Despite Metaplanet latest acquisition, Metaplanet still has 500m yen left for further Bitcoin investments.

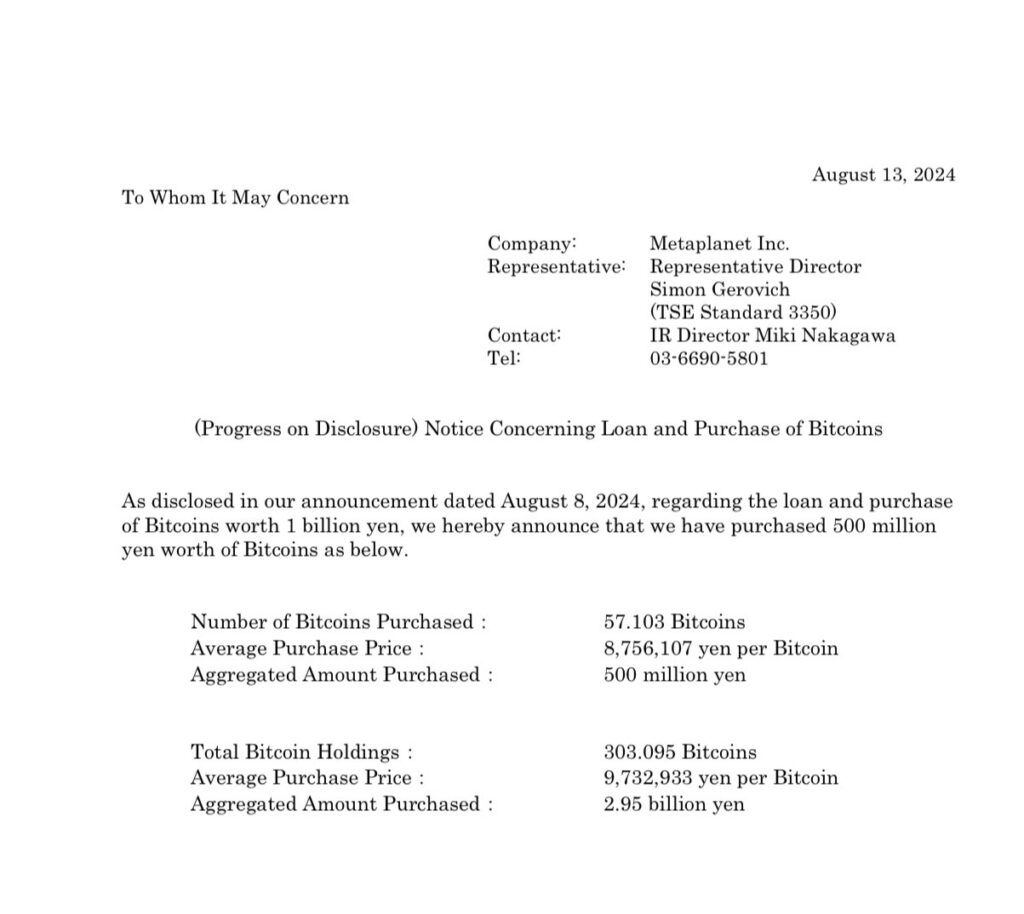

The publicly traded Japanese investment business Metaplanet announced on Tuesday that it had increased its Bitcoin holdings by 57 transactions as a result of its latest purchase.

A few days before this move, the corporation made an announcement regarding a loan to purchase bitcoins with a value of one billion yen. The company has just raised one billion Japanese yen at an annual percentage rate of only 0.1%, indicating that it is on a buying binge for Bitcoin.

Metaplanet On Bitcoin Buying Spree

In spite of the current acquisition, the company still has 500 million yen available to purchase additional Bitcoin. The company now holds 303,095 bitcoins, valued at 2.95 billion yen.

Following the acquisition of loans, the corporation is making the most of the low interest rates that are available in Japan in order to purchase bitcoins. When it comes to the Japanese yen carry trades, which include purchasing the yen at a lower rate and then purchasing other assets on the global market, this appears to be the most effective use of the foreign currency.

The Tokyo Stock Exchange-listed company’s stock price dropped by 5.80% on Tuesday, reaching 1,121 JPY. Following the addition of Bitcoin to the company’s balance sheet, the stock price has reached a new high of over 600%.

It is quite clear that Metaplanet is following the blueprint that MicroStrategy has established for its Bitcoin acquisition. There is even a possibility that the two businesses will engage in intense competition in the years ahead.

In the meantime, other businesses, such as Marathon Digital and Selmer Scientific, have also adopted the policy of the largest Bitcoin holder based in the United States, meaning that they have included bitcoins in their balance sheet.

In a recent announcement, MicroStrategy revealed that the company intends to acquire additional bitcoins by raising as much as $2 billion. Through the sale of MSTR class A shares, the company will be able to raise these sums.

It currently has 226,500 Bitcoins, which are worth approximately $14 billion depending on market swings. On Monday, the price of MSTR ended the day at $131.46, a decrease of 2.89%.

Due to the recent volatility and uncertainty surrounding Bitcoin, the price has decreased by more than 18% in a month. It is currently trading at $58,937, which is a 1% increase from the previous twenty-four hours.

During the past twenty-four hours, the low price is $57,860, and the high price is $60,680. Furthermore, the trading volume has decreased by 24 percent over the past twenty-four hours, which is an indication of traders’ interest.

Conversely, analysis showed the emergence of a Bitcoin death cross on the chart, suggesting the possibility of a price decline.