This article will explore how Synthetix leads synthetic assets and its impact on the broader DeFi ecosystem.

Synthetix has emerged as a trailblazer in Decentralized Finance (DeFi), carving a path for developing and adopting synthetic assets. With its innovative platform and strong community, Synthetix is at the forefront of the movement to democratize access to diverse financial instruments. Synthetix is changing the way investors can participate in DeFi by creating synthetic versions of traditional assets.

Synthetic Assets in DeFi

Synthetic assets replicate the value of real-world assets and enable users to gain exposure to various financial products without physically owning them. These assets are generated using blockchain technology, enabling seamless trading and global accessibility for users.

Synthetic assets in DeFi provide several advantages, such as enabling users to diversify their investment portfolios and hedge positions and access traditional financial markets previously inaccessible because of geographical restrictions or high costs.

What is Synthetix, and the Roles it Plays in Synthetic Assets in DeFi?

Synthetix is a decentralized protocol that works on the Ethereum blockchain. It enables the creation, trading, and management of synthetic assets. It plays multiple crucial roles in developing and growing synthetic assets within the DeFi ecosystem.

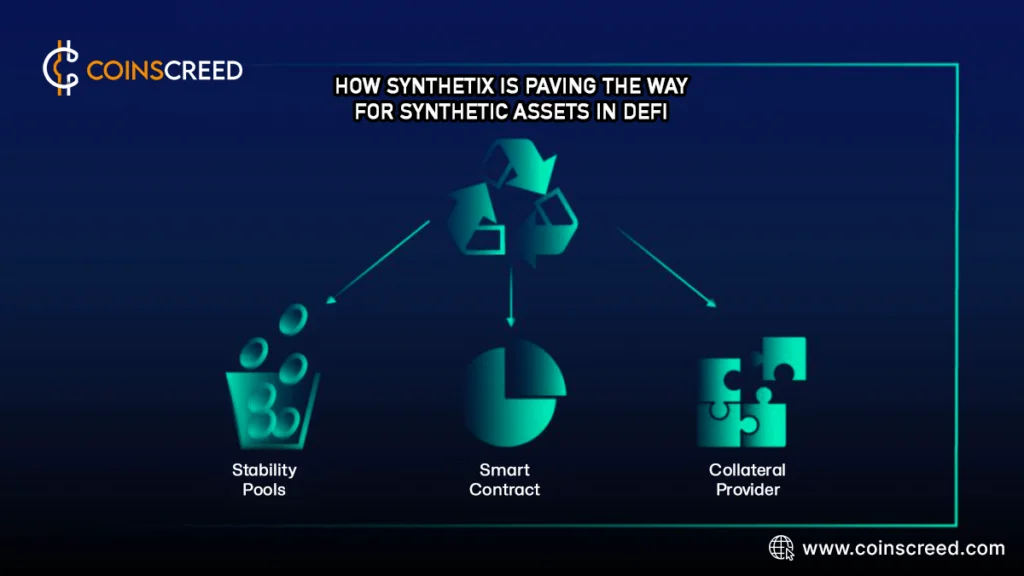

Below are some of the Roles it Plays in Synthetic Assets in DeFi

- Smart Contracts

- Collateral Provider

- Decentralized Exchange for Synthetic Assets

- Stability Pools

Smart Contracts

Using smart contracts, Synthetix allows users to create and trade synthetic assets that mimic the price movements of real-world assets.

Collateral Provider

Synthetix also allows holders of its native cryptocurrency, SNX, to serve as collateral providers. By doing so, they can issue synthetic assets on the Synthetix platform, thus playing an integral part in ensuring the stability and integrity of the synthetic assets created.

Decentralized Exchange for Synthetic Assets

Besides serving as a platform for creating synthetic assets, Synthetix also acts as a decentralized exchange where users can trade these assets. This function is critical in providing liquidity and building a thriving marketplace for synthetic assets within the DeFi ecosystem.

Stability Pools

Synthetix has introduced a new concept known as ‘stability pools.’ These pools permit users to provide excess collateralization to various synthetic assets. The critical function of this mechanism is to ensure stability even in fluctuating market conditions and help maintain the pegged value of synthetic assets to their real-world counterparts.

How Synthetix Facilitates the Creation of Synthetic Assets in DeFi

Synthetix employs a unique mechanism for facilitating the creation of synthetic assets within the DeFi space. The process requires users to stake SNX tokens as collateral in exchange for minting synthetic assets.

