The Aptos Foundation announced the introduction of Ondo Finance’s yield-bearing stablecoin, Ondo US Dollar Yield (USDY), on the Aptos blockchain.

USDY, an instrument guaranteed by United States Treasurys, will be accessible to non-US residents via the Aptos blockchain, as per the Aptos Foundation. Digital asset registration under the Securities Act in the United States has yet to be completed.

In its announcement, the Aptos Foundation acknowledged the advantages of stablecoins in democratizing finance and serving marginalized communities.

Interestingly, stablecoin issuers and other entities in the crypto industry are now significant purchasers of US government debt.

One example is Tether, which supports its stablecoin Tether with US dollar reserves and US Treasury bills. The stablecoin issuer maintained $72.5 billion in US Treasury bills in 2023.

The potential for stablecoins to benefit the US dollar has even captivated the attention of former US lawmaker Paul Ryan.

During geopolitical efforts to forsake the dollar in international trade settlements, the former speaker of the US House of Representatives emphasized the potential of dollar-pegged stablecoins to generate demand for the dollar. This demand could extend the US dollar’s dominance by decades.

In July, Binance.US became one of the most recent crypto companies to receive regulatory sanction to invest customer funds in US Treasury bills.

The agreement allowed Binance.US to invest in the instruments provided it utilized a third-party custodian for the funds. It refrained from investing customer funds back into Binance.US or Binance-related business operations.

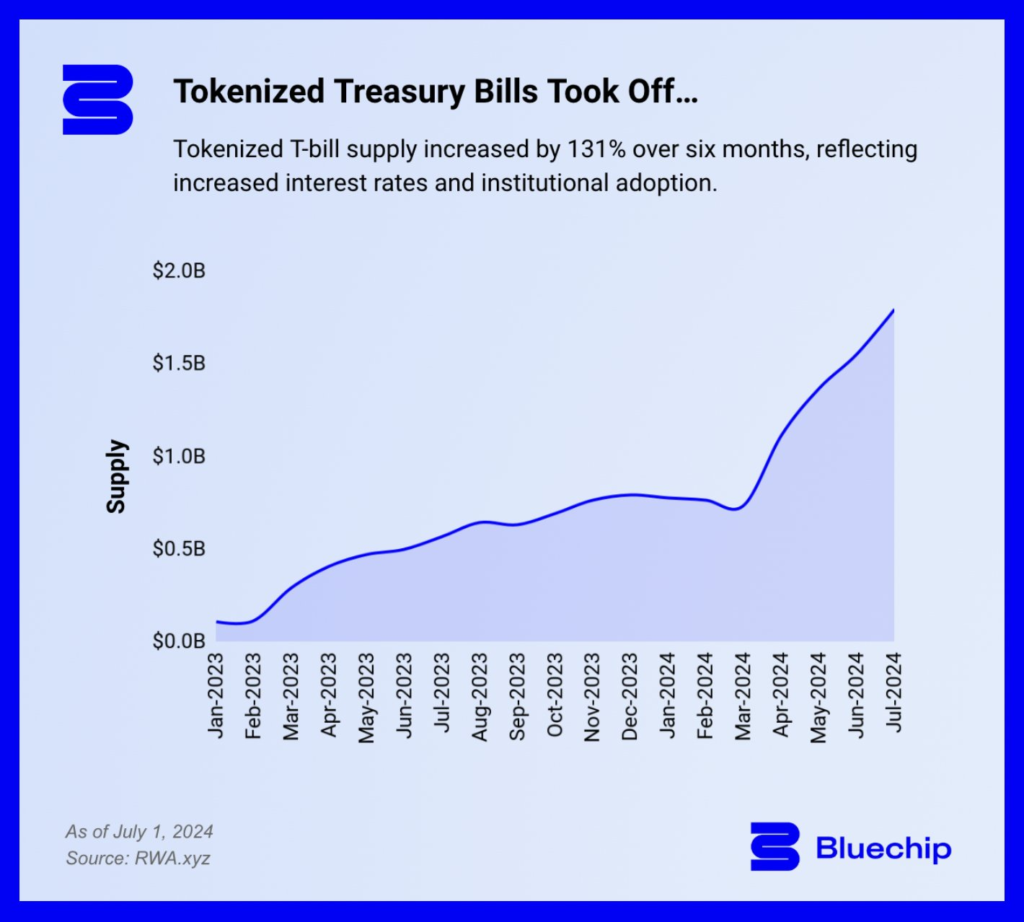

US Treasury Market to Surpass $3B 2024

A research strategist, Tom Wan, anticipates that the tokenized US Treasury market will surpass $3 billion by the conclusion 2024.

