JPMorgan Chase unveils LLM Suite, an AI-powered ChatGPT-like tool, to increase asset and wealth management productivity.

Investment banking giant JPMorgan Chase is allegedly introducing an internal version of a generative artificial intelligence product that is similar to ChatGPT and is capable of performing the duties of a research analyst.

Employees of JPMorgan’s asset and wealth management division were granted access to the recently introduced generative AI tool, LLM Suite, which was designed to assist them in document summarization, idea generation, and writing.

An internal memo co-signed by Teresa Heitsenrether, the company’s chief data and analytics officer, Mike Urciuoli, the managing director, and Mary Erdoes, the CEO of JPMorgan Chase’s asset and wealth management division of the business, introduced the tool.

Can generative AI replace JPMorgan research analysts?

The memo was viewed by the Financial Times, which explained the employees:

“Think of LLM Suite as a research analyst that can offer information, solutions and advice on a topic.”

JP Morgan explained that LLM Suite is a “ChatGPT-like product” that can work with other internal systems that handle sensitive financial information to increase “general purpose productivity.”

Meanwhile, FT reported that the bank released the LLM Suite in early 2024 and granted access to 15% of its workforce (50,000 employees).

However, JP Morgan has not yet publicly acknowledged the appointment of its new AI research analyst, LLM Suite.

According to a Blooomberg report, JPMorgan developed an AI tool last year that analyzes Federal Reserve statements and speeches to identify potential trading signals.

Analysts were able to identify policy changes and receive notifications regarding trading indications as a result of the AI tool.

“Preliminary applications are encouraging,” JPMorgan economist Joseph Lupton reportedly said.

Growing support for AI from institutional traders

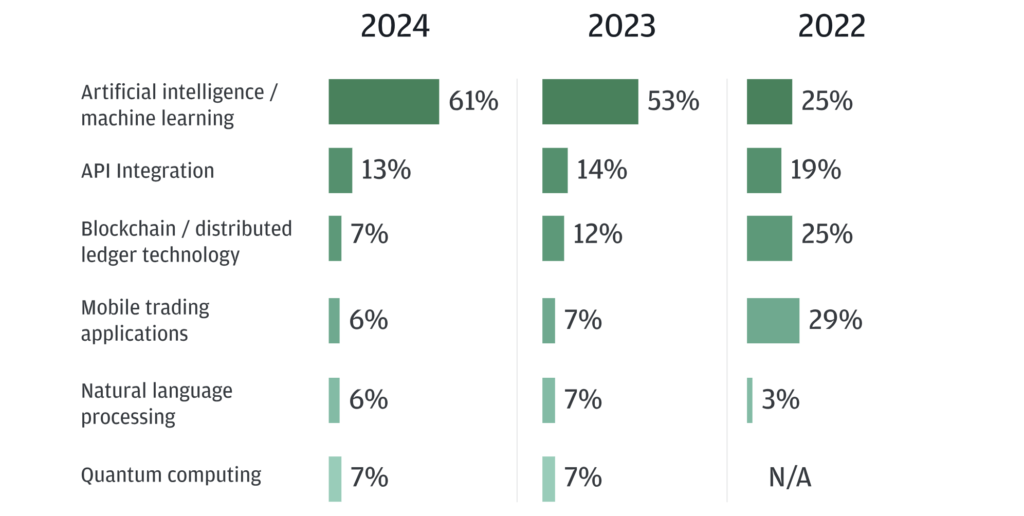

JPMorgan recently surveyed 4,010 institutional traders, and the results indicated that 61% of the respondents consider AI to be the most influential technology in the future of trading.

Among the 65 countries represented, the majority of participants anticipate that AI and machine learning will become the most influential trading technologies within the next three years.

While 13% expected a greater impact from API integration, blockchain or distributed ledger technology and quantum computing each earned 7% of the votes.