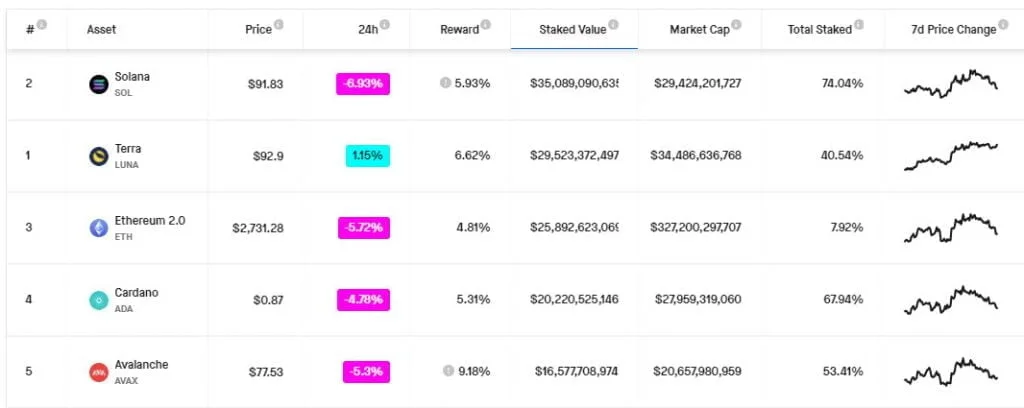

According to recent data, LUNA records a staggering 226,325 stakes, which for $29.5 billion, thereby pushing the network into second place (above Ethereum) in staked value.

LUNA has toppled Ethereum (ETH) in terms of staked value, according to Staking Rewards, with $29.5 billion worth of LUNA locked up compared to Ether’s $25.9 billion.

According to data from the platform, there are presently 226,325 LUNA stakes, making it the second most staked crypto asset, with more than four times the number of ETH stars (54,778). Solana is the staking leader, with a staked value of $35 billion.

The token is expected to yield 6.62 percent in annual staking incentives, whereas Ethereum is expected to yield 4.81 percent. Polkadot (DOT) is the most profitable of the top ten staked assets, with a yield of 13.92 percent.

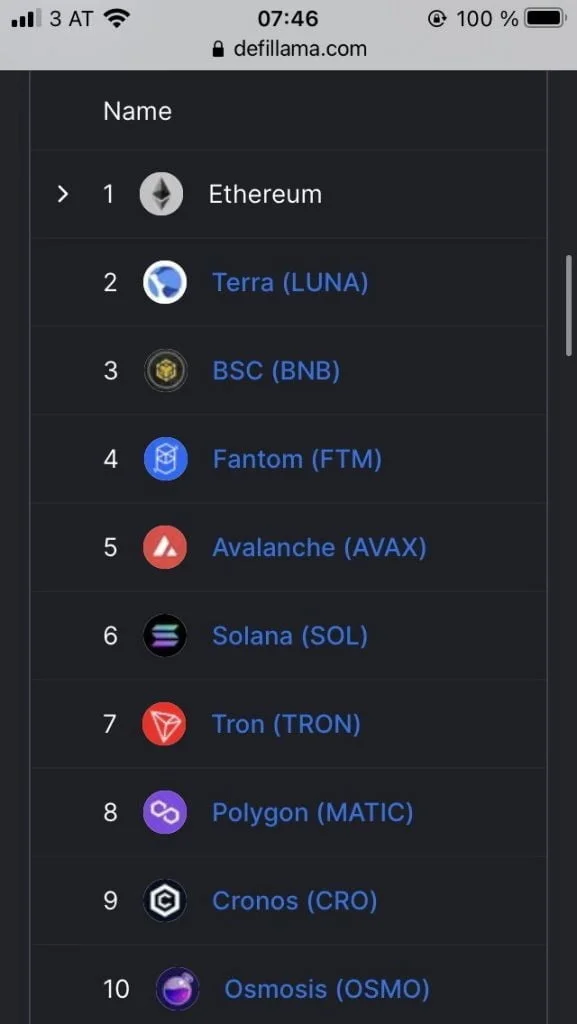

On March 1, Staking Rewards announced that LUNA staking has surpassed Ethereum, although numerous users pointed out that data from Defi Llama appeared to substantially contradict the findings.

According to Defi Lama’s data, Ethereum has a total value locked (TVL) of $111.4 billion, which is significantly higher than LUNA’s TVL of $23.35 billion. The discrepancy is because these values include collateral locked across Defi protocols, not only ETH staked on the Beacon Chain. At present pricing, the Beaconcha. in explorer estimates 9.7 million ETH staked valued about $26.5 billion, which is identical to Staking Rewards figures.

However, both data aggregators have indicated that interest in the token has increased recently. LUNA’s TVL has gained 26.905 percent in the last seven days, putting it considerably ahead of third-placed Binance Smart Chain (BSC), which has $12.03 billion in TVL.

Staking Rewards explained that staked value and TVL measurements are “completely different,” as the latter can include assets locked in Defi protocols for lending and other functions.

LUNA Value Increase

The price of Terra has risen by 78.4 percent in the last 30 days, to around $92.84 at the time of writing, with a market capitalization of $34.5 billion.

The asset’s optimistic return comes after the Terra protocol burned 29 million LUNA tokens worth $2.57 billion late last month, as Coinscreed previously reported. The move corresponded with a 14.5 percent increase in the supply of Terra USD (UST), a stablecoin backed by LUNA, to 12.92 million tokens.