ParaSwap, a DEX aggregator, is introducing an intent-based trading protocol intended to address the issue of MEV assaults, which result in millions of dollars in daily losses on crypto transactions.

MEV is an acronym that stands for the maximum extractable value. In this context, validators exploit their capacity to regulate the order, inclusion, and implementation of onchain transactions to generate user revenue.

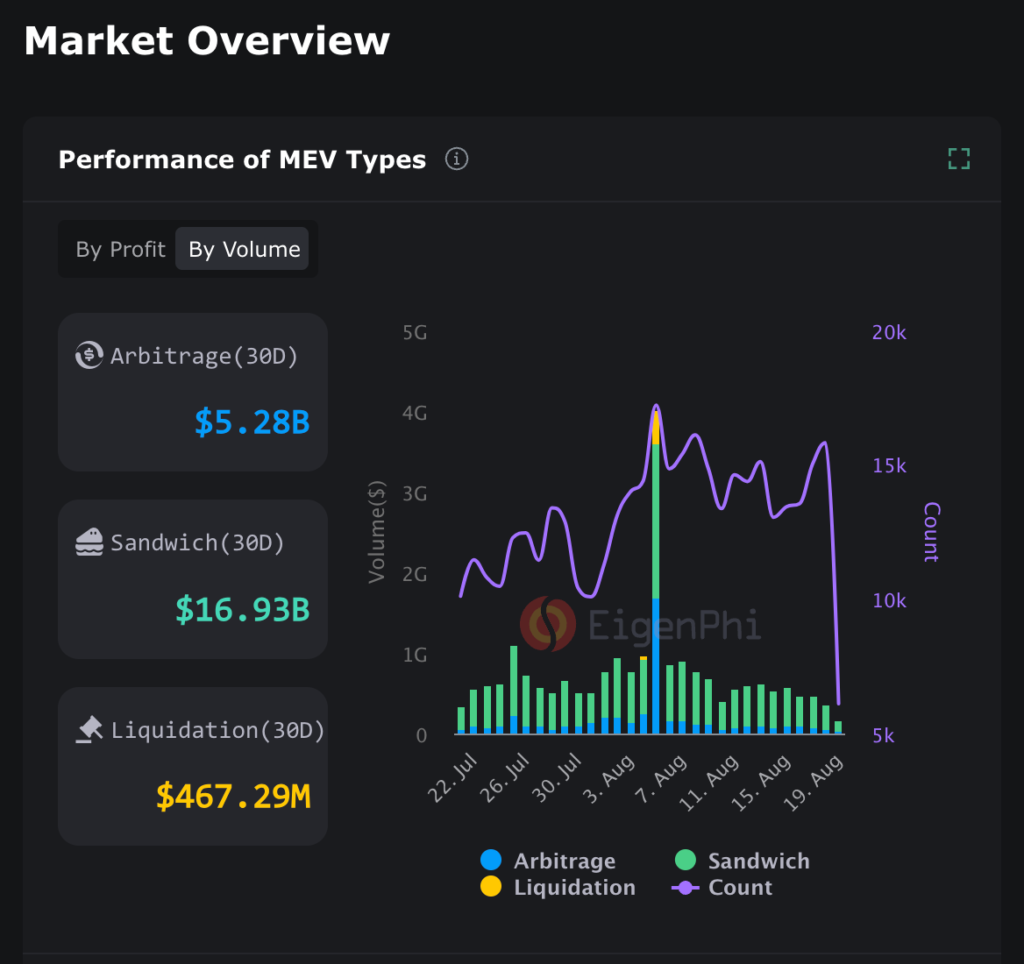

Over the past 30 days, attackers have earned nearly $17 billion in profit from widespread attacks, including sandwich transactions, according to data from EigenPhi.

“MEV has resulted in a degraded user experience and a decrease in the efficiency of protocols in DeFi, costing users billions,” stated Mounir Benchemled, the founder of ParaSwap, speaking to Cointelegraph.

ParaSwap’s team developed its intent-based trading model in early 2024 to protect MEVs. Benchmade asserts that the protocol enables users to specify their trading “intent” rather than exposing naked transactions to mem pools.

The extraction of MEVs was particularly profitable during the decentralized finance growth of 2021. Bots heavily targeted specific protocols, such as Uniswap, which prompted global apprehension regarding potential market exploitation.

The trader’s intent during the execution of a transaction may even mitigate potential liabilities related to market manipulation in certain jurisdictions; however, this does not prevent miners and validators from attempting to profit from attacks.

“The presence of MEV has a significant impact on the DeFi ecosystem, affecting not only individual transactions but also the overall fairness, accessibility, and decentralization,” argued Benchemled. Consequently, it is one of the most urgent issues that requires attention.

ParaSwap’s Delta protocol endeavours to resolve this issue by facilitating the submission of intended transactions in three stages. The process commences with pre-processing, which involves the identification of the user’s intent, such as their price range.

This intent is subsequently submitted to an auction in which AI agents compete to propose the most efficient execution strategy, considering factors such as liquidity and timing. To minimize the risk of MEV exploitation and adhere to the user’s intent, the winning agent executes the transaction through the Portikus Swap module.

In addition to profitability, other liquidity aggregators, such as 0x, have also actively developed mitigation strategies for MEV attacks. These strategies include consolidating transactions into a single batch to reduce the likelihood of attacks and mechanisms that prioritize transactions based on other criteria, such as time priority and a fair distribution of block space.

ParaSwap’s dashboard indicates that the protocol has facilitated over $76 billion in lifetime transactions since 2019. The team’s roadmap encompasses expanding support for additional chains, automated strategies, and AI-driven agents.