The purported BTC salary tax fiasco involving NFL star Odell Beckham Jr. (OBJ) may serve as a grave warning to anybody considering receiving payment in cryptocurrency.

The choice of NFL star Odell Beckham Jr. (OBJ) to pay his $750,000 salary in Bitcoin looks to have cost him dearly owing to the market fall that occurred shortly after he signed the contract. Some believe that OBJ made 61% less than if he had received his compensation in fiat due to the whims of cryptocurrency tax legislation and current values.

The loss has brought to light the financial implications of getting a salary or dividend in cryptocurrency, since crypto investors must pay tax on the amount received, not what it is worth when they file their taxes.

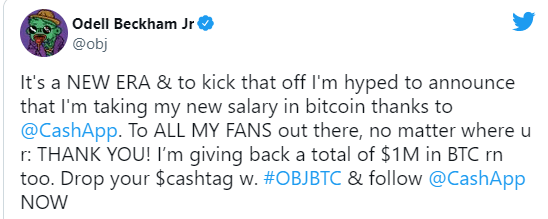

OBJ inked a one-year agreement with the Los Angeles Rams worth $750,000 on November 12 of last year. OBJ stated that he will be getting 100% of his $750,000 yearly pay in Bitcoin in a promotional Twitter tweet paired with CashApp (BTC).

How the dip affected OBJ

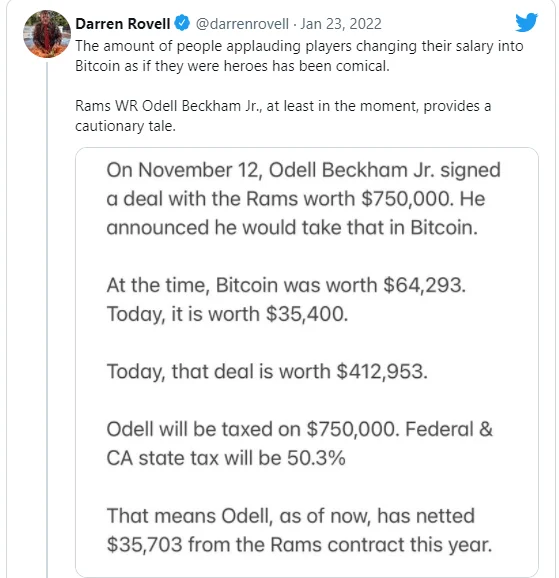

Bitcoin was setting new all-time highs at the time, and just two days before OBJ signed with the Rams, it hit its all-time high of $69,044. Unfortunately for OBJ, Bitcoin is now valued $36,972, down 46 percent from its high.

OBJ’s choice to take his whole paycheck in Bitcoin, according to sports business expert and senior executive producer for The Action Network Darren Rovell, may not have been the best idea.

According to Rovell, OBJ’s whole compensation is now only worth $413,000, down from the initial $750,000.

Odell will only have made $35,000 over the last two and a half months if both Federal and State taxes are taken into account at a cumulative rate of 50.3 percent, which corresponds to just one Bitcoin. This is a far cry from the $90,000 he would have gotten if he had taken his pay in cash.

Joe Pompilano (brother of influencer Anthony) noted that there were several key inconsistencies between Rovells’ claim and reality, including the fact that he got paid weekly rather than annually.

Rovell, on the other hand, claimed that the weekly payments had no bearing on the tax treatment: “The aggregate payment has been finished.” It makes no difference when he was compensated.”

Problems with taxes

This isn’t the first time that crypto assets have resulted in significant tax differences, and it won’t be the last as crypto use grows globally. Many users faced large tax payments owing to the price of assets when they obtained them, rather than the rock bottom price they sank to by tax time, during “crypto winter.”

Although regulations differ, it is typical for taxing authorities to demand that the value of crypto assets be disclosed at the time of receipt. This exposes investors to a hefty tax charge if the value of their crypto assets drops between the time of acquisition and the time they file their tax return.

Adrian Forza, director of Crypto Tax Australia, told local publication Micky in 2019 about a crypto investor in Australia who was compelled to pay roughly five times the value of his coins in taxes.

“It was a disaster… It was a really unfair outcome because he’s basically received cryptocurrency and the value has dropped significantly and now he has to pay tax on money he doesn’t have.”

Forza went on to claim that the largest difficulty with cryptocurrency taxation wasn’t necessarily due to the regulations themselves, with the majority of troubles stemming from crypto fans’ lack of understanding of tax laws:

“The demographic is 25- to 40-year-old guys, and many of them have never invested in stocks or even visited an accountant,” he added.

Axie Infinity, a blockchain-based play-to-earn game, may be an example of this. In one well-known example, a 22-year-old man from the Philippines used the money he gained from playing the game to buy two residences.

Hopefully, he consulted with a tax advisor because now, both Philippine and international officials are after those gains, reminding Axie Infinity‘s 2 million active players that any in-game transfer of crypto assets is a taxable event.