On October 1, asset manager Hashdex submitted an amended registration filing for a proposed exchange-traded fund (ETF) intended to function as a comprehensive cryptocurrency portfolio.

The filing suggests that the crypto index ETF is making steady progress with the United States Securities and Exchange Commission (SEC) following the agency’s request for additional time to determine whether to authorize the fund for trading in August.

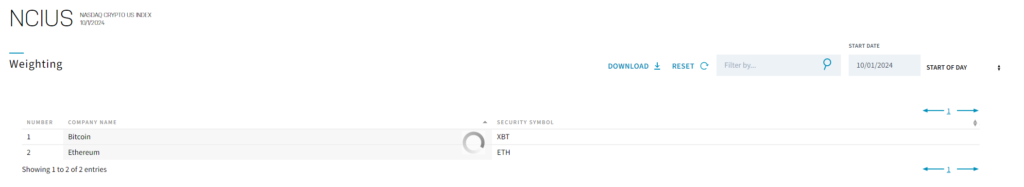

Bitcoin will be the initial component of the Hashdex Nasdaq Crypto Index US ETF.

According to the filing, the Nasdaq Crypto US Index comprises only BTC and Ether, but it may expand to encompass additional virtual currencies.

After listing ETFs holding BTC and ETH in January and July, respectively, industry analysts predict that crypto index ETFs will be the next significant focus for issuers.

“Index ETFs are the subsequent logical progression, as they are efficient for investors, similar to how individuals purchase the S&P 500 in an ETF.” In August, Katalin Tischhauser, the director of investment research at the crypto bank Sygnum, informed Cointelegraph that this would be the case in the crypto sector.

As per an August 16 filing, Franklin Templeton, an asset manager, is attempting to introduce a comparable crypto index exchange-traded fund (ETF).

Similar to the Nasdaq Crypto US Index, the Franklin Crypto Index ETF will monitor the performance of the CF Institutional Digital Asset Index, which currently consists solely of BTC and ETH.

Tischhauser stated that the SEC has only authorized the inclusion of BTC and ETH in crypto index ETFs thus far.

“They intend for it to function as an index, and as long as only Bitcoin and Ethereum are approved, that is what it will include,” Tischhauser stated. She also said there is a limited demand for novel types of single-asset ETFs, such as a Solana fund.

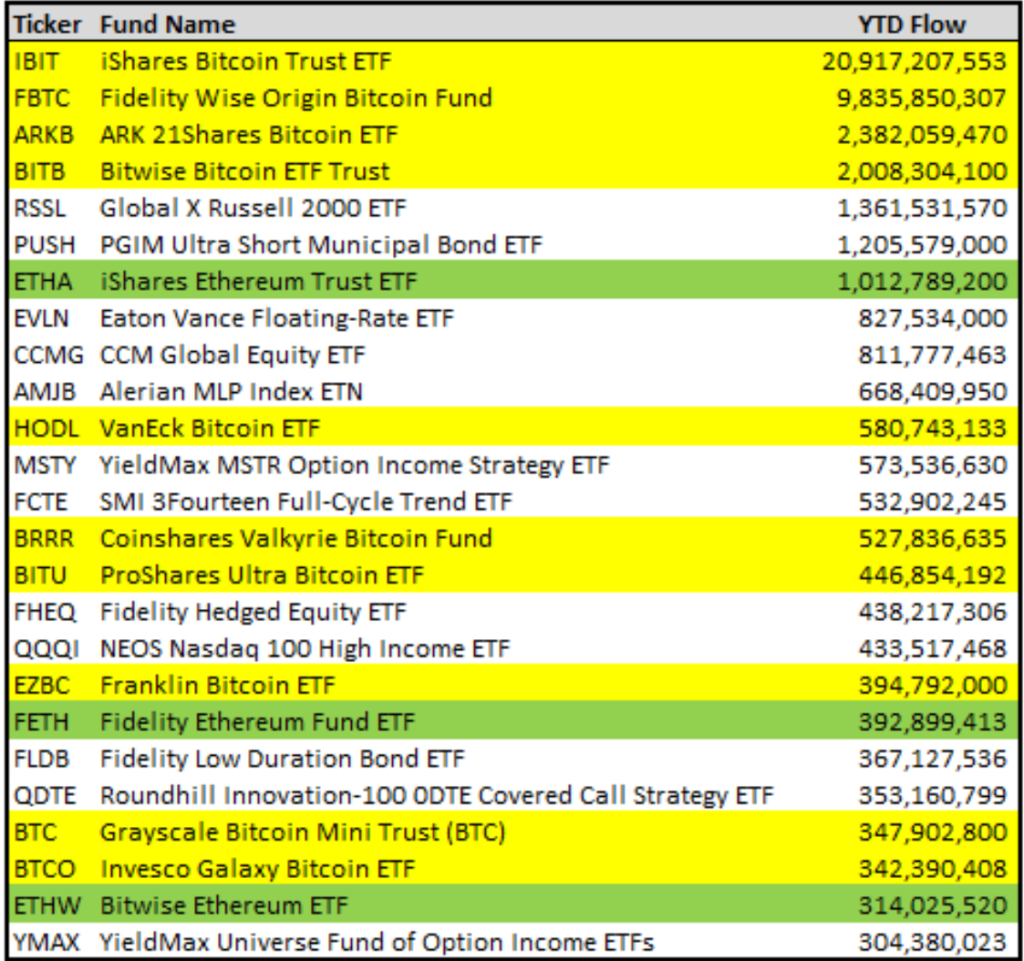

According to data from Bloomberg Intelligence and fund researcher Morningstar, the total assets in US ETFs surpassed $10 trillion for the first time on September 27. This increase was partially driven by over $20 billion in inflows into cryptocurrency ETFs in 2024.

Nate Geraci, president of The ETF Store, an investment adviser specializing in ETFs, reported that crypto ETFs were responsible for 13 of the 25 most significant ETF launches in 2024, as measured by inflows through the end of August.