Chris Yin says investor demand for RWAs is going “upstream” from tokenized treasury bills to private alternative assets.

Plume Network, a blockchain specializing in real-world assets (RWA), is set to launch a tokenized ‘Mineral Vault’ in response to rising demand for high-yield private assets onchain, CEO Chris Yin told Cointelegraph on September 9.

Developed by asset manager Allegiance Oil & Gas, the Mineral Vault will consist of tokenized mineral interests, a type of real estate that generates royalty income from the extraction and sale of natural resources.

Plume stated in a press release that the Vault will offer “financial exposure to resource production like gold, silver, coal, and primarily crude oil and natural gas” in the United States.

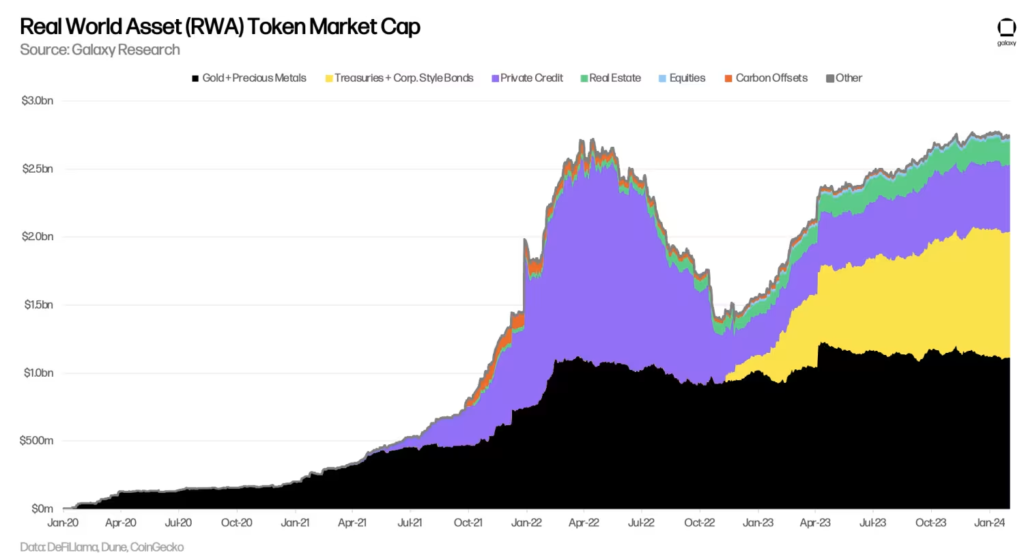

According to RWA.xyz, tokenized RWAs currently hold nearly $12 billion in total value locked (TVL) and could represent a $30-trillion global market opportunity, as noted by Colin Butler, Polygon’s global head of institutional capital, in an interview.

“If you look at [RWA] adoption, it’s very clear there is a specific area that is the fastest growing—yield-bearing assets,” Yin stated.

Among the highest TVL RWAs are tokenized US treasury bills and money funds, such as BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) and Franklin’s OnChain US Government Money Fund (FOBXX), which have around $514 million and $443 million in TVL, respectively, according to RWA.xyz.

Yin further explained, “we’ve seen an increased demand in accessing more private, liquid assets like mineral interests (that are traditionally very difficult to access) as the yields are upward of 10%+, paid out in stablecoins.”

He added that the next logical step is to move “slightly upstream where the products have a very similar look and feel, but now provide some extra yield on top.”

Plume aims to build an RWA-centric ecosystem, referred to as RWAfi, which will “imbue real-world assets with the same properties that crypto-native assets have,” such as using RWA tokens as collateral for loans and other decentralized finance applications.

Yin noted, “For instance, $10 worth of tokenized mineral interests can easily be worth 1.5-2x more if collateralized and borrowed against properly within Plume’s RWAfi ecosystem, unlocking more liquidity and yield for the end-user.”

Plume launched its testnet in partnership with the data availability layer Celestia in July but is not yet live on mainnet.