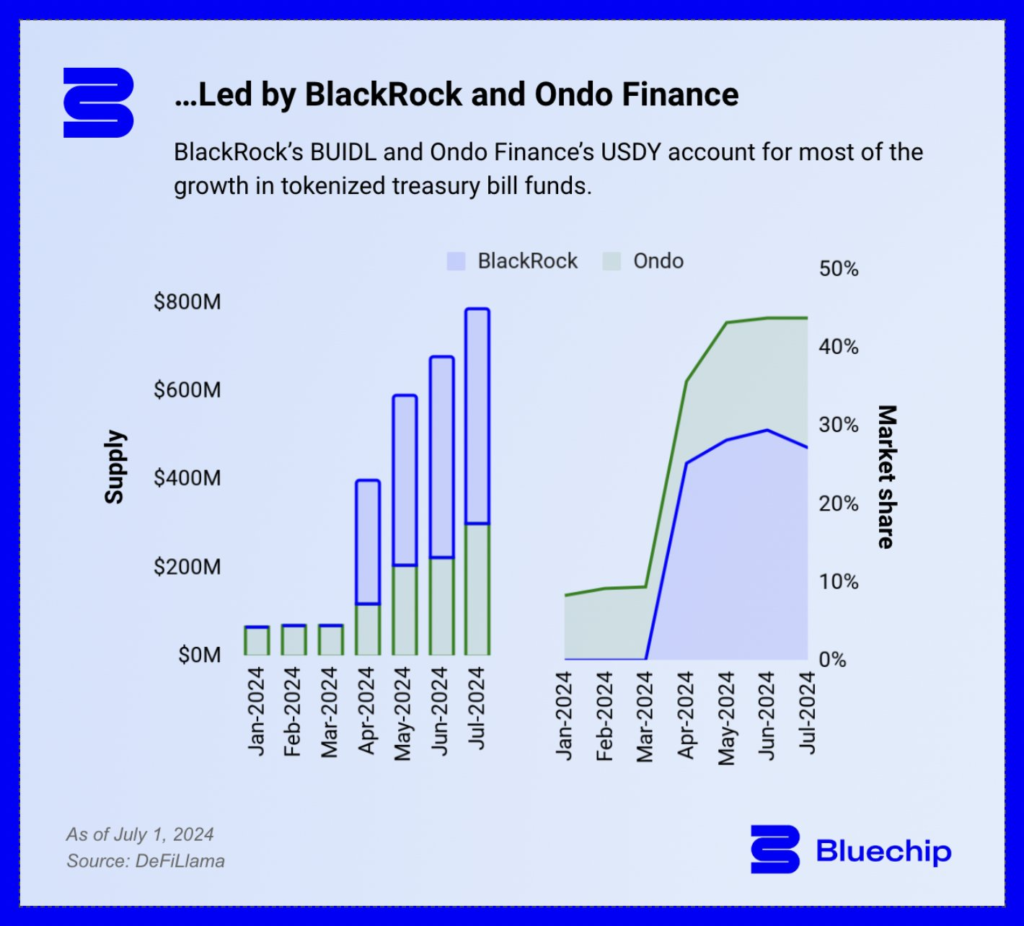

As per the strategist, the tokenized Treasury offerings from BlackRock and Securitize will attract increased capital to the tokenized US debt instrument market.

The analyst observed that BlackRock’s Institutional Digital Liquidity Fund (BUIDL) is currently the world’s largest tokenized Treasury investment fund.