Semler Scientific, a Nasdaq-listed medical manufacturer, decided to add Bitcoin (BTC) to its treasury last month. It now holds 828 BTC and has plans to purchase more Bitcoins.

On June 6, the organization disclosed its most recent Bitcoin acquisition in an S-3 filing to the United States securities regulator. It currently possesses 828 Bitcoin, collectively valued at over $58.5 million, following its initial purchase of 581 Bitcoin on May 28.

“[It underscores] our view that bitcoin is a compelling investment and can serve as a reliable store of value. We will continue to pursue our strategy of purchasing bitcoins with cash.”

Additionally, Semler is spending a reasonable amount of time. It disclosed that it could raise an additional $150 million in debt securities, with a portion of the proceeds allocated to acquiring additional Bitcoin.

The firm stated that it plans to allocate the net proceeds from the sale of any securities offered under this prospectus to general corporate purposes, which may include the acquisition of bitcoin.

The firm’s CEO, Doug Murphy-Chutorian, stated on June 6 that Semler’s Bitcoin investment strategy has become its second top-line priority, in addition to its healthcare business.

In its SEC filing, Semsler stated that Bitcoin, currently its primary treasury reserve asset, can function as a “reasonable inflation hedge and haven amid global instability.”

The organization reiterated that it “has no intention of purchasing cryptocurrency assets other than Bitcoin.”

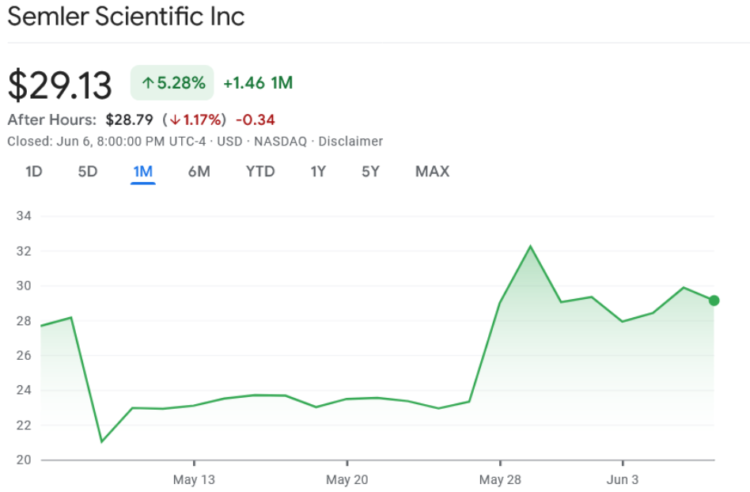

The news of Semler’s (SMLR) acquisition on May 28 caused a 30% increase in the company’s stock. Conversely, it was unsuccessful in its attempt to surge this time, plummeting 2.5% to $29.13 on June 6, according to data from Google Finance.

Another company that has implemented MicroStrategy’s Bitcoin strategy is Metaplanet, an investment firm located in Japan.

It acquired $6.5 million of Bitcoin on April 8 and has since made numerous purchases, accumulating 117.7 Bitcoin or $8.3 million at the current price.

Metaplanet was the most successful stock on the Tokyo Stock Exchange for two consecutive days due to its most recent Bitcoin acquisition on May 22.