The Lightning Network, Bitcoin’s layer 2 scaling solution, has seen payment volume increase by over 400% as real adoption grows.

According to a new report, the Lightning Network has grown in popularity as a means of transferring digital assets quickly and efficiently around the world.

Today, CNBC told the story of Alena Vorobiova, a Ukrainian refugee seeking asylum in Poland. Vorobiova used Lightning to send $100 in Bitcoin from Miami to Poland, where it was withdrawn from an ATM in the equivalent Polish currency — all in three minutes.

This is the type of low-cost, high-speed transaction that has seen the Layer 2 scaling solution for Bitcoin increase payment volume by 410 percent in the last year.

According to an Arcane Research report, the number of Lightning Network payments has doubled in the last year, while the total value of those payments has quadrupled.

The report cautioned that the widely-cited public metrics used to measure Lightning Network adoption, most notably total value locked (TVL), understates the network’s size because they exclude private channels and invisible nodes. Furthermore, the metrics do not reflect real-world Lightning Network usage, whereas explicitly looking at payment volume paints a more accurate picture of true Lightning adoption.

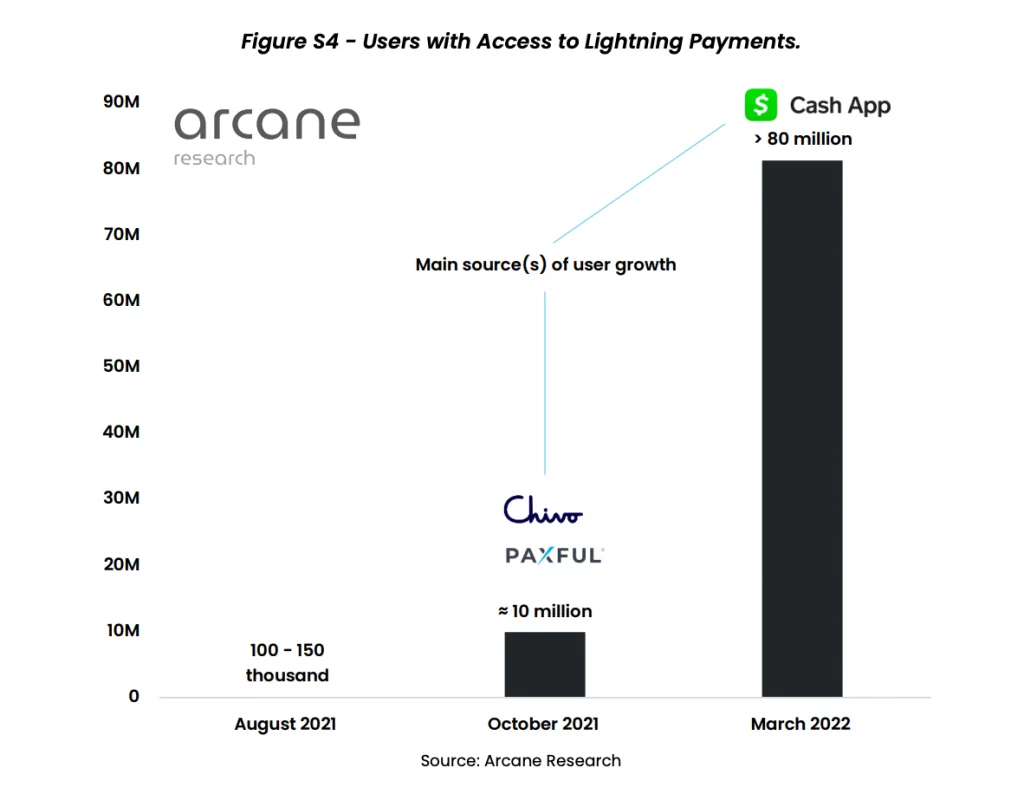

The massive increase in the number of users who have recently gained access to the Lightning Network explains a portion of the surge in payment. This is done through apps such as El Salvador’s Chivo Wallet and CashApp, a payment app based in the United States.

Arcane estimated that roughly 100,000 users would have access to Lightning payments by August 2021. Over 80 million people had access to payments on the Lightning Network by March of this year, indicating that there is a large potential user base.

According to the report, direct transactions between individuals — Peer-to-Peer (P2P) transactions — accounted for roughly half of all payments. Almost one-third of the payment value was derived from exchange withdrawals and deposits, with the remaining 20% derived from vendor purchases.

Even though Bitcoin was originally designed as an electronic cash system, the Bitcoin networks’ slowness in resolving transactions gave rise to layer-2 solutions. In March 2018, the Lightning Network was launched to provide faster and cheaper BTC transactions.