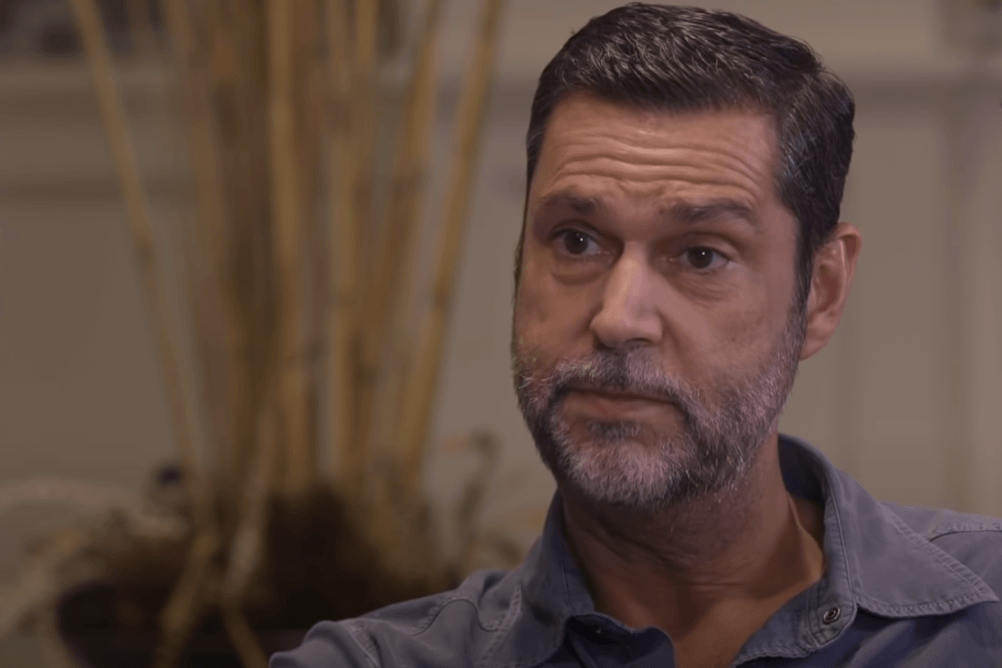

Raoul Pal, a former executive at Goldman Sachs, does not believe that the US government’s accumulation of millions of Bitcoin (BTC) is entirely beneficial for the crypto monarch.

Robert F. Kennedy Jr., an independent presidential candidate, declared at the recent Bitcoin2024 Conference that his administration would accumulate four million Bitcoin as a strategic reserve asset in the event that he were to secure the presidency.

In the same event, Senator Cynthia Lummis disclosed that she had introduced a measure that would require the United States government to accumulate one million Bitcoins or 5% of the total supply of Bitcoin within the next five years.

However, macro expert Raoul Pal is apprehensive about the potential conduct of the United States government in the event that it constructs a substantial Bitcoin cache.

Pal stated during an interview with Anthony Scaramucci, the founder of Skybridge Capital, that the government has a history of abusing its authority. He also noted that the government’s substantial BTC reserve places it in a position to heavily influence the price of Bitcoin.

“Yes, it’s good for the crypto market because there’s yet another buyer but it’s also weird because Bitcoin was set up to try and replace the government’s control over money, and now you’re inserting the government as one of the largest buyers of private money.

I don’t really like that actually…

If the government can manipulate it, they could dump it onto the market, they could buy more and before you know it, they’re using it like they are interest rates in controlling regular money, and we don’t want that.”

At time of writing, Bitcoin is trading for $58,464, down slightly on the day.