validators request blocks from a network of builders. This is one way that Ethereum validators can get around some controversial MEV practices. Validators earn MEV by connecting to MEV-Boost through relays as the one Flashbots runs.

On Nov. 9, users of Flashbots’ MEV-Boost platform won a maximum of 3,203 ETH.

Since MEV-Boost is the main tool and Flashbots controls about 79% of the blocks that are relayed, most of the information about MEV activity can be found in their datasets.

When big news hits the market, prices often change quickly, either up or down. And that can cause big price changes, giving people in the middle a chance to make money, whether they are market makers for stocks or validators for Ethereum.

The co-founder of Eden Network, which runs a relay, Chris Piatt, said, “Volatility is MEV fuel.” “Strong builder/searcher performance is linked to big news like this [the FTX implosion] that moves markets.”

The price of MEV went up as people became more worried about FTX’s health. This made Binance, a larger exchange competitor, rush in to help, but they pulled out the next day, on Nov. 9. There was panic all over crypto.

People moved quickly to get their money out of FTX. This movement of cryptocurrency also meant that there were more transactions that could be MEVed, which may help explain why MEV profits went up, especially from November 8 to November 12.

Toni Wahrstatter, an Ethereum researcher who made his own MEV-Boost monitoring dashboard, said, “The more activity on the market, whether it’s going up or down, the more MEV there is.” “In theory, if no one is trading, then there is also no MEV.”