Coinbase and Glassnode reported on stablecoin adoption and Ethereum layer-2 scaling solutions in the cryptocurrency market.

Coinbase and Glassnode published research on the cryptocurrency market on October 15, citing the rapid acceptance of stablecoins and the ongoing development of Ethereum layer-2 scaling solutions as key catalysts for the market’s maturation.

In the course of this year, the cryptocurrency market has continued to receive billions of dollars in investment capital. The volume of transactions on the blockchain increased as a result of their appearance as spot crypto ETFs.

Significant trading volumes, active on-chain activity, and thriving spot exchange-traded funds all indicate a market that is expanding, becoming more liquid, and expanding access. Coinbase and Glassnode’s research on the cryptocurrency market reveals its tremendous development and maturity.

The market went into spot exchange-traded funds, which significantly boosted its accessibility and liquidity. The blockchain has seen a huge increase in activity alongside this funding. As a result, the cryptocurrency market will be less volatile in 2024 as investors shift their attention to assets of greater quality.

For example, the spot price volatility for Bitcoin over the past three months has dropped below sixty percent. The drop from the peak of approximately 130% in 2021 is significant. Because of this transformation, the environment in which the dominant cryptocurrency operates is becoming more stable.

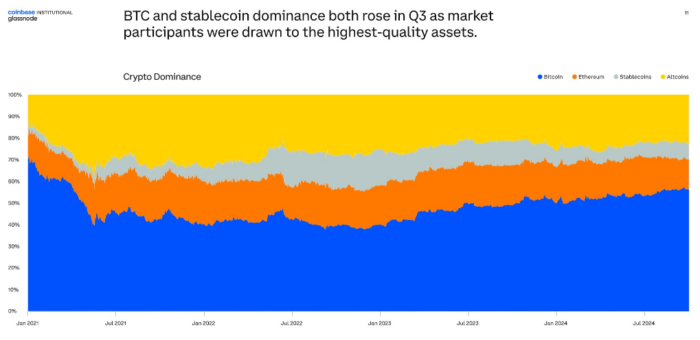

More crucially, the market capitalization of stablecoins and Bitcoin accounts for a greater proportion of the entire market capitalization of cryptocurrencies in the third quarter than it did in the second quarter. This indicates a flight to more secure asset classes due to the shifting dynamics of the market.

The launch of spot Bitcoin exchange-traded funds (ETFs) in the United States in January 2024 sparked this movement. Bloomberg and Coinbase reported that such exchange-traded funds (ETFs) attracted approximately $5 billion into Bitcoin during the third quarter, partially reflecting investors’ desire for regulated, exchange-traded exposure to the digital asset.

The overall market value of stablecoins hit an all-time high of approximately 160 billion dollars during the third quarter of 2024. This is a reflection of the continuous use of stablecoins for a wide variety of business applications within the cryptocurrency economy.

There has been a surge in speculation in the cryptocurrency market just today as a result of Ripple’s announcement of significant improvements on its stablecoin, RLUSD.The unveiling of the first exchange and platform that would support its upcoming debut attracted a significant amount of market attention.

On the other hand, Ethereum exchange-traded funds (ETFs) experienced net outflows as investors withdrew their funds from the Grayscale Ethereum Trust (ETHE). In reality, this trust existed under a different construction type from 2017 until its conversion into an exchange-traded fund this year, 2024.

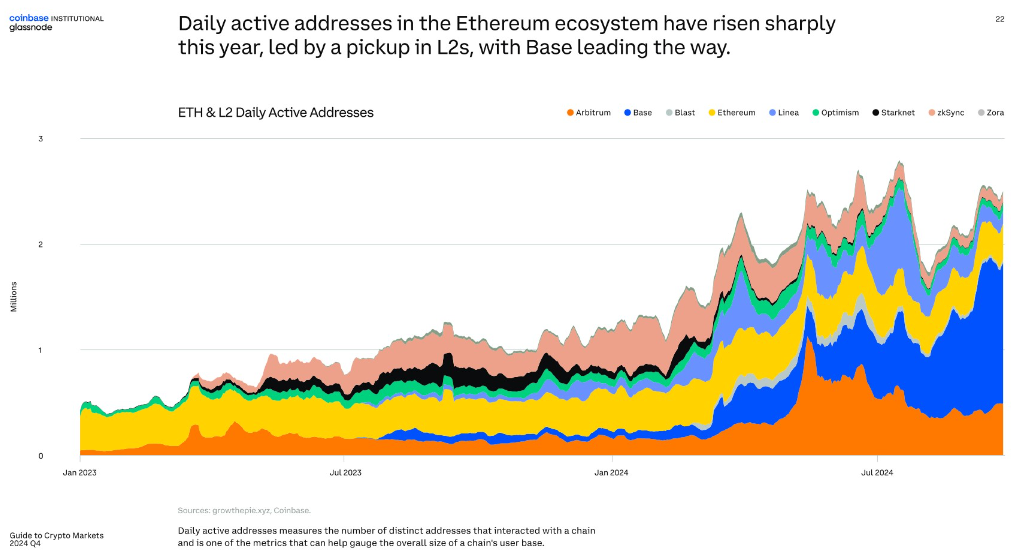

This shift in trend is illustrative of a change in investor sentiment that has occurred as a result of the shifting dynamics of the market. Despite Ether’s spot price performance lagging behind Bitcoin’s, the Ethereum ecosystem is revealing strong growth.

Specifically, a class of cutting-edge Layer-2 scaling technologies is driving this growth, simultaneously expanding the network’s capabilities. This research on the cryptocurrency market demonstrates that the expansion of the ecosystem as a whole indicates a wider acceptance of apps and services that are based on Ethereum, despite the fact that Ethereum’s price swings trail behind those of Bitcoin.

Between the beginning of 2023 and the beginning of 2024, the volume of Ethereum transactions and the number of daily active addresses began to increase. On-chain activity increased by a factor of 5. Experts believe that this is due to the proliferation of layer-2 scaling solutions, such as Coinbase’s Base network, which enhances the efficiency of the network by settling a greater number of transactions at a lower cost, making the ecosystem more accessible.

Furthermore, Ethereum’s portion of the total fee generation among the layer-1 blockchains that generate fees has significantly recovered. DeFi activity and layer-2 acceptance drove a comeback in network demand and usage, resulting in an increase from 9% at the end of August to 40% at the end of September.

Despite changing market dynamics, the network’s ability to recover fees highlights its usefulness in the wider cryptocurrency ecosystem. Despite the fact that it has its own problems, Coinbase collaborated with Glassnode in order to produce this analysis on the cryptocurrency industry.

With the help of its consultant, History Associates Inc., Coinbase filed a lawsuit in the United States District Court for the District of Columbia on Tuesday. The motion requested that the court order the Securities and Exchange Commission (SEC) to produce papers that clarify how securities laws apply to cryptocurrencies.