KyberSwap, a decentralized exchange, has suffered a major security breach, resulting in the loss of around $46 million in various cryptocurrencies. The attack targeted the KyberSwap Elastic protocol, which offers speed, efficiency, and top-tier governance.

KyberSwap, which operates on the Kyber Network, has been hit by a massive exploit that drained about $46 million worth of crypto assets from its platform.

The hack, which occurred on X, affected the KyberSwap Elastic protocol, a cross-chain token swap service that enables users to exchange tokens between Ethereum, Arbitrum, Optimism, and other blockchains.

According to KyberSwap’s official announcement, the exploit was caused by a vulnerability in the KyberSwap Elastic smart contract, which allowed the attacker to manipulate the price of the tokens and withdraw them from the liquidity pools.

KyberSwap said that it had paused the KyberSwap Elastic protocol and notified all the affected liquidity providers. The platform also urged all users to withdraw their funds from KyberSwap as a precautionary measure.

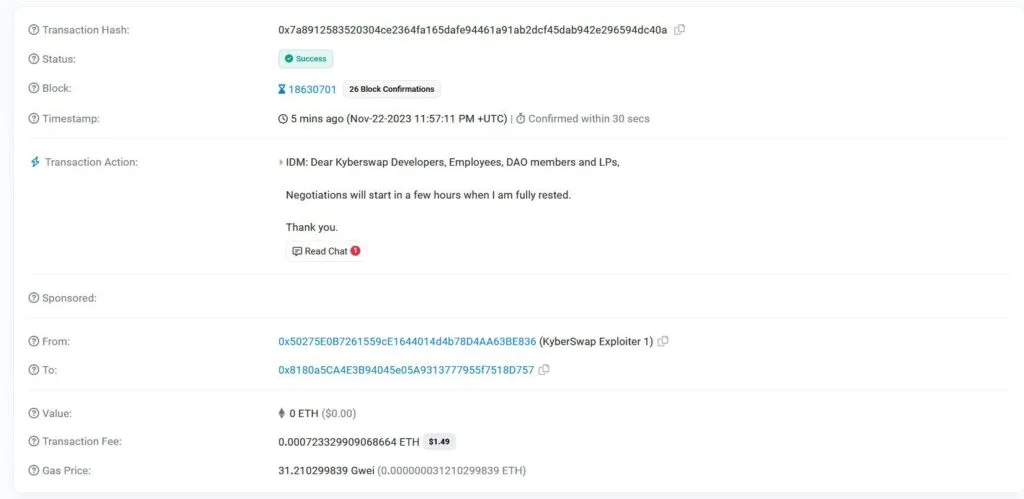

The attacker, who used multiple addresses to carry out the hack, reportedly left some on-chain messages on the Ethereum blockchain, suggesting that they were willing to negotiate with the KyberSwap team, employees, DAO members, and liquidity providers.

The messages also claimed that the attacker did not intend to harm the platform or the users but only wanted to expose the security flaw.

The exploit had a significant impact on the platform’s total value locked (TVL), which is a measure of the amount of crypto assets locked in a DeFi protocol.

According to DeFiLlama, a website that tracks DeFi data, KyberSwap’s TVL dropped by nearly 70% within hours of the hack, from $84.9 million to $14.32 million.

The top affected assets in the exploit were Arbitrum (ARB), Optimism (OP), Ethereum (ETH), and Base, according to DeBank. The attacker stole around $18.85 million in Arbitrum, $15.36 million in Optimism, and $7.44 million in Ethereum, among other tokens.

The hack also had a negative effect on the price of Kyber Network Crystal (KNC), the native token of the Kyber Network, which powers KyberSwap and other DeFi applications.

According to CoinGecko, KNC’s price fell by 2.86% in the last 24 hours, trading at $0.72 at the time of writing. However, the token’s trading volume surged by 154.39% to $58.48 million, indicating increased market activity.

The incident at KyberSwap is the latest in a series of hacks and exploits that have plagued the DeFi space in recent months, exposing the vulnerabilities and risks of the emerging sector.

In October, Coinscreed reported that Cream Finance, a DeFi platform, lost $130 million in a flash loan attack. In September, pNetwork, a cross-chain bridge service, was hacked for $12.7 million in Bitcoin.

These incidents have raised concerns about the security and regulation of DeFi platforms, which operate without intermediaries or centralized authorities.

As the crypto industry faces increasing scrutiny and challenges from regulators, lawmakers, and hackers, the KyberSwap hack serves as a stark reminder of the need for more robust and reliable security measures and standards in the DeFi ecosystem.

Meanwhile, users and investors are advised to exercise caution and due diligence when interacting with DeFi platforms and protocols.