Pyth Network’s pull-based model has resulted in significant transaction volumes, adding to Oracle’s competition with Chainlink.

Pyth Network, a leading Oracle provider, has recently surpassed Chainlink in 30-day transaction volume despite holding a lower total value secured (TVS).

This change could be due to Pyth’s unique pull-based Oracle model, which delivers data upon request rather than continuously updating, unlike Chainlink’s push-based model.

Pyth’s approach caters to high-frequency applications like trading, where access to real-time data is essential.

In an interview, Niklas Kunkel, founder and former CEO of Oracle provider Chronicle, shared insights on the evolving Oracle market. “We’re seeing an interesting situation play out in Oracle dominance currently,” Kunkel noted, adding:

“Chainlink appears to be losing market share to three key players: Chronicle, Pyth, and Redstone. Pyth and Redstone focus on Pull Oracles, which are built for speed and are ideal for derivatives and options protocols.”

Pyth Achieves $36 Billion in 30-Day Transaction Volume

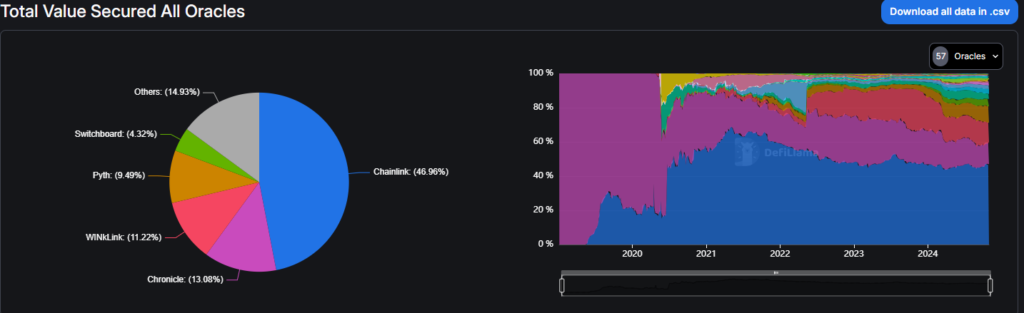

Data from DefiLlama indicates a rising market share for Pyth in Oracle transaction volume, pointing to an increased demand for high-frequency data solutions.

Over the past 30 days, Pyth recorded $36 billion in transactions, emphasizing the value of Oracles that can support fast-paced applications.

Reflecting on Oracle evolution, Kunkel remarked, “DeFi saw a period of growth and innovation during the recent bear market, but Oracles didn’t evolve fast enough,” adding that,

“This lack of innovation led them to gain a reputation as the Achilles heel of DeFi – often being the root cause of DeFi hacks.”

By using a pull-based model, Pyth can serve applications needing constant updates without the higher operational costs typically associated with larger providers. Chronicle also redefined the push Oracle model, reportedly lowers operating costs by 80% in gas fees compared to Chainlink.

As Kunkel explained, “The pull-based Oracle model allows providers like Pyth to support applications that require frequent updates without incurring higher operational costs.”

Chainlink’s Continued Dominance and Adoption

Despite Pyth’s recent gains, Chainlink still leads in DeFi with high-value assets secured, benefitting from its established reputation for reliable validator networks.

However, Kunkel pointed out an opportunity to address gaps in Oracle infrastructure, noting, “While Chainlink currently leads in total value secured (TVS), it lags in innovations such as a scalable validator set, the ability to maintain near-constant gas fees, and data transparency.”

Chronicle’s Market Comeback and Future Outlook

One of the earliest Oracles on Ethereum, Chronicle, was initially limited to MakerDAO.

Following its reentry outside MakerDAO in late 2023, Chronicle has since integrated with 10 additional blockchains and gained adoption by significant players like Morpho, Euler, Gnosis Pay, Coinbase, and Circle.

Kunkel highlighted the role of Oracles in the industry’s future: as traditional finance and DeFi continue to intersect, “choosing an Oracle partner will be a risk mitigation and management decision” for institutions.

Oracles with strong security, transparency, resilience, and innovation in real-world assets, he noted, “will win business.”