In response to its inclusion on the Investor Alert List (IAL) by the Monetary Authority of Singapore (MAS), which serves to caution investors about dubious platforms, imToken has taken action requesting to be removed from the list.

On January 9, ImToken announced via X (previously Twitter) that it had been blacklisted in Singapore because the organization remains “headquartered in Singapore” without having applied for a financial business license in the country.

“We are currently actively communicating with MAS to clarify the distinctions in our business model to get imToken removed from the Investor Alert List,” the company said in a statement.

According to ImToken, the organization manages a self-custodial wallet and offers decentralized wallet services globally, including within the jurisdiction of Singapore.

“Centralized custodial services are distinct from imToken, which operates as a decentralized wallet,” the company emphasized, adding that user assets “remain unaffected.”

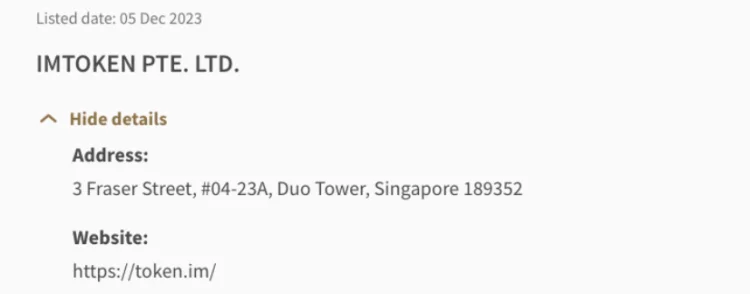

After the firm’s listing on the IAL by the MAS on December 5, 2023, imToken published the notice. The website of the MAS offered no information regarding the grounds for blacklisting imToken.

Following the blacklisting of imToken, the MAS, on December 8, 2023, included the cryptocurrency exchange BKEX on the list of crypto-related firms. The blacklisting occurred several months after the exchange’s declaration of suspending withdrawals in May 2023.

The eponymous software cryptocurrency wallet and the imKey hardware cryptocurrency wallet are both operated by ImToken. With respective review scores of 4.2 and 4.4, ImToken’s cryptocurrency wallet applications are accessible on the Apple Store and Google Play.

Reportedly established in Hangzhou, China, imToken relocated to its present headquarters in Singapore in 2016. Series B funding for imToken was completed in 2021 under the leadership of Qiming Venture Partners and with the support of new investors, including HashKey and its previous investor, IDG Capital. The round was valued at $30 million.

Reportedly, as of 2021, the imToken platform housed $50 million in cryptocurrency and 12 million users, with a cumulative transaction value surpassing $500 billion. The mainland of China accounted for approximately 70% of the consumers, with South Korea, the United States, and Southeast Asia following suit.

While the MAS has blacklisted cryptocurrency firms such as imToken, it has also authorized industry firms. The regulator granted Upbit, a South Korean cryptocurrency exchange, a Major Payment Institution license on January 7, enabling the company to broaden its range of services.