Bitcoin (BTC) investors who bought the all-time high in 2017 are yet to sell despite the strong profits and equally strong corrections in 2021

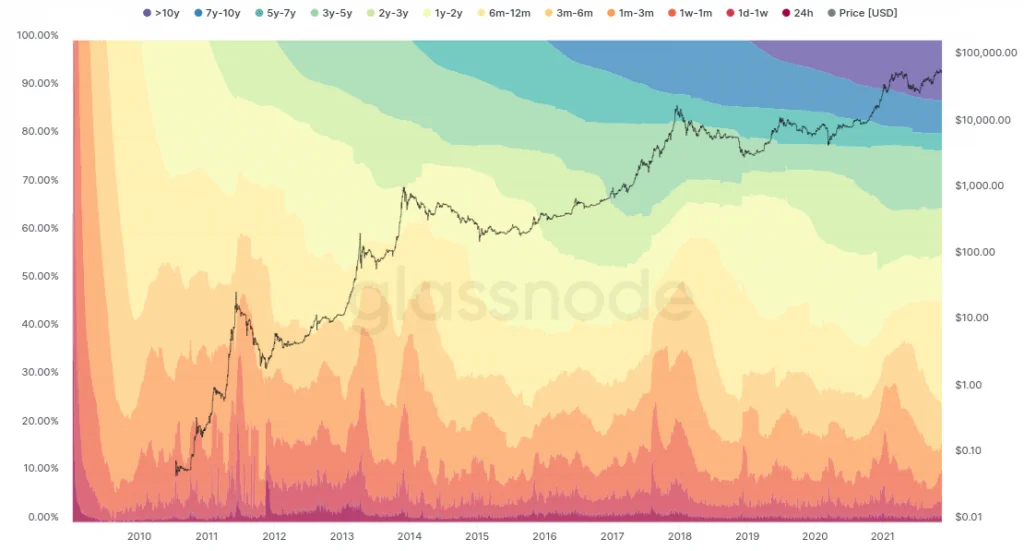

According to HODL Waves data, coins that haven’t moved in the last six to twelve months currently account for the majority of the BTC supply.

Bitcoin buyers maintain a positive attitude

Market investors refuse to add to their positions in or after November 2020 to sell, despite big profits and equally strong corrections in 2021.

The supply held by “Hodler” increased from 8.7% in early June to 21.4 percent on June 17th, according to HODL Waves, which measures the age distribution of unused Transaction Spending (UTXOs).

Simultaneously, multiyear stocks fell only a little, implying that only minor sales have taken place and that, with the exception of the six-to twelve-month group, investor confidence has not waned.

The data supports the idea that few Bitcoin owners will sell at present prices, even if they reach all-time highs.

However, as Cointelegraph observed, long-term holders have begun to distribute assets, which is a common occurrence during bull market rises. This happened the last time in November of last year.

The bull market “has a long way to go”

Other data on “older” bitcoins, on the other hand, suggests that the oldest bitcoins will continue to lose value.

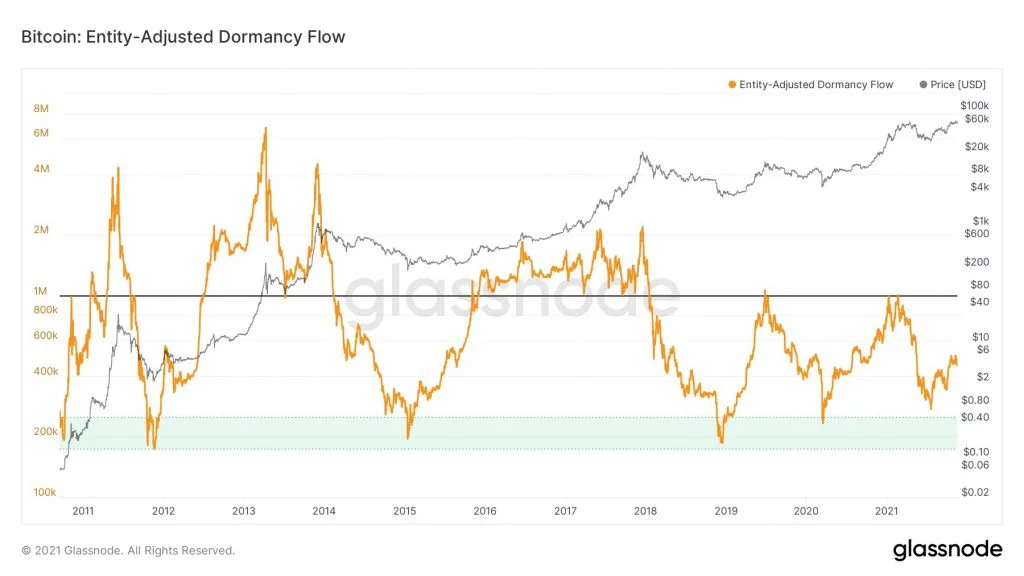

Inactivity outflows — Bitcoin’s market cap divided by annual dormant time – persist at lows near BTC / all-time highs / USD, as highlighted by online analyst William Clemente this week.

According to Clemente, a long hibernation indicates the use of antique currencies.

grandfather On Wednesday, include Twitter comments.

“This Bitcoin bull market still has many options to orientate itself on the metric.”