Michael Saylor, executive chairman of MicroStrategy, has initiated a four-month process to sell $216 million worth of his company’s stocks, stating a portion of the proceeds will be used to purchase additional Bitcoin.

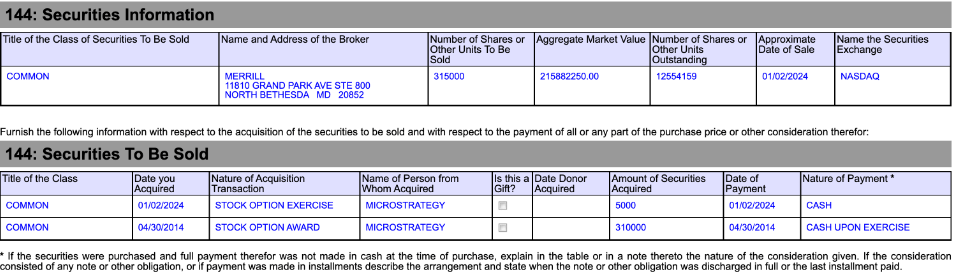

Saylor disclosed in a filing with the United States Securities and Exchange Commission dated January 2 that he had commenced the sale of the 315,000 stock options initially allocated to him in April 2014. The options on the issued stock will expire on April 30, 2024.

Saylor commenced the procedure on January 2, selling his initial allotment of 5,000 shares, as per the filing.

Saylor stated on the November 2 call for third-quarter earnings of MicroStrategy that he intended to sell 5,000 MSTR shares per day for the next four months to satisfy “personal obligations” and increase his Bitcoin holdings.

Saylor stated on the call, “By exercising this option, I will be able to fulfill personal obligations and acquire additional Bitcoin for my account.” He added that his stake in the company’s equity remains “significant despite personal transactions.”

Saylor may exercise a maximum of 400,000 vested options for sale from January 2 to April 26 this year, as disclosed in a Q-10 filing with the SEC on November 1.

MicroStrategy has outperformed the asset by over twofold, increasing by 411% over the past year, according to TradingView data, whereas Bitcoin experienced a remarkable 170% increase since the beginning of last year.

MicroStrategy acquired an additional 14,620 Bitcoin on December 27 for $615 million. The acquisition increased MicroStrategy’s Bitcoin holdings to an astounding 189,150, currently valued at approximately $8.5 billion.