MATIC from Polygon is now ranked 11th in terms of market cap. The altcoin has gotten a lot of attention because it is working with more and more companies. Even though Polygon is making more partnerships, interest in its dApps has not changed.

But the new partnership between Polygon and Axelar Network could change things for the better.

Polygon dApp me up

Polygon said in a tweet on October 27 that its partnership with the Axelar network will help dApp users move assets to and from the PolygonSupernet.

Even so, Polygon didn’t see a lot of progress in the dApp area, even though it was working harder than ever to get more people to use its dApps and use more than one chain.

DappRadar says that the number of unique active wallets for the best-performing dApps on the Polygon network, like Make Me Rich, has dropped by 14.82 percent over the past week. Over the last 24 hours, the number of unique wallets using other dApps like QuickSwap and 1inch Network also went down.

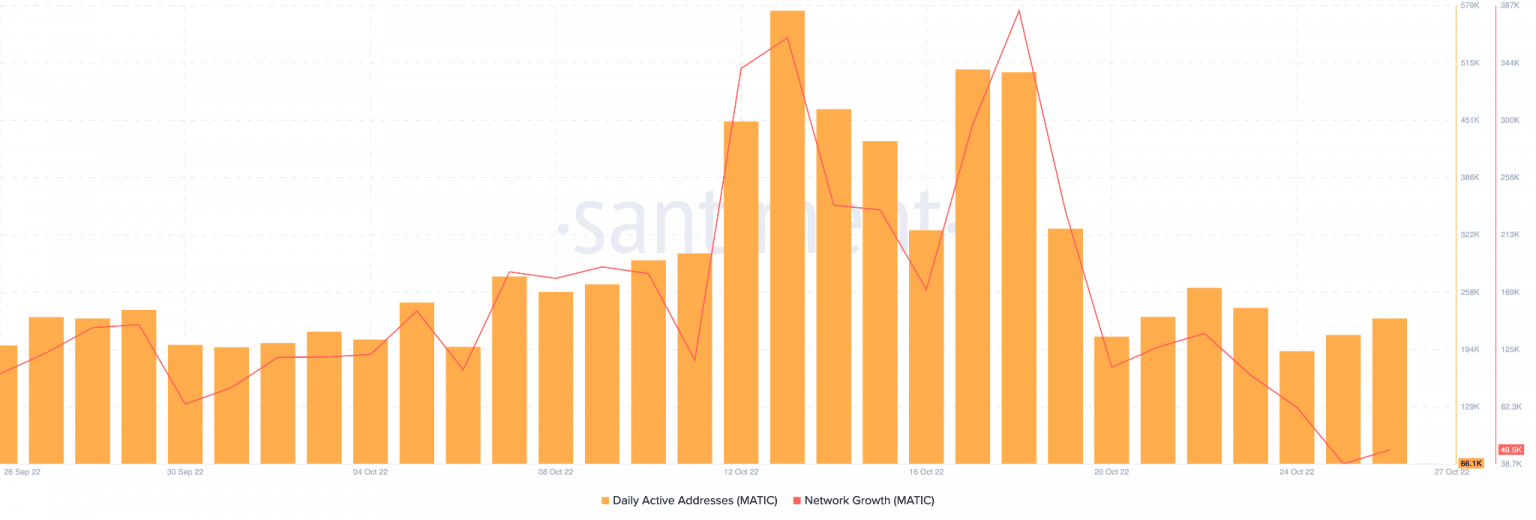

Not only did the Polygon dApp activity go down, but so did an everyday activity on the Polygon network. As the chart below shows, the number of daily active addresses has been going down for the last few weeks. At the time this was written, there were only 222,000 active addresses on the network.

On a day-to-day basis

In the same time period, Polygons’s network growth has also slowed down sharply. This meant that fewer new addresses were transferring MATIC for the first time. This meant that fewer new addresses were interested in MATIC.

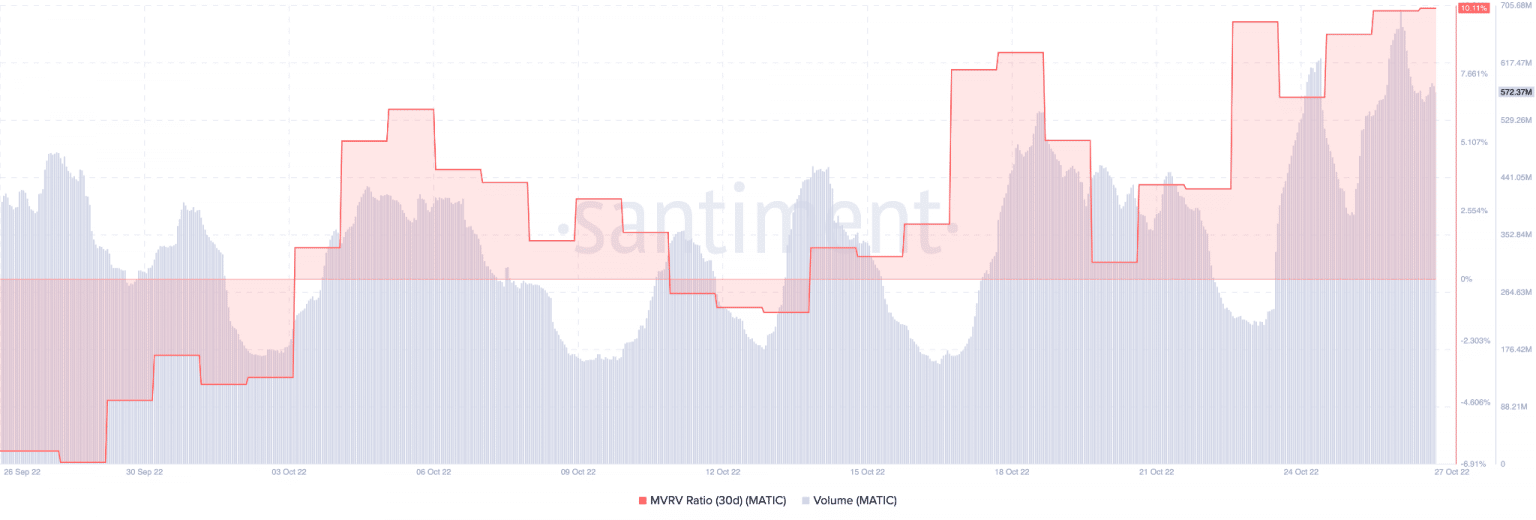

On the contrary, the volume has gone up a lot in the last few days, even though the number of daily active addresses has been going down. In just this week, MATIC’s volume went from $394 million to $572 million. Also, the MVRV ratio has been going up over the past two weeks, which could affect its price.

At the time of writing, MATIC was trading at $0.938. In the last 24 hours, its price had gone up by 0.13%.

Messari says that its market cap dominance has grown by 2.9% over the past week. Also, its volatility went down by 9%, making it less risky for investors who might want to buy MATIC.