When users mint a synthetic asset, they lock the corresponding amount of SNX tokens in a smart contract as collateral. This collateralization helps stabilize the synthetic asset’s value by ensuring appropriate reserves are backing it.

Additionally, Synthetix utilizes an oracle mechanism to obtain real-time price feeds of the underlying assets associated with the synthetic assets. It ensures synthetic asset prices accurately reflect real-world assets, giving users trust and transparency.

Real-world Applications of Synthetic Assets in DeFi

Synthetic assets created through the Synthetix platform have many real-world applications within the DeFi ecosystem.

- Diversifying Investment Portfolios

- Hedging and Risk Management

- Creation of Stablecoins

Diversifying Investment Portfolios

One of the significant applications of synthetic assets is the ability to gain exposure to traditional financial assets like stocks, commodities, and indices without physical ownership. This feature breaks down barriers previously restricting users’ access to global financial markets and allows them to diversify their investment portfolios.

Hedging and Risk Management

Another essential application of synthetic assets is their potential for hedging and managing risks. Through synthetic assets, users can create copies of the original asset with inverse or leveraged exposure. This ability helps protect users against market downturns or increase potential gains.

Creation of Stablecoins

They can also use Synthetic assets in creating stablecoins, which are pegged to the value of a specific currency like the US Dollar or Euro. These synthetic stablecoins provide users with a stable store of value across the volatile cryptocurrency market, offering a safer alternative to traditional fiat currencies.

Challenges and Future Prospects: How Synthetix is Paving the Way for Synthetic Assets in DeFi

Despite the promising potential of synthetic assets in DeFi, several challenges need to be addressed for widespread adoption; let’s look at some of them:

- Regulatory Uncertainty

- Market Liquidity

- Oracles and Data Feeds

- Education and Awareness

- Scalability

Challenges

Regulatory Uncertainty

The regulatory landscape of synthetic assets needs clarification to ensure compliance and protect investors. Synthetix and other platforms must work closely with regulatory bodies to establish clear guidelines.

Market Liquidity

As the DeFi market expands, ensuring sufficient liquidity for synthetic assets becomes crucial. Building robust liquidity pools and attracting market makers will be necessary for the healthy growth of synthetic assets.

Oracles and Data Feeds

Accurate price feeds are vital for the reliability of synthetic assets. Developing secure and decentralized Oracle solutions that provide real-time data feeds is critical to maintaining trust and transparency.

Education and Awareness

Educating users about the benefits and applications of synthetic assets is necessary to foster adoption. Increasing awareness and understanding will help overcome skepticism and encourage participation.

Scalability

As the demand for synthetic assets grows, scalability becomes paramount. Synthetix and other platforms must explore layer 2 solutions or alternative scaling mechanisms to ensure efficient operation.

Future Prospects

- Increased Asset Variety

- Integration with Traditional Finance

- Enhanced Risk Management

- Global Accessibility

- Continued Innovation

Increased Asset Variety

Synthetix is continually expanding the range of assets that can be synthesized. In the future, users may gain exposure to more diverse asset classes, including real estate, intellectual property, and more.

Integration with Traditional Finance

Through collaboration between Synthetix and traditional financial institutions, we can establish a connection that bridges the gap between traditional and decentralized finance. This combination would provide users with seamless access to both realms.

Enhanced Risk Management

Synthetix is actively exploring ways to improve risk management tools for synthetic assets, which includes introducing more advanced hedging mechanisms and enhancing stability to minimize risk exposure.

Global Accessibility

The decentralized nature of Synthetix allows individuals worldwide to access synthetic assets and financial opportunities, transcending geographical barriers.

Continued Innovation

As synthetic assets evolve, further innovations will emerge within the DeFi ecosystem. Synthetix aims to remain at the forefront of this innovation, continually improving its protocol and expanding its offerings.

Conclusion

Synthetix is revolutionizing the DeFi ecosystem by paving the way for the creation and trading of synthetic assets. With its unique protocol and role in facilitating the creation of synthetic assets, Synthetix has established itself as a key player in decentralized finance.

The real-world applications of synthetic assets are vast, offering users opportunities for investment diversification, risk management, and global market access. Although there are challenges to overcome, Synthetix’s commitment to innovation and addressing these challenges positions it as a frontrunner in the evolution of synthetic assets within the DeFi space.

As the DeFi industry progresses, the prospects for synthetic assets look promising, with an increased asset variety, improved risk management tools, and enhanced accessibility. Synthetix sets the stage for continued growth and innovation in synthetic assets, paving the way for a more inclusive and decentralized financial future.