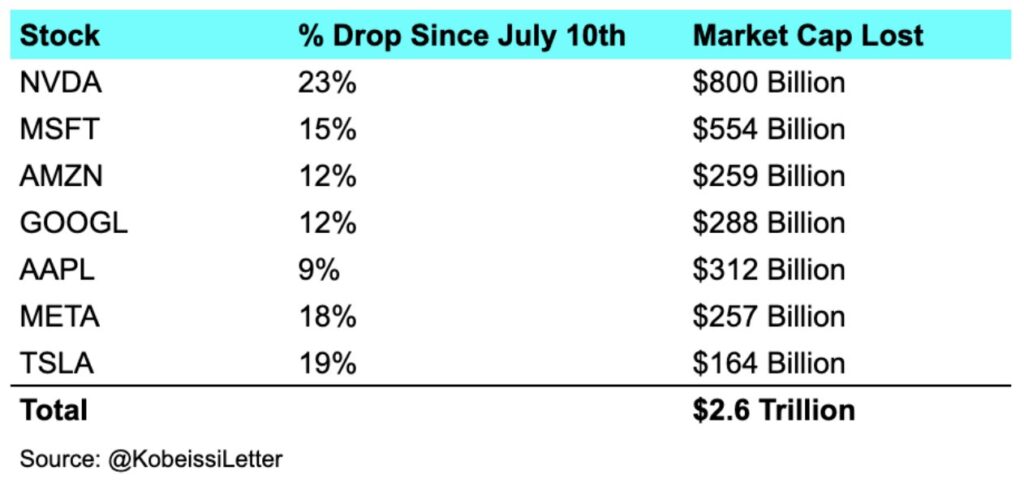

The “Magnificent Seven” tech stocks have lost $2.6 trillion 20 days ahead of earnings week, exceeding Brazil’s entire stock market value.

A group of high-performing tech firms, including Microsoft and Nvidia, known as the “Magnificent Seven,” have lost $2.6 trillion from their combined market cap in the 20 days leading up to a high-profile earnings week.

The Kobeissi Letter, an economics media outlet, stated in a July 31 post on X that “The Magnificent Seven has lost triple the value of Brazil’s entire stock market in 20 days.”

Since the market nadir in 2022, the group that includes Google parent Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla has outpaced the rest of the S&P 500 in terms of growth.

Microsoft has already disclosed its fourth-quarter earnings for the fiscal year 2024, which concludes on June 30. Meta’s most recent quarterly results are scheduled for publication on July 31, while Apple and Amazon are scheduled to report on August 1.

The tone for the higher-risk asset markets in the coming months, including crypto, could also be set by the quarterly results of the market-leading group of tech titans.

Results for Nvidia’s second quarter are anticipated on August 28.

The semiconductor colossus has already experienced a 23% stock decline, which has resulted in a $800 billion loss in market capitalization since July 10. Nivida’s Q2 earnings report is not anticipated until Aug. 28, but the company has already experienced a 23% stock decline.

On July 30, the firm’s share price (NVDA) plummeted by 7% to close at $103.73, and it has a market capitalization of $2.55 trillion.

Microsoft experiences a 3.8% decline in spite of its favorable earnings report.

Despite delivering a better-than-expected earnings report on July 30, Microsoft stock (MSFT) fell 3.8% on the day, closing at $422.92.

The market capitalization of the software behemoth, which is the second-largest company in the world with a value of $3.1 trillion, has decreased by 15% in the past three weeks.

Alphabet (Google)

With a market capitalization of $2.1 trillion, Google’s parent company is the fourth largest of the seven. However, it has also experienced a 12% decline since July 10.

The company’s shares (GOOG) remained essentially unchanged throughout the day, ultimately settling at $171.47 in after-hours trading. On July 23, the technology company disclosed earnings of $84.72 billion for the second quarter, which represented a 5.2% increase from the previous quarter.

Apple is scheduled to disclose its earnings results on August 1.

On August 1, the earnings report of the world’s largest company by market capitalization, which is $3.35 trillion, will be disclosed. However, Apple’s market capitalization has declined by 9%, or $312 billion, since July 10.

AAPL’s shares remained unchanged on the day, concluding at $218.80. However, they have declined by 7% from their all-time high earlier this month.

Amazon anticipates submitting its results on August 1.

With a market capitalization of $1.89 trillion, Amazon is the fifth-largest company in the world. Nevertheless, this has decreased by 12% in the last three weeks. The stock price of Amazon (AMZN) decreased by 1.5% on the day and ultimately settled at $180.90 in after-hours trading.

Additionally, Amazon is scheduled to disclose its second quarter earnings report on August 1.

The Meta Q2 earnings report is scheduled for July 31.

The corporation, which was previously known as Facebook, has a market capitalization of $1.17 trillion, which places it sixth among the Magnificent Seven.

Nevertheless, Meta has experienced a $257 billion decline in market capitalization, or 18%, since July 10. It is anticipated that the organization will disclose its second quarter earnings report on July 31.

On July 30, Meta stock (META) experienced a 2.5% decline in value, concluding the day at $463.19.

Tesla stocks experienced a 9.4% decline in a single day.

Tesla, which has a market capitalization of $711 billion, is the final member of the Magnificent Seven, led by Elon Musk. Nevertheless, it has experienced a 19% decline in capitalization since July 10.

On July 23, Tesla reported its lowest quarterly profit margin in five years, with earnings per share falling short of expectations for the fourth consecutive quarter. On Tuesday, July 30, the stock of the company (TSLA) decreased by 9.4% to $222.62.

In contrast, the total crypto market capitalization has increased by 11% over the same three-week period, indicating an early divergence.