The proposal to significantly reduce funding for the SEC and other government agencies is outlined in the Financial Services and General Government bill.

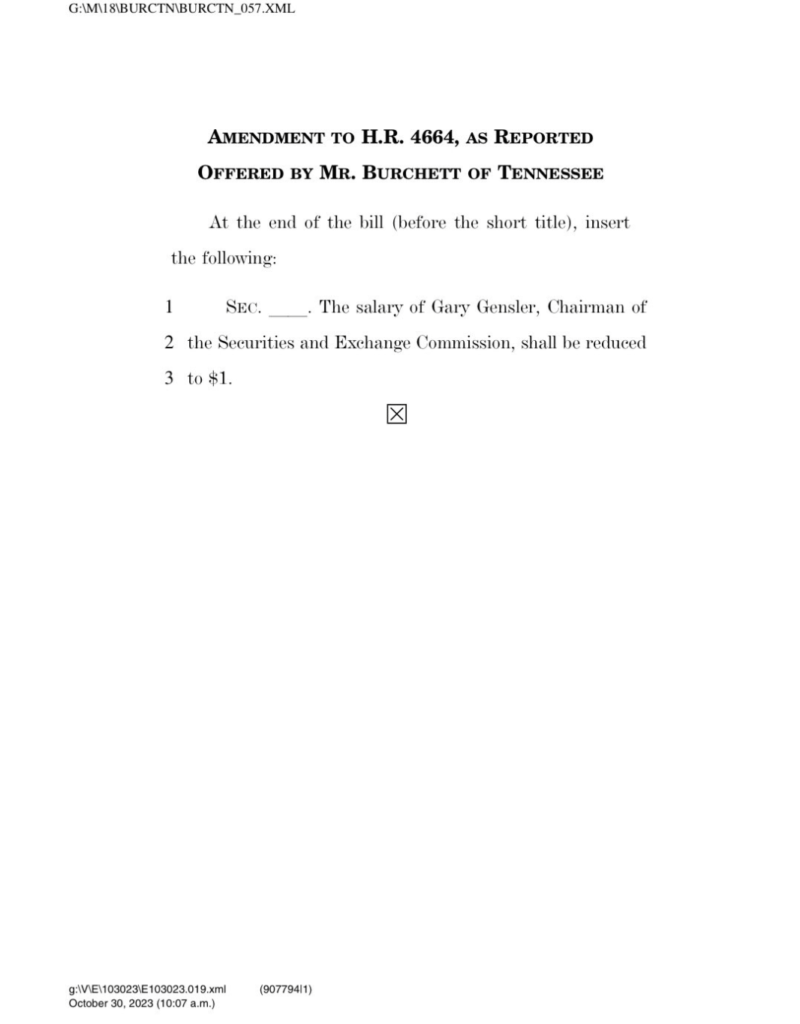

A lawmaker from the United States proposes that Gary Gensler, the chairman of the Securities and Exchange Commission, be remunerated at a rate of $1 per annum.

In a proposed amendment to the Financial Services and General Government (FSGG), Rep. Tim Burchett, as part of a broader effort to defund the regulator, suggested that Gensler’s salary be reduced to $1.

The FSGG bill, initially introduced on July 13 of this year, is an all-encompassing bill to diminish government expenditures in all domains substantially.

An estimated $300,000 or more is earned annually by Gensler in his capacity as director of the SEC.

Burchett was not the only lawmaker to criticize the SEC; the measure sought to reduce government agency funding by a significant amount.

Representative Steve Womack explained to the House Rules Committee on November 6 that the SEC, along with other government agencies, had succumbed to regulatory overreach and were imposing an excessive financial burden on the government.

The best course of action, according to Womack, would be to defund the SEC in order to limit its regulatory “intrusiveness” and compel the regulator to revert to its primary mission.

“Specifically, we turn off rulemakings at the Securities and Exchange Commission that lack proper cost-benefit analysis and aggregate impact analysis.”

“To be clear, the agencies under our jurisdiction perform important functions; however, many have strayed from their mandate and the results have been a true disservice to the American people,” Womack added.

U.S. politicians have criticized Gensler and his agency on multiple occasions prior to this one.

The SEC Stabilization Act, which was introduced to the House of Representatives on June 12 by United States Representatives Warren Davidson and Tom Emmer, included as one of its principal provisions an attempt to remove Gary Gensler from his position as chair of the SEC.

Approval of the measure would result in Gensler’s dismissal and a redistribution of agency authority between the SEC chair and commissioners.

Additionally, a sixth commissioner would be appointed to the agency, and an executive director position would be established to prevent a single political party from gaining majority control.

Emmer has long referred to the SEC Chair as a “bad faith regulator” and accused him of “blindly spraying the crypto community with enforcement actions while completely missing the truly bad actors.” Davidson and Emmer have both been outspoken critics of the SEC, which Gensler heads.