Regardless of the fact that Bitcoin had dropped 4% in the past 24 hours at the time of publication, several indicators still appeared to show a positive market for the cryptocurrency.

Lark Davis, a well-known analyst and trader, highlighted these charts when discussing his ideas on Bitcoin’s price in the future and how these charts can help him figure that out.

a.) Bullish Divergence

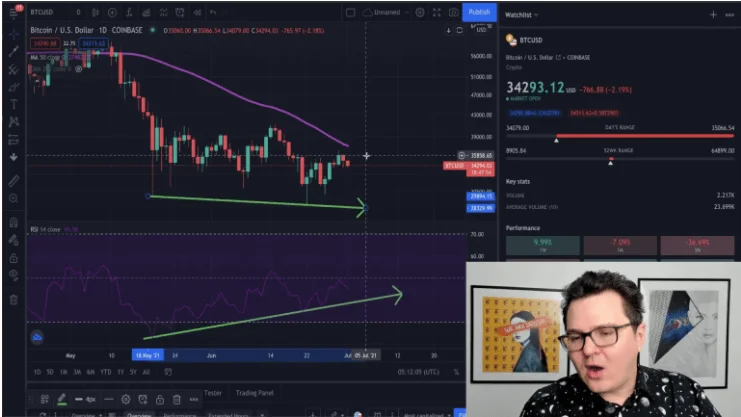

The Bullish Divergence is the first thing that comes to mind when thinking about the market.

When the price makes a lower low and the Relative Strength Index (RSI) makes higher lows, this is referred to as a bullish divergence.

The RSI began rising from its oversold position on May 19th, when the price began to decrease, and it has continued to rise since then. The positive divergence on Bitcoin’s chart is formed by such opposing conclusions.

“This shows that the market is starting to build up again. This indicator could indicate that we are getting ready to see that price recovery coming in from Bitcoin” – Davis

Furthermore, the 50 Day Moving Average is also a significant level here, as it would aid in the bullish turnaround.

b.) Wyckoff Accumulation

For a long time, this structure has been a heated topic. Although a long-term study revealed a Wyckoff Distribution, the short-term analysis indicated the possibility of a Wyckoff Accumulation.

Phases A and B have already been confirmed, and Phase C will be confirmed with a simple test in the lower $30k-33k area.

A bounce-off could drive BTC into Phase 4 once this phase is completed. As previously said, such a move might assist the coin in reclaiming the $40,000 level, sign of strength (SOS), and then rallying forward.

c.) Bull Cycle

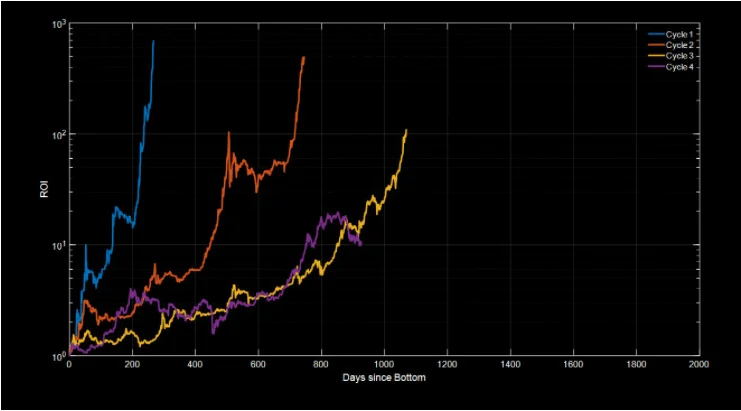

Davis’ final comment was about Bitcoin’s previous bull cycles and how they’ve performed so far. The first-ever Bitcoin bull run was depicted by the blue cycle (Cycle 1).

The 2013 bull run was reflected by the orange line (Cycle 2), while the 2017 bull run was represented by the yellow line (Cycle 3). Finally, the purple line (Cycle 4) identified the active bull cycle that was now in play.

Furthermore, a closer examination revealed that, as the bull cycle lengthens, the total amount of money pushed decreases. According to Davis,

“The current bull market has lasted for significantly less time than the 2017 bull market, which means it is highly unlikely that this bull market cycle has finishe”

For the time being, the currency may enter a period of stabilization before rising to the ROI levels, as it has done in past bull cycles.