According to new filings with the US Securities and Exchange Commission, or SEC, four wealth management businesses have purchased shares of Grayscale’s Bitcoin Investment Trust, demonstrating institutional adoption of digital assets.

Institutional investors are flocking to the Grayscale Bitcoin Trust, which trades under the ticker sign GBTC, seeking more traditional exposure to digital assets.

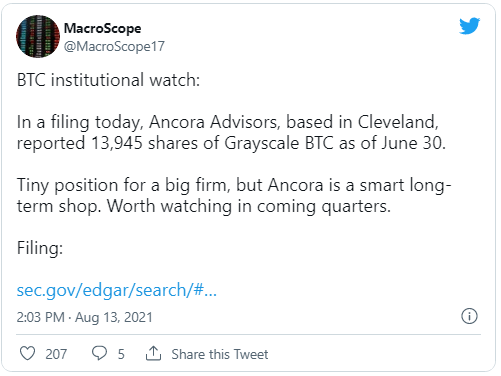

The firms disclosed their GBTC holdings in new disclosures for the period ending June 30, 2021, as first reported by MacroScope, a Twitter feed dedicated to institutional trading and asset management.

On Friday, Clear Perspective Advisors, a wealth management firm based in Illinois, disclosed direct ownership of 7,790 GBTC shares.

As of June 30, Ancora Advisors, based in Ohio, owned 13,945 shares of GBTC. While it’s a minor holding for the multibillion-dollar asset management, it’s a significant strategic decision given the company’s long-term investment outlook.

Meanwhile, for the June 30 reporting period, two more corporations increased their GBTC holdings. Boston Private Wealth boosted its GBTC exposure to 103,469 shares as of March 31, up from 88,189 shares as of March 31.

Parkwood Management, based in Ohio, increased its holdings to 125,000 shares from 93,000 at the end of March.

Major corporations are experimenting with new and innovative ways to obtain exposure to Bitcoin and other virtual assets.

Intel recently declared a substantial holding in Coinbase shares, which provides direct exposure to the digital currency sector, as Cointelegraph reported.

Institutions are likely to increase their digital asset exposure in the coming months if the positive narrative persists.

Many cryptocurrency experts believe in the four-year cycle theory, which tries to explain and forecast Bitcoin’s price as it moves from one cycle low to the next.

It looks that the next phase of the bull cycle is gathering pace, with the crypto asset class rising above $2 trillion this week, signifying a $700 billion recovery from the local bottom.