OKX cryptocurrency exchange has initiated extending its user services to include a local Web3 wallet platform and cryptocurrency exchange in Brazil.

The organization announced on November 27 that it is concentrating on facilitating access to decentralized finance (DeFi) and cryptocurrency trading using real fiat-on-ramp capabilities in Brazil.

The Brazilian market has “enormous potential” to lead in crypto adoption and DeFi, according to Guilherme Sacamone, general manager of OKX Brazil.

“We know that Brazilians expect fast and liquid trading, along with a secure self-custody wallet solution, all in one app.”

A recent survey reveals that 92% of Brazilian respondents desire “clear and transparent information” regarding their investment security, according to OKX.

Additionally, according to the study, 86% of respondents concurred that proof-of-reserves can contribute to the legitimacy and maturity of the cryptocurrency market.

Sacamone said:

“With OKX’s launch in Brazil, we’re not just expanding globally; we’re committing to Brazil’s crypto community.”

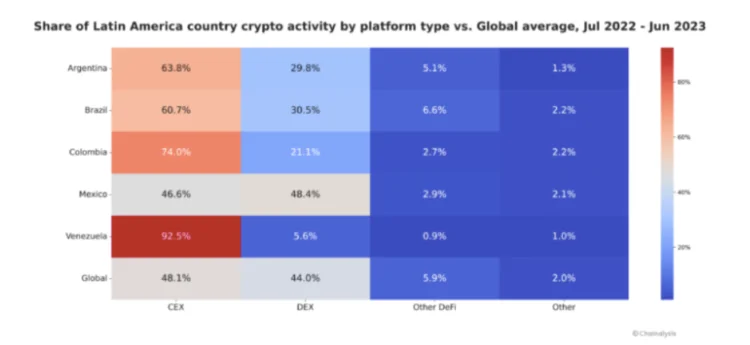

Chainalysis data indicates Brazil, Argentina, and Mexico were among Latin America’s main cryptocurrency markets in 2023. According to the data, Brazil ranks ninth globally regarding cryptocurrency adoption.

Currently, consumers in the Brazilian market have access to eToro, Bybit, Kraken, Mercado Bitcoin, and Binance, among others. According to the data, Brazil also dominates the region in decentralized exchange and other DeFi-related activities.

According to the nation’s revenue service agency, the adoption of the stablecoin Tether has increased significantly over the past year, accounting for 80% of all cryptocurrency transactions.

In a recent interview with Cointelegraph, José Ribeiro, the CEO of cryptocurrency exchange Coinext, stated that the regulatory environment surrounding cryptocurrencies in Brazil is the propelling force behind “competitiveness,” which he claims has increased “astronomically.”

Brazil is one of only two South American nations and one of 47 countries that have pledged to authorize the Crypto-Asset Reporting Framework in collaboration with the Organization for Economic Cooperation and Development by 2027.