Bitcoin’s price is above $68,000 after support at $65,500, with whale holdings rising as 297 new wallets holding over 100 BTC emerged in two weeks.

The price of BTC has surged back above $68,000 today, after taking support at the $65,500 level. This comes at the same time that the Bitcoin whale holdings reached a new all-time high.

The whale wallet, which previously contained more than 100 Bitcoins, has had its number of wallets increase by 297 over the course of the past two weeks. The swift achievement of this significant milestone indicates heightened confidence in the asset class and signals the impending correction in Bitcoin.

Bitcoin Whale Wallets on the Rise

The combined holdings of Bitcoin whales have reached an all-time high, with this group of investors possessing more than 670,000 BTC. Because of this new event, there is the potential for a new wave of optimism to sweep through the market, particularly among BTC investors.

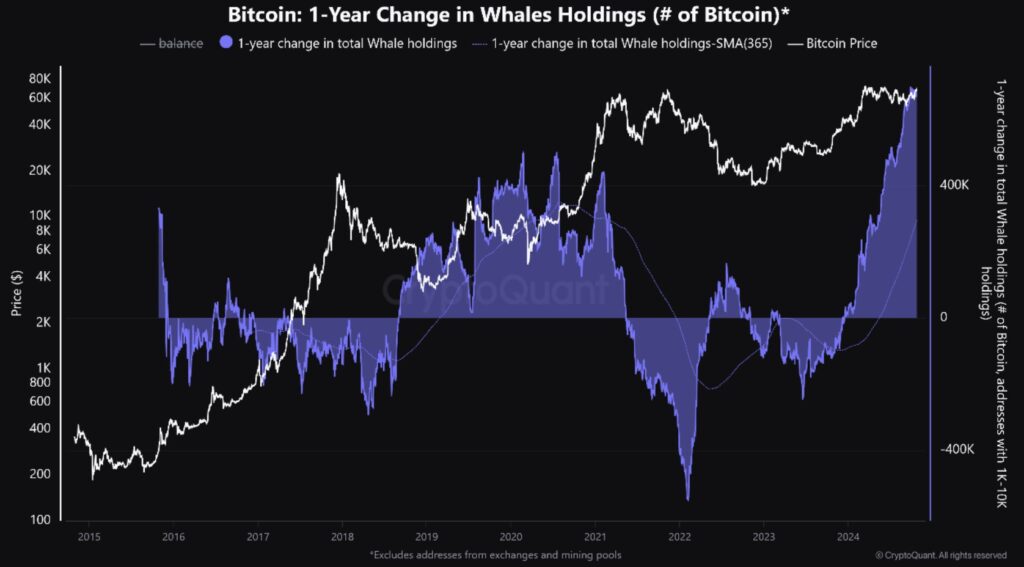

According to the cryptocurrency analytics site CrypoQuant, if the BTC whale holdings exhibit a positive trend, the BTC price typically experiences a slight decline or tends to move in a sideways direction. Some have suggested that this is the prelude to a medium-to-long-term upheaval.

“The real surge in Bitcoin growth begins after whales gradually reduce their holdings until they reach negative percentage change values”.

Another platform, Santiment, reported that in the past two weeks, there have been 297 new Bitcoin whale wallets that contain more than 100 BTC. Additionally, the number of wallets that contain less than 100 BTC has decreased by 20,629 wallets.

CryptoQuant confirmed this information. In most cases, optimistic outcomes are the result of the largest holders consolidating their positions following the dumping and panic selloff that occurred among retail traders.

Exchange-traded funds (ETFs) have experienced significant inflows, with the BlackRock BTC ETF leading the way. Over the course of nine consecutive trading sessions, BlackRock’s IBIT had accumulated approximately 30,000 digital currencies.

As a result, it currently has more than 2% of the BTC supply that is in circulation, with 399,355 Bitcoins in its wallet. Given the rejection of the price of BTC at $69,000, retail investors are now more cautious about the next move in the cryptocurrency market.

Despite the fact that the price of BTC is making up for lost territory, it is still necessary for it to surpass $69,000 in order to maintain the upward trend. Despite the positive developments brought about by the increasing number of Bitcoin whale wallets, CryptoQuant has issued a warning to investors.

If the price of BTC fails to establish a new all-time high around the time of the forthcoming presidential elections in the United States, which are scheduled to take place on November 28 ±21 days, it may indicate that there are severe concerns with the current bull cycle.

Using the present price movement, another cryptocurrency analyst named Justin Bennett provided an explanation of three key points. In contrast to the current situation, he claimed that when Bitcoin is in a significant bullish state, it rarely gives resets. Therefore, investors should closely monitor upcoming developments while concurrently building new positions for Bitcoin.