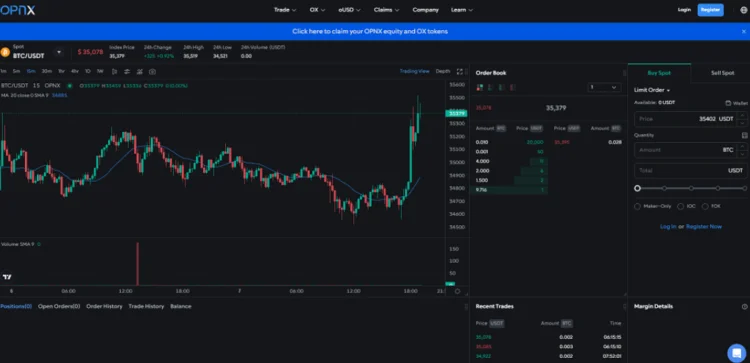

On November 8, OPNX exchange acquired a virtual asset service provider license (VASP) OPNX in Lithuania, authorizing it to offer spot crypto trading services across the European Union.

This license would necessitate that the exchange “maintain the utmost standards of compliance and security,” according to the announcement. The team has already implemented a “robust” Know Your Customer and Anti-Money Laundering system to ensure compliance with EU regulations.

OPNX CEO Leslie Lamb remarked, “Obtaining the VASP license from the Lithuanian authorities is a major milestone in our mission to serve crypto users worldwide and in our ongoing global expansion.”

Lamb clarified in an interview that certain OPNX services may remain inaccessible in certain EU jurisdictions. “While this license enables us to provide services throughout Europe, certain jurisdictions within the EU do necessitate additional licenses to operate particular services,” she explained, adding that OPNX is presently trying to obtain those licenses.

Nevertheless, OPNX will be capable of delivering spot trading services across the European Union under its existing mandate, with additional services becoming accessible upon acquiring supplementary licenses.

OPNX has been a source of contention ever since its inception. Kyle Davies, Su Zhu, Mark Lamb, and Sudhu Arumugam, who also established the insolvent cryptocurrency exchange CoinFLEX, and Su Zhu, who founded the defunct hedge fund Three Arrows Capital (3AC), were its founders.

Due to the exchange’s affiliation with these previous insolvencies, OPNX detractors have asserted that utilizing it is hazardous. Conversely, the exchange says it facilitates the expeditious payment of bankruptcy creditors by permitting them to sell bankruptcy claims.