The two largest layer-2 networks, Optimism and Arbitrum currently process more transaction volumes than the mainnet Ethereum due to an increase in on-chain activity on the Ethereum network.

Over the last three months, there have been more transactions on Arbitrum and Optimism. In contrast, according to Etherscan, transactions on the Ethereum network have decreased by around 33% since late October, with a few surges.

Dune Analytics data shows that as a result, the two L2s were able to flip Ethereum for this statistic.

According to the graph, Ethereum handled more than 1.06 million transactions on January 10 while Arbitrum and Optimism together processed more than 1.12 million.

Additionally, after a steady climb in activity since September, Optimism has now eclipsed Arbitrum in terms of daily transactions.

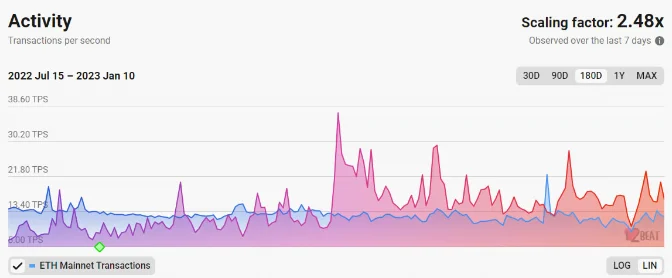

Website for layer-2 ecosystem analytics According to L2beat, all L2 activity has continued to outpace Ethereum in terms of transactions per second (TPS) since October.

Ethereum processed almost 12 TPS on average on January 10 compared to the L2’s average of roughly 16.5 TPS.

According to L2beat, Arbitrum and Optimism make up over 80% of the layer-2 ecosystem.

With about $2.34 billion in collateral, Arbitrum One maintains its position as the industry leader in terms of total value locked (TVL), holding a 52.5% market share.

With a TVL of $1.28 billion and a 28.6% market share, optimism is in second place.

Decentralized finance (DeFi) protocols are one of the major forces behind the adoption of the Optimism chain, said Nansen researcher Martin Lee.

Additional layer twos, like zk-rollup Additionally, StarkNet has lately processed more transactions. ImmutableX and dYdX are two further products that use StarkWare technology.

According to a study from October, StarkNet processes more transactions each week than the Bitcoin network.

Furthermore, according to Starkscan, the network’s TVL is at an all-time high of $5.2 million.